2026-2-12 21:18 |

Cardano is aggressively expanding the types of tokens that can operate on its network and raise the ceiling for its decentralized finance ecosystem over the next 12 to 18 months.

On Feb. 12, the Charles Hoskinson-led blockchain announced it would integrate with LayerZero, a widely used cross-chain messaging system.

This move represents the single largest interoperability unlock in Cardano’s history as LayerZero connects over 160 blockchains and has facilitated more than $200 billion in cross-chain volume.

A pipeline into 400 tokens and $80 billion in omnichain assetsLayerZero’s core value proposition is its chain-agnostic messaging layer. This means that applications can send and receive messages between endpoints, regardless of the execution model on the underlying chains.

For Cardano, this enables direct access to major blockchain ecosystems, including Ethereum, Solana, Base, Arbitrum, BNB Chain, Sui, and more than 140 others, without changing its underlying model.

That model difference has been a practical hurdle. Cardano is built on an extended UTXO architecture, the same foundational approach as Bitcoin, which is designed for determinism, predictability, and security.

However, much of the broader crypto economy runs on account-based architectures, including Ethereum, Solana, and Base. Because much cross-chain tooling has been designed primarily for account-based systems, Cardano has often faced additional friction when accessing cross-chain liquidity.

LayerZero’s integration is positioned to address that tooling gap. It does not require Cardano to become account-based. Instead, it routes interoperability through messaging endpoints.

If Cardano becomes a supported endpoint, it becomes part of the same connectivity layer that many projects already use to coordinate cross-chain actions.

The most direct asset-level implication comes from the OFT standard.

OFTs are designed to exist natively across multiple blockchains while maintaining a single, unified supply through a burn-and-mint mechanism. A token is burned on one chain and minted on another, coordinated through the messaging layer.

This design reduces reliance on traditional token wrapping and on liquidity pools that sit between users and the assets they want to move.

The scale of that catalog is what makes the LayerZero integration meaningful in a Cardano context. More than 400 tokens, with a combined market capitalization of more than $80 billion, already use the OFT standard.

While Cardano does not automatically inherit the liquidity, it provides a technical pathway for those live assets to expand to Cardano.

Why Cardano is pushing interoperability nowCardano has spent years leaning into a development style built around formal methods and a security-first posture.

It has also spent years contending with a practical drawback, it has not been as connected to the broader multichain economy as many other networks, and that has limited how much liquidity and application activity it can compete for.

The timing is important because Cardano’s DeFi starting point is modest enough that incremental changes can have visible effects.

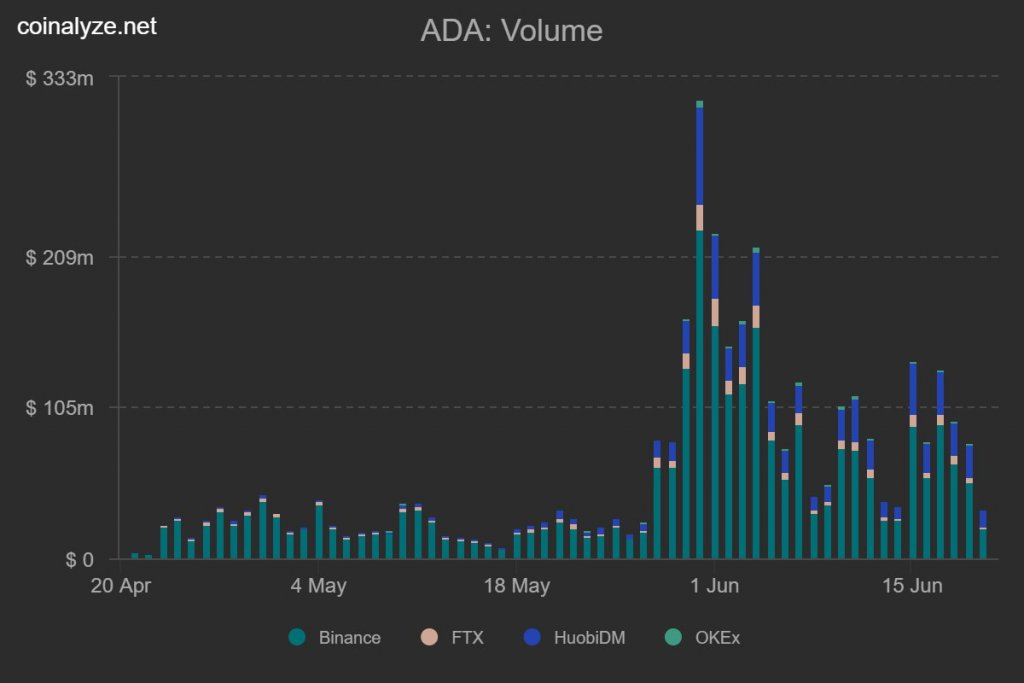

DefiLlama data show Cardano with roughly $125 million in total value locked, about $37 million in stablecoin market capitalization, and around $2 million in 24-hour DEX volume. Those numbers are small relative to the largest DeFi venues, which is why interoperability is being viewed as a potential catalyst.

This is where LayerZero’s value to Cardano becomes concrete.

If Cardano becomes an endpoint for a system that already spans more than 160 blockchains, and if it becomes a viable deployment target for more than 400 OFT tokens with more than $80 billion in combined market capitalization, Cardano does not need to win a large share of global liquidity for its on-chain profile to change.

But the mechanism is not automatic. Cardano needs actual deployments and actual usage. It needs stablecoins that sit on Cardano long enough to support trading and lending.

It needs tokenized assets that become collateral, not just transitory flows. It needs applications that draw users who would otherwise stay on other networks.

So, supporters of the integration argue it would make categories of assets that have been difficult to use on Cardano more accessible, including stablecoins, Bitcoin-linked liquidity, tokenized real-world assets, and DeFi building blocks.

This includes lending assets, governance tokens, and liquid staking derivatives that already operate across many networks through LayerZero.

What it changes for builders and for usersFor developers, the integration is positioned as a shift from building for a single network to building for a distribution layer.

This means Cardano developers can build omnichain applications using LayerZero’s OApp standard, the same framework used by projects including Ethena, PayPal, BitGo, Stargate, and many other protocols.

Moreover, it means a team can build on Cardano while still reaching users and liquidity across LayerZero-connected chains.

For context, a lending protocol on Cardano could source collateral from Ethereum, or a stablecoin product could launch on Cardano and distribute across other ecosystems from the start.

The key point is that Cardano’s developer experience and chain model do not need to change. What expands is the addressable market.

For users, the shift is framed more simply. The integration is supposed to remove barriers that have made certain assets and strategies easier on other chains than on Cardano.

Stablecoins from other ecosystems could be brought to Cardano without complex workflows and assets held on Hoskinson-led network could more easily move into the broader crypto economy.

LayerZero’s Stargate product is also part of the rollout story.

Stargate is the largest cross-chain bridge by volume its unified-liquidity model enables asset transfers without fragmentation or wrapped-token designs, emphasizing native asset movement between chains.

For Cardano users, this would mean a widely used transfer interface becomes directly available within its ecosystem.

What comes next, and how the market will judge itThe most important near-term milestone is implementation.

The integration involves deploying LayerZero Endpoint smart contracts on Cardano, with OFT-compatible token support to follow.

Cardano backers have also emphasized that the network is investing in critical infrastructure in parallel, including stablecoins, cross-chain connectivity, custody solutions, and institutional tooling.

The argument is that LayerZero is just one component of a broader effort to make Cardano a place where assets can arrive and stay.

That is the core test. Interoperability can make assets technically accessible. It does not automatically make them sticky.

The next few quarters will show whether OFT token issuers actually extend to Cardano, whether stablecoin balances grow from the current roughly $37 million base, and whether Cardano’s DeFi activity rises in a sustained way from roughly $125 million in TVL and about $2 million in daily DEX volume.

If those metrics move together, the LayerZero integration will look like more than plumbing. It will look like a distribution.

If they do not, Cardano will still have expanded its connectivity, but it will also have reinforced a familiar lesson in crypto markets: interoperability is increasingly necessary, but demand still has to be earned

The post New Cardano deal opens a path to $80 billion in omnichain assets, but liquidity still isn’t guaranteed appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cardano (ADA) на Currencies.ru

|

|