2020-10-10 15:00 |

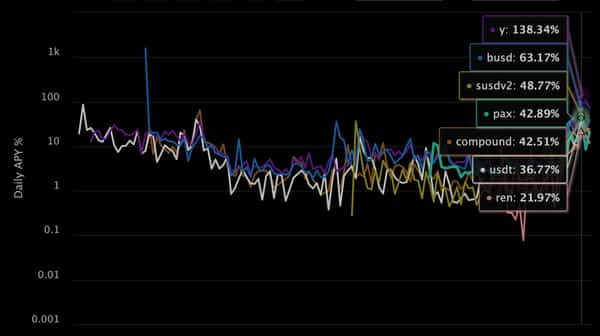

Ethereum yield farming has declined dramatically over recent weeks as retail investors have seemingly sidelined their capital and as the price of leading DeFi coins has moved dramatically lower. Curve DAO Token (CRV), for instance, has plunged in excess of 90 percent since its all-time high price established just around two months ago.

Yield farming, though, is far from dead: a new yield farming project backed by top investors in the space, along with leading crypto exchange Binance, just launched. And it promises to allow users to bolster the yields they can access while dabbling in DeFi.

New Ethereum yield farm backed by top firms goes liveJust hours ago, Alpha Finance’s “Alpha Homora” product went live with liquidity mining.

The platform operates similarly to Yearn.finance in that it allows users to easily earn with popular yield farms at a low gas cost and with minimal technical knowledge. Alpha Homara differs from Yearn.finance, though, in that it allows users to take on leverage.

For instance, a user depositing 10 ETH to farm Unswap’s ETH/WBTC pool through Alpha Homora can pay an interest rate and borrow 20 ETH from a public pool to bolster their yields by 200 percent. Borrowers and lenders of the pool of ETH earn regular rewards paid in the project’s native ALPHA token.

Alpha Homora manages liquidation risks by allowing “liquidators” to easily liquidate leveraged yield farming positions that are at risk of being undercollateralized.

Behind this new product is Alpha Finance Lab, an ecosystem of DeFi products focused on Ethereum and Binance Smart Chain.

“Alpha Finance Lab is focused on building an ecosystem of automated yield-maximizing Alpha products that interoperate to bring optimal alpha to users on a cross-chain level.”

Alpha Finance Lab’s ALPHA token is being listed by Binance while the company itself has received financial support from three top venture capitalists in the DeFi space: Spartan Group, Multicoin Capital, and DeFiance Capital.

With this capital, Alpha Finance Lab is looking to solve the following four problems in DeFi:

Sustainable yield-generation Impermanent loss Privacy-preserving token swap Lending with fixed interest rates Continued innovation to push DeFi higherAnalysts say that the continued innovation in the space will push DeFi coins higher over time despite the ongoing stagnation in this volatile market.

Andrew Kang, founder of Mechanism Capital, said at the end of September that he remains optimistic on DeFi because the rate of innovation in the space continues to grow rapidly:

“For both public and private DeFi projects, the innovation and pace of development continues forward at a blistering pace – even faster than it was two months ago. Early players created the building blocks for new developers to build off of or take inspiration from.

The post New Ethereum yield farm backed by Binance, top crypto VCs just launched appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|