2019-8-3 22:30 |

On Friday, Ikigai Asset Management founder and CIO Travis Kling released an incredibly detailed report which makes a strong case for Bitcoin price achieving a new all-time high in 2020.

The Devil is in the DetailsOn Friday Ikigai Asset Management released its tenth monthly crypto and traditional market update and the report was filled with some intriguing Bitcoin price action observations. Ikigai believes that the crypto-sector can “fundamentally change the world and create trillions of dollars of value in the process.”

The asset management firm also firmly believes that the crypto-market is “well on its way to new ATHs for BTC after a truly spectacular Q2-19 – the fourth-best quarterly performance since 2012.”

In fact, Ikigai explicitly said:

In our Monthly Update letter that went out June 1st we said, “last month we stated that new all-time highs were well within reach for 2020. We now believe that may have proven too conservative, and there is a meaningful chance new ATHs are possible in 2019, and likely in 2020.

Ikigai supported this conclusion by pointing out that:

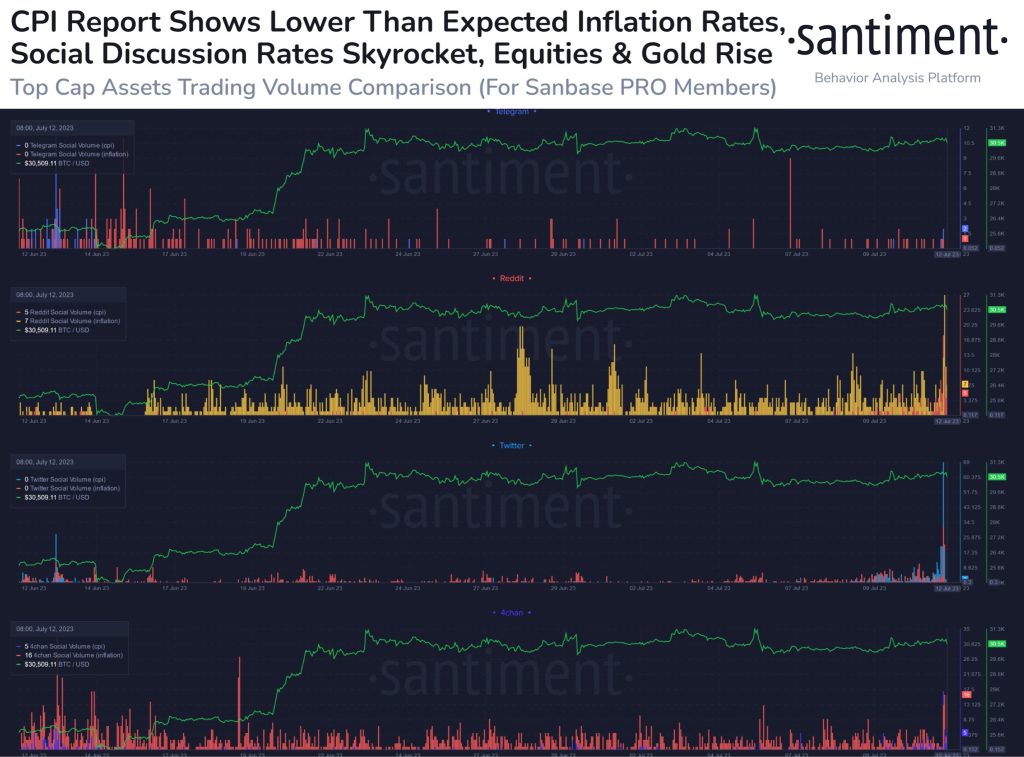

Mainstream media coverage of cryptocurrency has risen significantly. No-coiners are joining the pack, or at least expressing more interest in cryptocurrency. Exchange volume has exploded upwards. Credit Due to FacebookIkigai also suggested that the crypto market’s bullish sentiment is partially driven by Facebook’s Libra cryptocurrency. According to Ikigai:

Facebook’s Libra project is tremendously important to the crypto ecosystem. While Libra competes with certain crypto projects, it does not compete with Bitcoin – it is a gateway to Bitcoin. With 2.4bn MAU’s across the Facebook Messenger, WhatsApp and Instagram platforms, Libra has the potential to bring the concept of “value accrual in digital assets” to the world at a scale never before seen.

Metrics Support a Rising Bitcoin PriceKling confidently asserts that “we are in the midst of a raging bull market [but it is] important to note [that] we are experiencing a significant and much-needed pullback.” Ikigai explained that a strong correction was expected as Bitcoin had already appreciated by +60% in the month of June.

The report also mentioned that the strong pullback resulted in more than $260 million worth of long liquidations on Bitmex in just one hour.

As the chart shows below, Bitcoin was severely overbought and in historical correction territory.

The report also delves a bit into the world of conspiracy theory by suggesting that:

While a deeper pullback in the near term is certainly possible, we believe it is most likely simply an engineered opportunity for Risky Whales to profit from short-term shorts and accumulate more BTC at lower prices before taking the market to new YTD highs.

All-Time Bitcoin Price Highs are ImminentThe report points out that another case for Bitcoin rallying toward new all-time highs is Bitcoin’s rising dominance level. In June the dominance rate rose to heights not seen since the 2017 bull market.

Ikigai attributes this rise in BTC dominance to improving fundamentals and deep interest from institutional investors. According to Ikigai:

BTC is separating itself from the rest of the crypto asset landscape in terms of institutional investability.

The report takes a deep view at an array of metrics (hash rate, volume, on-chain activity, USDT printing, short and long-term price action ) and Ikagai concludes that despite the current pullback, Bitcoin is incredibly bullish.

The firm suggests that the upcoming Bitcoin halving event will catalyze a powerful bull market which will take Bitcoin and the crypto-sector to new all-time highs.

Do you think Bitcoin price will rally to $2o,000 before the end of 2019? Share your thoughts in the comments below!

Image via:Kanaandkatana

The post New Bitcoin ‘ATHs Possible in 2019, Likely in 2020’: Report appeared first on Bitcoinist.com.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|