Borrow - Свежие новости [ Фото в новостях ] | |

Aave price forecast: how will the launch of Aave Arc impact the value of the AAVE token?

Aave AAVE/USD is a decentralized finance protocol that lets people lend as well as borrow cryptocurrencies. It enables lenders to earn interest through depositing digital assets within specially created liquidity pools, which borrowers can then use through posting crypto as collateral and taking flash loans through using the liquidity. дальше »

2022-1-8 16:07 | |

|

|

Dharma.io Review 2022 – How to Lend and Borrow on Dharma?

A few weeks ago, I have been testing Maker DAO, the most successful “DeFi” application on the Ethereum network so far. In April 2019, a new protocol went live called Dharma, which has a similar purpose and in my opinion has the chance to become an even bigger success. дальше »

2022-1-5 13:07 | |

|

|

Kava is skyrocketing, up 10% in 24 hours: top places to buy Kava now

Kava is a cross-chain DeFi lending platform that allows users to borrow USDX stablecoins… The post Kava is skyrocketing, up 10% in 24 hours: top places to buy Kava now appeared first on Coin Journal. дальше »

2022-1-5 12:39 | |

|

|

Aave price movement: will the partnership with Balancer increase its value?

Aave AAVE/USD is an open-source as well as a non-custodial protocol that allows users to earn interest on deposits where they can borrow assets. It is known due to the fact that it allows for Flash Loans, which are instantly issued and settled. дальше »

2021-12-19 19:01 | |

|

|

Coinbase Loans Review [2022] – LTV, Collateral, Rates

You may have seen the recent headlines about Coinbase offering million-dollar loans against Bitcoin. This is important – it’s how rich people have always done it – they borrow against their hard assets but never sell them. дальше »

2021-12-15 15:10 | |

|

|

Silo, Winner of ETHGlobal’s 2021 Hackathon Launches Genesis Token Auction

Silo is a permissionless protocol that permits any user to create a market for any token. As a non-custodial lending protocol, Silo allows users to borrow against any cryptocurrency asset The post Silo, Winner of ETHGlobal’s 2021 Hackathon Launches Genesis Token Auction appeared first on BeInCrypto. дальше »

2021-12-4 15:05 | |

|

|

Top 3 finance tokens to buy on November 23: KAVA, POLY, and SXP.

Kava KAVA/USD is a cross-chain DeFi lending platform that was developed to allow users to borrow USDX stablecoins and deposit other cryptocurrencies to earn yield. Polymath POLY/USD provides the technology to create, issue, and manage security tokens on the blockchain. дальше »

2021-11-24 18:17 | |

|

|

Transactions with Polygon’s MATIC now on Nexo

Nexo’s selection of digital assets is expanding at lightspeed. Members of the crypto community can now buy, swap, borrow against, and earn impressive interest on Polygon’s MATIC (MATIC/USD) on the cryptocurrency exchange, Invezz learned from a press release. дальше »

2021-11-24 17:00 | |

|

|

AAVE Price Movement: Will Aave v3’s new portal feature lead to an increase in the token’s value?

Aave AAVE/USD is an open-source, non-custodial protocol that allows users to earn interest on deposits and borrow assets. Aave utilizes the decentralization and security of Ethereum’s blockchain. дальше »

2021-11-15 17:42 | |

|

|

New Coinbase feature allows Bitcoin as collateral for up to $1 million cash loan

Coinbase users can now borrow up to $1 million in cash using their Bitcoin as collateral, this information was revealed via the crypto exchange’s official Twitter handle. The post New Coinbase feature allows Bitcoin as collateral for up to $1 million cash loan appeared first on CryptoSlate. дальше »

2021-11-4 19:00 | |

|

|

Coinbase to allow users to borrow up to $1 million

Could crypto exchanges be the new banks or money lenders? When Coinbase tried to launch its high-interest crypto "Lend" product, the SEC hit them with a Wells Notice. Coinbase later dropped the plan wThe post Coinbase to allow users to borrow up to $1 million appeared first on AMBCrypto. дальше »

2021-11-3 18:30 | |

|

|

Avalanche’s AVAX goes live on Nexo

Avalanche (AVAX/USD) public blockchain’s native token is now live on Nexo. Users of the platform, which has been a pioneer of crypto-backed credit, can now trade, purchase, save, and borrow against AVAX all in one place. дальше »

2021-11-4 17:36 | |

|

|

Not an “Aggressive Buy” At Bitcoin’s High Price, But It Is Indication of A “Crisis Moment,” says Tech Billionaire Peter Thiel

Apple co-founder Steve Wozniak also commented on Bitcoin, calling it a “mathematical purity” unlike USD, in which “the government can just create new and borrow; it is like you never have it fixed. дальше »

2021-11-1 15:23 | |

|

|

Bitcoin Loans: Understanding the Fundamentals

Let’s take a moment and discuss what a Bitcoin loan is. Any regular borrower or lender will quickly understand this. You can borrow or lend BTC just like any other loan. However, there are terms and conditions that both parties sign to bind them to the agreement. дальше »

2021-10-29 11:53 | |

|

|

Lending platform Adayield sets a new cornerstone in DeFi lending market

Adayield is a lending platform where users can hold their assets and receive interest or borrow tokens and repay it after a while. Like other currency market protocols, Adayield is built on Cardano neThe post Lending platform Adayield sets a new cornerstone in DeFi lending market appeared first on AMBCrypto. дальше »

2021-10-21 16:15 | |

|

|

Lending Platform Adayield Sets a New Cornerstone in DeFi Lending Market

Adayield is a lending platform where users can hold their assets and receive interest or borrow tokens and repay it after a while. Like other currency market protocols, Adayield is built on cardano network, open-source, and non-custodial Defi protocol. дальше »

2021-10-21 14:00 | |

|

|

ADAyield lending protocol announce token private sale after massive success in seed sale

Adayield is a lending platform where users can hold their assets and receive interest or borrow tokens and repay it after a while. Like other currency market protocols, Adayield is built on cardano network, open-source, and non-custodial Defi protocol. дальше »

2021-10-20 16:49 | |

|

|

Coinovy Forms a Strategic Partnership With UABA

Digital finances app Coinovy, whose unlimited wallets allow you to trade, receive, send, earn and borrow cryptocurrency assets. Is proud to announce its strategic partnership with United Africa Blockchain Association (UABA), a non-profit organization promoting blockchain technology throughout Africa. дальше »

2021-10-20 20:00 | |

|

|

How Stellar’s $40M Investment In Tala Will Give Millions Access To Financial Services

The Stellar Development Foundation (SDF) has made a fresh bet on the financial services sector. According to a press release, the institution participated in a $145 million series E for Tala. A global technology company working on providing millions of people with access to lend, borrow, and other financial services Tala reached an over $350 million funding with support from the SDF and its Enterprise Fund, Upstart, and others. дальше »

2021-10-15 01:00 | |

|

|

Crypto Lending and Savings Platform Nexo Adds Support for Solana (SOL)

Leading cryptocurrency lending and savings platform Nexo today introduced support for SOL, the native coin of the high-speed, open-source blockchain platform Solana. Nexo Supports Solana In an announcement made today, Nexo said that its users can now buy, swap, borrow against, and earn up to 8% interest on their SOL coins. Users will now beRead More дальше »

2021-10-4 17:00 | |

|

|

Coinovy forms Strategic Partnership with Luna PR

Dubai, United Arab Emirates, 1st of September 2021. Coinovy, a digital finance app with digital assets which combine wallets to send, receive, exchange, earn and borrow, forms a strategic partnership with award winning marketing agency, Luna PR. дальше »

2021-9-1 17:00 | |

|

|

Nebeus Launches iOS and Android App

Nebeus is a cryptocurrency and crypto-backed lending platform. Founded in 2014, Nebeus users can insure, borrow, earn, and exchange crypto assets all in one ecosystem. Born in a time when crypto was nowhere near the mass adoption that it is today, Nebeus was a catalyst of change for how people use their digital assets. дальше »

2021-9-1 11:00 | |

|

|

Bitwise Launched crypto funds for Uniswap and Aave, are the tokens worth buying?

Uniswap UNI/USD is one of the most popular decentralized trading protocols which is known for its role in facilitating automated trading in decentralized finance (DeFi). Aave AAVE/USD is a decentralized finance protocol that allows people to easily lend as well as borrow cryptocurrencies where lenders can earn interest through depositing digital assets into specially created […] The post Bitwise Launched crypto funds for Uniswap and Aave, are the tokens worth buying? appeared first on Invezz. дальше »

2021-8-5 01:46 | |

|

|

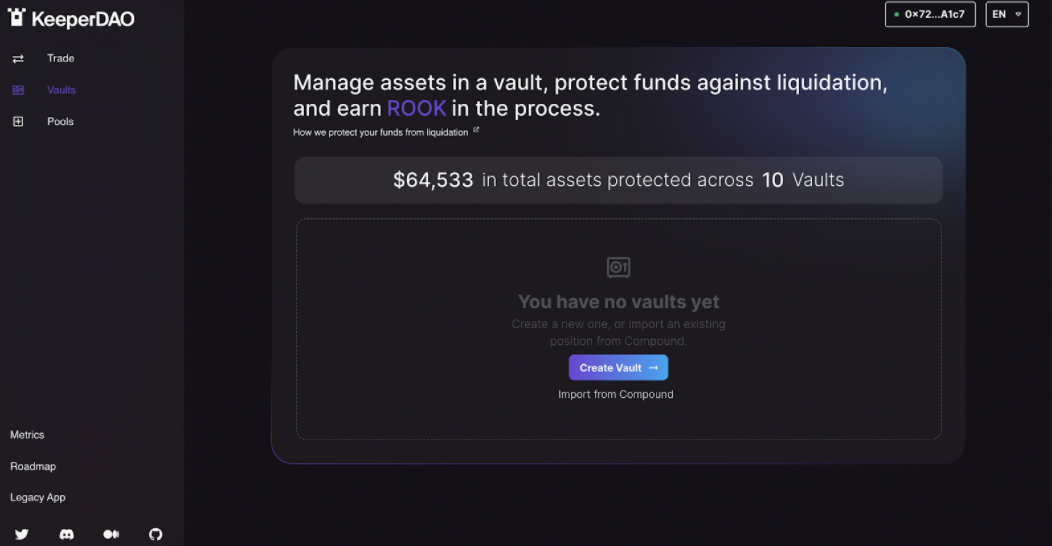

DeFi app KeeperDAO introduces new smart contract borrowing and liquidation protection

KeeperDAO, an MEV protection protocol on Ethereum, announced today a major update to its DeFi platform. KeeperDAO has introduced a smart contract-based borrowing and liquidation protection service; that gives borrowers the most profitable way to open or upgrade a borrow position on Compound. дальше »

2021-7-20 00:23 | |

|

|

I’m buying Aave (AAVE) this week, and this is why!

Aave AAVE/USD has slowly become one of the most prominent decentralized finance (DeFi) protocols that allow people to lend and borrow cryptocurrencies through the creation of liquidity pools. On March 31, we saw a glimpse of what the future of Aave will hold as they explored new scalability frontiers with Polygon. дальше »

2021-7-9 01:40 | |

|

|

Alpha Finance selects short-selling crypto platform Beta Finance as first incubated project

Alpha Finance Lab, a DeFi ecosystem, today announced the first project of its Alpha Launchpad program – Beta Finance, a permissionless money market protocol to lend, borrow, and short crypto-assets. дальше »

2021-7-9 19:18 | |

|

|

DeFi Protocol Cream Finance To Launch On Polygon

Decentralized lending protocol Cream Finance is set to launch on the Ethereum layer 2 scaling solution network, Polygon. Cream To Roll Out Ten Digital Assets At Launch According to the announcement published by Cream, the integration with Polygon would enable users to lend and borrow ten digital assets, such as USDC, USDT, DAI, WMATIC, LINK, […] The post DeFi Protocol Cream Finance To Launch On Polygon first appeared on BitcoinExchangeGuide. дальше »

2021-6-30 17:39 | |

|

|

Compound (COMP) Unveils Institutional-Grade DeFi Product Compound Treasury

DeFi protocol Compound (COMP) launches Compound Treasury to give institutions a taste of lucrative DeFi yields. Compound Protocol Launches Compound Treasury Compound (COMP), a blue-chip decentralized finance (DeFi) protocol built on Ethereum that lets users earn interest or borrow assets against collateral has launched Compound Treasury which is geared toward non-crypto native businesses and financialRead More дальше »

2021-6-29 10:16 | |

|

|

Coinbase’s Bitcoin-Collateralized Loans Now Available in 20 States in the U.S

Coinbase announced today that it has increased the number of U. S. states in which residents are eligible for Bitcoin-collateralized loans from the exchange. The company has also increased the percentage limit that customers can borrow on their Bitcoin holdings, from 30% to 40%. дальше »

2021-6-11 17:55 | |

|

|

MicroStrategy To Pump $500 Million More Into Bitcoin After 50% Crash

Michael Saylor has doubled down on MicroStrategy’s huge bets on bitcoin, borrowing $500 million through junk bonds to plow into the cryptocurrency – $100 million more than expected. Michael Saylor’s MicroStrategy ramps up junk-bond The firm said that it will borrow around $500 million in the form of senior secured notes. At a time when […] дальше »

2021-6-10 02:12 | |

|

|

The Top 5 Platforms for Crypto Collateralized Loans

There are now a growing number of crypto finance platforms that enable HODLers to borrow for necessary expenses - while continuing to hold their assets for gains over the longer term. дальше »

2021-6-9 19:00 | |

|

|

Bitfinex Borrow добавила Solana в качестве обеспечения по кредитам

Биржа Bitfinex объявила, что добавила Solana (SOL) в качестве обеспечения на своей платформе Bitfinex Borrow, предназначенной для кредитования. Таким образом, теперь клиенты Bitfinex смогут брать в долг до 70% стоимости своих SOL как в долларах США (USD), так и в токенах Tether (USDt). дальше »

2021-6-8 11:00 | |

|

|

How Do You Borrow Money if Your Credit is Bad?

If you’re in a situation where your credit has gone to the dogs, it can be really difficult to figure out how to get out of it. In some cases, you may find that it is really hard to get any sort of money, whether a loan or a credit card, because of your bad […] The post How Do You Borrow Money if Your Credit is Bad? appeared first on ItsBlockchain. дальше »

2021-5-29 12:18 | |

|

|

Hoard Launches NFT Marketplace

Aarhus, Denmark, 26th May, 2021, Hoard Exchange, an Ethereum-based NFT marketplace for trading, renting and lending NFT’s, will be opening its gates on May 26, 2021. Hoard allows users to borrow and pledge NFT’s like in-game items, digital art, domain names and more. дальше »

2021-5-27 00:03 | |

|

|

Use Your NFTs to Lend, Borrow, Stake, and Earn at Hoard Exchange NFT Marketplace

In a significant service update, Hoard exchange, a platform that empowers game developers with the infrastructure to integrate in-game items with Ethereum blockchain, has launched its NFT marketplace today. дальше »

2021-5-27 20:15 | |

|

|

Demand to Borrow Bitcoin Declining While Ether sees Significant Increase: Genesis Q1 Report

The company saw a “tremendous” amount of interest from treasury executives, taking positions in bitcoin for the first time. The post Demand to Borrow Bitcoin Declining While Ether sees Significant Increase: Genesis Q1 Report first appeared on BitcoinExchangeGuide. дальше »

2021-4-30 16:58 | |

|

|

Digital Money 2025: What You Could Spend, Where You Could Invest, and How You Could Borrow?

Cryptocurrencies have been on an incredible trajectory over the past 12 months, with the total market capitalization growing from $198 billion in April 2020 to more than $2 trillion today. This meteoric rise is coupled with increasing adoption from consumers driven by major announcements from household names, such as Square, Visa, and PayPal, which now […] дальше »

2021-4-21 16:10 | |

|

|

Cosmos (ATOM) now available as collateral on Bitfinex Borrow

CryptoNinjas » Cosmos (ATOM) now available as collateral on Bitfinex Borrow Bitfinex, the popular cryptocurrency token trading platform, today announced it has added Cosmos (ATOM) as collateral on Bitfinex Borrow, the platform’s peer-to-peer (P2P) digital token loan portal, after it was successful in a social media poll. дальше »

2021-4-16 22:23 | |

|

|

Kava Protocol Upgrades to V5.1, Hard Money Market Now Fully Functional Allowing Bitcoin Whales to Earn 45% APR

Kava—a cross-chain and multi-asset DeFi platform trusted by financial institutions, has optimized its blockchain. It is upgrading to version 5. 1 and activating the borrow side functionality of the Hard Protocol–a product built on the Kava blockchain. дальше »

2021-4-9 18:32 | |

|

|

Holdefi (HLD) Review: Borrow and Lend Digital Assets Securely

Accessing credit should be easy, better, paperless. However, the current state of affairs in traditional finance is full of needless hops that, as expected, trip potential borrowers. Decentralized finance (DeFi) is a radical shift away from this style of doing business. дальше »

2021-3-30 11:49 | |

|

|

Ray Dalio: Investing in Bonds is “Stupid,” Rather Borrow Cash to Buy Higher-Returning Assets

Because holding cash “is and will continue to be trash. ” The billionaire hedge fund manager says there’s so much money injected into the markets that they have become casinos with “people playing with funny money. дальше »

2021-3-16 17:30 | |

|

|

Best Crypto Derivatives Exchanges [2021] – Trade Crypto With Leverage

Margin trading is a type of investing which gives individuals a chance to increase their investment by adding leverage to it. This practice lets you borrow someone else’s cryptocurrency and invest it as you see fit. дальше »

2021-3-16 15:40 | |

|

|

What is Aave? An Overview of the Budding DeFi Lending Platform

Aave is a decentralized, open-source, non-custodial liquidity protocol that enables users to earn interest on cryptocurrency deposits, as well as borrow assets through smart contracts. Aave is interesting (pardon the… The post What is Aave? An Overview of the Budding DeFi Lending Platform appeared first on CoinCentral. дальше »

2021-3-8 22:34 | |

|

|

IOTA token added as collateral asset on Bitfinex Borrow

CryptoNinjas » IOTA token added as collateral asset on Bitfinex Borrow Bitfinex, the popular cryptocurrency exchange platform, today announced it has added IOTA as collateral on Bitfinex Borrow; after it was successful in a recent social media poll. дальше »

2021-3-7 23:51 | |

|

|