2023-8-11 10:43 |

A new report from the Bank of Canada indicates that Canadians have ‘relatively weak incentives to adopt and use a central bank digital currency (CBDC) on a large scale. The report identifies obstacles to CBDC adoption because most Canadians seem happy with their current payment choices.

Canadians already have access to various payment methods, including cash, bank accounts, and debit and credit cards. The research assumes that these possibilities will remain even in a cashless world.

Canadian Challenges to Widespread CBDC AdoptionThe paper notes, “Ownership and use of other crypto instruments for payments is even less significant.” This means there aren’t many compelling reasons for customers to switch to CBDC, especially given that their use of current payment methods is often trouble-free.

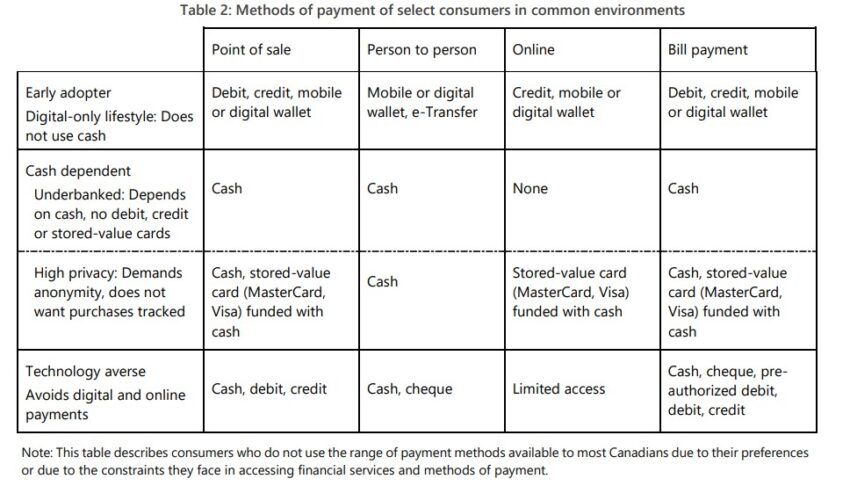

Payment preference of Canadians. Source: Bank of Canada“Currently, most Canadian consumers do not experience gaps in their access to payment methods, and this will likely remain the case in a cashless environment,” the central bank document noted.

According to the research, 14% of Canadians no longer use cash, and in 2021, only 13% of people possessed Bitcoin, with only 1% of people using it for payments.

However, a June survey found that 59% of Canadians would utilize a CBDC if one were made available. In addition, 25% of respondents reportedly preferred using it over cash.

Have a look at our guide on the Indian CBDC here: Digital Rupee (e-Rupee): A Comprehensive Guide to India’s CBDC

Public Opinion Remains MixedThe Bank of Canada also sought citizens’ feedback about a digital Canadian currency during the month. And apart from political opposition to a CBDC as an alternative form of payment, around 56% of the respondents expressed concern about possible fraud, while 53% were concerned about cyberattacks.

51% said they believed in the Bank of Canada to protect their privacy, while 25% were unconvinced.

The willingness of Canadians to adopt CBDC. Source: WealthRocketThe skepticism toward CBDC is not unique to Canada. As Russia prepares to launch its digital currency, a survey reveals that 32% of respondents believe the digital ruble may be a potential scam.

According to a Bank of Canada assessment, major obstacles, and insufficient incentives hamper the implementation of CBDC. Meanwhile, 130 countries worldwide have considered a CBDC, according to the Atlantic Council. Notably, 19 of the G20 countries are already on the frontlines.

The post New Bank of Canada Research Highlights Lack of Appeal for CBDC Adoption appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Usechain (USE) на Currencies.ru

|

|