Blackrock - Свежие новости [ Фото в новостях ] | |

Bitcoin ETF inflows reach $88M as BTC price struggles at $67K

Bitcoin ETFs recorded $88. 04 million in net inflows on February 20, breaking a three-day outflow streak that drained $403. 90 million. BlackRock’s IBIT led with $64. 46 million while Fidelity’s FBTC attracted $23. дальше »

2026-2-21 09:39 | |

|

|

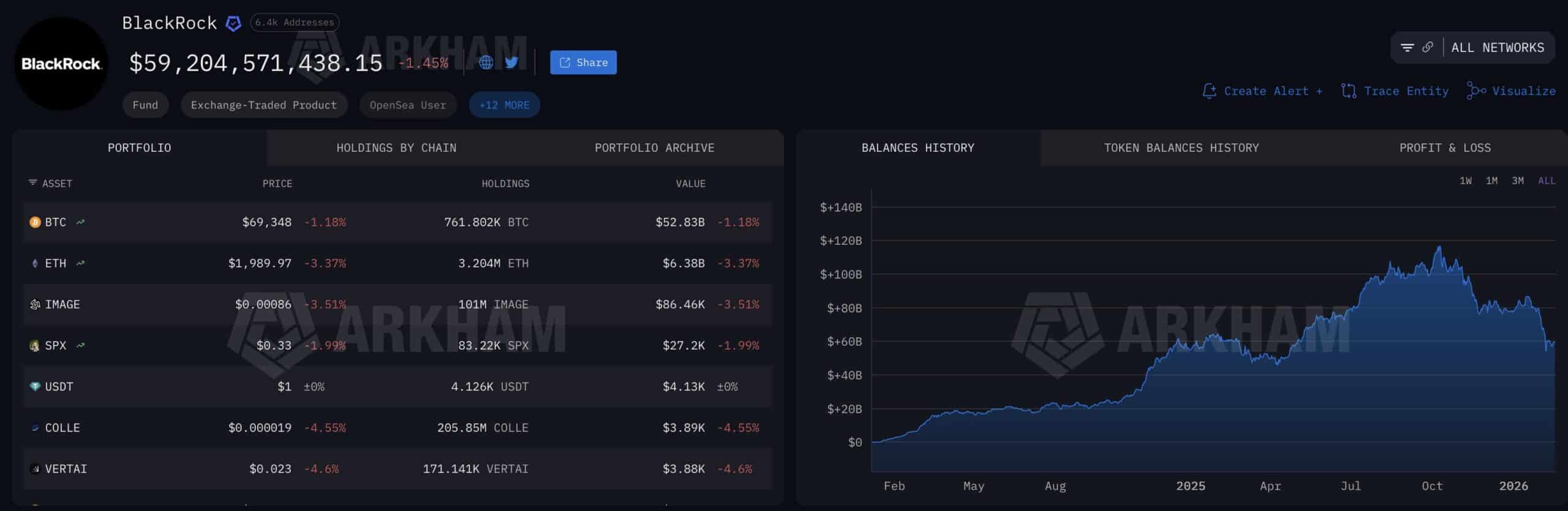

BlackRock moves $270M in Bitcoin, Ether to Coinbase as weekly outflows spike

BlackRock's crypto fund adjustments amid market shifts highlight the growing integration of digital assets into traditional finance systems. The post BlackRock moves $270M in Bitcoin, Ether to Coinbase as weekly outflows spike appeared first on Crypto Briefing. дальше »

2026-2-22 15:55 | |

|

|

Is China using US Bitcoin ETFs as a backdoor? Mystery Hong Kong firm invested $436M in BlackRock’s IBIT

An obscure Hong Kong firm has disclosed a $436 million position in BlackRock’s Bitcoin ETF, a revelation that is fueling speculation about Chinese capital flowing into crypto through offshore side doors. дальше »

2026-2-18 17:00 | |

|

|

BlackRock trims stake in Bitcoin proxy Strategy but keeps top shareholder spot

BlackRock's slight reduction in Bitcoin proxy holdings may signal cautious optimism, impacting market perceptions and investment strategies. The post BlackRock trims stake in Bitcoin proxy Strategy but keeps top shareholder spot appeared first on Crypto Briefing. дальше »

2026-2-18 16:41 | |

|

|

BlackRock will skim 18% of staked Ethereum ETF rewards from investors — and ETHB exits could take weeks

BlackRock has sharpened the staking posture for its iShares Staked Ethereum Trust ETF (ETHB), outlining a plan to keep most of the fund’s ETH staked and earning rewards rather than held in custody. дальше »

2026-2-18 13:33 | |

|

|

BlackRock, Coinbase to keep 18% of ETH ETF staking revenue

BlackRock and Coinbase plan to take an 18% share of staking rewards from BlackRock’s proposed Ethereum staking exchange-traded fund, according to an updated regulatory filing. The firms disclosed the fee structure in an amended S-1 filing with the U.S. Securities… дальше »

2026-2-18 07:31 | |

|

|

Abu Dhabi’s Mubadala Boosts Bitcoin ETF Holdings to $630 Million

Bitcoin Magazine Abu Dhabi’s Mubadala Boosts Bitcoin ETF Holdings to $630 Million Abu Dhabi investment vehicles together held over 20 million shares of BlackRock’s Bitcoin IBIT at the close of last year, with a combined value exceeding $1. дальше »

2026-2-18 21:28 | |

|

|

Abu Dhabi’s Al Warda Raises Bitcoin ETF Stake to 8.2 Million IBIT Shares in Q4 Filing

Bitcoin Magazine Abu Dhabi’s Al Warda Raises Bitcoin ETF Stake to 8. 2 Million IBIT Shares in Q4 Filing Abu Dhabi’s Al Warda Investments increased its bitcoin exposure via BlackRock’s IBIT to 8. дальше »

2026-2-18 18:58 | |

|

|

Here are 5 Stocks BlackRock is Buying Now!

Mid-February is always an interesting time for stock investors, because new SEC filings start rolling in. That’s when the public gets a fresh look at what the biggest institutions have been buying. дальше »

2026-2-17 18:30 | |

|

|

This is what “Wall Street crypto” looks like: IBIT options went vertical as Bitcoin hit $60k intraday

Bitcoin’s slide toward $60,000 came with the usual noise from exchanges, but the sheer size of the panic was evident somewhere else. Options tied to BlackRock’s iShares Bitcoin Trust (IBIT) traded about 2. дальше »

2026-2-15 22:10 | |

|

|

Analyzing why UNI's upside will remain capped despite ETF, BUIDL updates

Uniswap [UNI] was in the news recently after the Securitize announcement. AMBCrypto reported that the asset tokenization platform will be plugging BlackRock's tokenized treasury product BUIDL into theThe post Analyzing why UNI's upside will remain capped despite ETF, BUIDL updates appeared first on AMBCrypto. дальше »

2026-2-14 10:00 | |

|

|

Will $2.3B options expiry jolt Ethereum price from key strike levels?

Ethereum price continues to lag its 2021 peak as institutions rotate cautiously into ETH exposure while weighing ETF flows, on-chain activity, and broader macro risk. BlackRock is leaning into the pain on Ethereum (ETH) price, quietly ramping up its exposure… дальше »

2026-2-14 14:56 | |

|

|

XRP price could double if BlackRock files for ETF, analyst suggests

XRP price could rally 100% if BlackRock files for an XRP ETF, as analysts flag a shift in institutional allocations beyond Bitcoin and Ethereum into alternative assets. A cryptocurrency analyst has projected that XRP (XRP) price could rally 100% if… дальше »

2026-2-14 14:47 | |

|

|

UNI price jumps as BlackRock’s BUIDL token lists on Uniswap, but risks remain

Uniswap (UNI) price surged on BUIDL news but quickly pulled back as momentum faded. Institutional access boosts Uniswap’s profile but remains tightly restricted. Whale activity before the news raised insider trading concerns. дальше »

2026-2-12 16:08 | |

|

|

BlackRock exec: 1% crypto allocation could pull in $2T from Asia

Asian 1% crypto allocations could add ~$2T, reshaping global market structure and ETF-driven liquidity. A BlackRock Asia executive said a 1% cryptocurrency allocation by investors across the region could generate approximately $2 trillion in market inflows, according to a statement… дальше »

2026-2-12 15:51 | |

|

|

Uniswap is bringing BlackRock’s $2.2 billion BUIDL to DeFi, but the trade access comes with a catch

On Feb. 11, Uniswap announced that BlackRock's $2. 2 billion USD Institutional Digital Liquidity Fund (BUIDL) would trade on UniswapX via a partnership with Securitize. The integration enables BUIDL holders to swap into USDC via an on-chain request-for-quote system that settles atomically with quotes from allowlisted market makers, including Flowdesk, Tokka Labs, and Wintermute. дальше »

2026-2-12 13:35 | |

|

|

UNI price pops as BlackRock taps Uniswap to tap liquidity for BUIDL

Uniswap token jumped to a high of $4.57, its highest point since January 29, and 62% above its lowest level this year. It then pulled back to $3.7 at press time. It remains 68% below its 2025 peak. дальше »

2026-2-12 23:30 | |

|

|

BlackRock Expands Into DeFi With BUIDL Launch On Uniswap

BlackRock, the world’s largest asset manager, is taking another decisive step into digital assets. The firm has announced plans to launch its Treasury-backed BUIDL token on the decentralized exchange Uniswap, marking a notable intersection between traditional finance and decentralized finance. дальше »

2026-2-12 19:28 | |

|

|

Best Crypto Presale: DeepSnitch AI Emerges Best Crypto Presale As 200x Rumors Grow Amid Presale Success While Ozak AI and Remittix Struggle To Compete

Market volatility has intensified across the crypto sector following reports that BlackRock’s spot Bitcoin ETF recorded its highest-ever single-day trading volume, driven by traders reacting to Bitcoin’s sharp price decline. дальше »

2026-2-10 22:30 | |

|

|

BlackRock’s IBIT Draws In $231M As Bitcoin ETFs Close Week Positively — Details

After a chaotic week for the cryptocurrency market, the US-based Bitcoin ETFs (exchange-traded funds) saw significant capital inflows on Friday, February 6. As the flagship cryptocurrency and the rest of the market suffered huge declines, the BTC-linked exchange-traded products also posted substantial withdrawals during the week. дальше »

2026-2-9 18:00 | |

|

|

Arthur Hayes Attributes Bitcoin Crash to ETF-Linked Dealer Hedging

BitMEX's Arthur Hayes posited that dealer hedging linked to BlackRock’s IBIT ETF is amplifying Bitcoin's volatility. The post Arthur Hayes Attributes Bitcoin Crash to ETF-Linked Dealer Hedging appeared first on BeInCrypto. дальше »

2026-2-9 17:13 | |

|

|

Bitcoin ETFs witness $330 million in inflow as BTC price dumps again

Bitcoin ETFs recorded $330. 67 million in net inflows on February 6, ending a three-day outflow streak that drained $1. 25 billion from products. BlackRock’s IBIT led with $231. 62 million in inflows. дальше »

2026-2-7 20:00 | |

|

|

Bitcoin investors face ‘harvest now, decrypt later’ quantum threat

IBIT’s heavy Bitcoin flows and rising institutional demand collide with growing “harvest now, decrypt later” fears and BMIC’s push for post-quantum wallet security. BlackRock’s iShares Bitcoin Trust recorded substantial daily trading volume, according to Nasdaq data, as digital asset security… дальше »

2026-2-6 14:39 | |

|

|

Bitcoin’s drop below $63k sparks BlackRock’s IBIT’s biggest trading day on record

BlackRock’s iShares Bitcoin Trust ETF has hit a new all-time high in daily trading volume as the bellwether cryptocurrency posted one of its largest intraday drops on Thursday. As noted by Bloomberg ETF analyst Eric Balchunas, IBIT reportedly “crushed its… дальше »

2026-2-6 11:11 | |

|

|

BlackRock moves $358M in Bitcoin to Coinbase as price drops toward $69,000

BlackRock's significant crypto transfer highlights ongoing market volatility and could influence investor sentiment amid declining prices. The post BlackRock moves $358M in Bitcoin to Coinbase as price drops toward $69,000 appeared first on Crypto Briefing. дальше »

2026-2-6 15:48 | |

|

|

BlackRock’s Altcoin Accumulation List EXPOSED – Best Cryptos to Buy Now in 2026

Something important is happening behind the scenes. BlackRock, the largest asset manager in the world, is no longer focused only on Bitcoin. The firm has been positioning around a small group of altcoins that sit at the core of a much bigger plan. дальше »

2026-2-4 01:00 | |

|

|

U.Today Crypto Digest: Ripple's RLUSD Eyes $1.5 Billion Milestone, BlackRock Dumps Staggering $671 Million in Bitcoin and Ethereum, XRP Hits 1,407% Liquidation Imbalance

Crypto news digest: Ripple’s stablecoin nears $1.5B market cap; BlackRock makes largest Bitcoin and Ethereum deposits of 2026; XRP shorts wiped out. дальше »

2026-2-6 20:47 | |

|

|

BlackRock sends over $670M in Bitcoin, Ethereum to Coinbase

BlackRock's significant crypto transfer to Coinbase highlights the growing institutional involvement and potential market volatility impacts. The post BlackRock sends over $670M in Bitcoin, Ethereum to Coinbase appeared first on Crypto Briefing. дальше »

2026-2-3 19:00 | |

|

|

Bitcoin ETFs extend four-day outflow streak while BTC stalls near $83,000

Bitcoin spot ETFs recorded $509.70 million in net outflows on January 30 and mark the fourth day of redemptions in five trading sessions. BlackRock’s IBIT led withdrawals with $528.30 million in outflows, while Fidelity’s FBTC attracted $7.30 million in inflows… дальше »

2026-2-1 20:00 | |

|

|

Avalanche RWA TVL Jumps 69% to $1.33B in Q4 as BlackRock, ETFs Fuel Onchain Surge

Key Takeaways: BlackRock tokenized $500 million on Avalanche and until the end the last quarter 2025, the total tokenized Real World Asset (RWA TVL) on this has reached up to The post Avalanche RWA TVL Jumps 69% to $1. дальше »

2026-1-30 19:23 | |

|

|

Upgrade your Bitcoin investment strategy using these 7 critical demand drivers

Bitcoin traders are treating fund flows like macro bets, and one Fed data change is the hidden risk Key takeaways Bitcoin’s institutional demand can be monitored in issuer AUM snapshots such as BlackRock’s IBIT, which listed net assets of $69,427,196,929 as of Jan. дальше »

2026-1-30 00:05 | |

|

|