2020-11-19 18:48 |

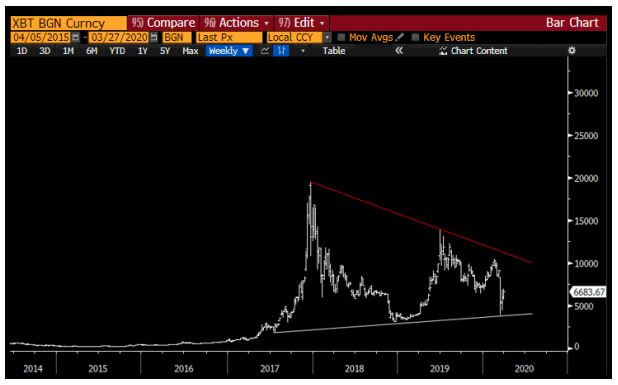

The price of Bitcoin surged past $18,000 once again, marking a sharp recovery from its earlier intraday drop to around $17,355. Behind the ongoing rally is a noticeable spike in the open interest of CME and other major futures exchanges.

The 15-minute price chart of Bitcoin. Source: BTCUSD on TradingView.comThe open interest of the CME Bitcoin futures market surged past $1 billion on November 18. This comes after an increase in the number of billionaires and large financial institutions publicly supporting or investing in BTC.

CME #bitcoin futures just crossed $1bln open interest pic.twitter.com/VLx4tL85zw

— skew (@skewdotcom) November 18, 2020

The CME Bitcoin futures market primarily targets institutions and accredited investors in the U.S. Hence, the open interest surpassing $1 billion would likely indicate significant demand for BTC from institutional investors.

The term open interest refers to the total sum of all long and short contracts in the market. It is useful to gauge the trading activity or a market or an asset, like Bitcoin.

Bitcoin Sees Aggressive Dip Buying, is it Institutions?Bitcoin had a strong narrative to see a sharp pullback at the start of this week. There were large sell orders at $17,500 and high time frame charts, including the weekly and monthly charts, both hovered well above short-term moving averages (MAs).

Instead, BTC pushed past the $18,000 level for the first time since 2017. It is repeatedly testing the $18,500 resistance area, supplemented with strong buy orders across major exchanges.

Albeit it is difficult to pinpoint where the demand is coming from, many analysts believe the primary source of demand for BTC in the recent rally is institutions.

Based on the recent trend, Kevin Kelly, the head of global macro at Delphi Digital, said he expects Bitcoin to evolve into an established portfolio asset. He said:

“If our thesis proves to be correct, $BTC could replace a substantial portion of Treasury & sovereign debt in the average investor’s portfolio in the coming years, resulting in immense capital flows for such a nascent asset.”

So far, at least within the last few months, more institutional and high-net-worth investors have started to consider Bitcoin as a recognized portfolio asset.

The institutional craze around Bitcoin could have caused the market sentiment around BTC to amplify. The overall BTC futures market open interest has also surged noticeably since October.

#bitcoin futures total open interest making new all-time-high > $6bln pic.twitter.com/G7IsPhEXQV

— skew (@skewdotcom) November 17, 2020

BTC is Still Early, Big Room to GrowAlthough Bitcoin is approaching $18,500 again, which still has a high number of sell orders, in the long term, BTC is still early in its growth phase.

Kelly notes that Bitcoin only accounts for around 0.4% of the global M2 money supply. He said:

“Notably, $10+ trillion has been added to global M2 money supply since the end of March. $BTC has nearly tripled over the same period but its total market value still only represents ~0.4% of global M2.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Rally (RALLY) на Currencies.ru

|

|