2020-3-14 18:05 |

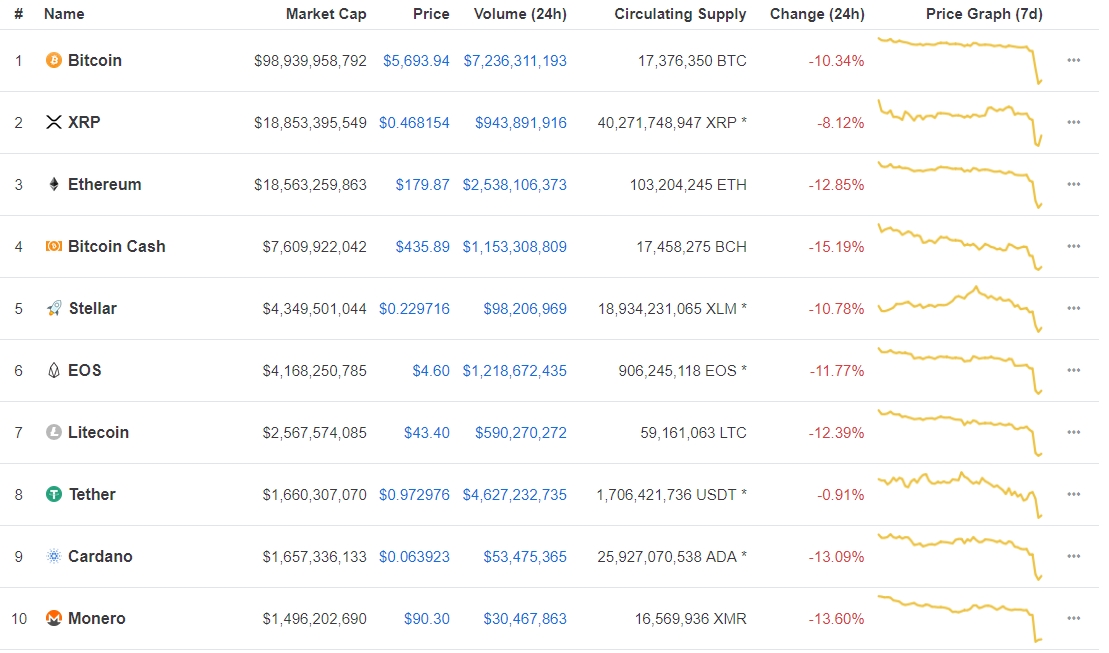

Bitcoin had its worst sell-off in 7 years as it dropped to $3,850 and even lower at $3,600 on BitMEX that resulted in only 44% of Unspent transaction output (UTXOs) in profit. Bitcoin’s market value to realized value (MVRV) has also fallen below 1 while Net unrealized profit/loss (NUPL) has dipped into capitulation. Bitcoin and USDT exchange inflows meanwhile surged during this sell-off.

A drop of about 66% from 2020 high of $10,500, saw a reshuffling of bitcoin ownership as a lot of bitcoin changed hands this week. The daily trading volume skyrocketed amidst the sell-off, going to the level last seen in 2019.

A whopping $4.2 billion changed hands on March 12 with the 7-day average real trading volume spiking to $1.5 billion, more than double the volume we recorded at the beginning of the week.

Such a big move has the 20-day volatility jumping above 7%, not seen since 2014. The futures market for bitcoin also turned extremely volatile, with the premium rates on futures gone. Most of the contracts are now trading below the spot price.

The March contract on deribit is trading $300 below spot price “implying an astonishing -80% annualized premium.” The bearish sentiment can be seen in the futures market as contracts for September expiry are also trading below spot.

It was Panic Selling Not Institutions Behind Bitcoin’s CrashThe crash in bitcoin price also recorded the highest correlation with the stock market in BTC history, going from 0.1 to over 0.5.

“Today proves that institutions buying Bitcoin has a flip side,” commented bitcoin developer Jimmy Song.

However, billionaire investor Mike Novogratz of Galaxy Digital believes that isn’t the case.

“That wasn’t institutions. That was a leveraged washout. Institutions aren’t fast enough to sell like that. That was panic selling from people who bought on margin,” said Novogratz.

We have been seeing the same sell-off even in gold, a traditional safe-haven asset which during the times of emergency had its worst weekly drop since 2013.

As Ari Paul says, “during standard panics, *everything* sells off except cash. That's because people want the stuff that lets them buy food and pay rent. Fear = everything falls except cash.”

On BTC as a safe haven, he said the deflationary crypto asset “does well when people *fear cash* – when they fear inflation/depreciation,” and not economic turmoil. Bitcoin was introduced as a censorship-resistant way to exchange value.

“I'd argue it's more valuable as a seizure resistant asset. Live in a place where a bank or thugs or the government might confiscate your money? It's very useful to you,” said Paul.

Bitcoin (BTC) Live Price 1 BTC/USD =$5,427.6555 change ~ 3.77%Coin Market Cap

$99.17 Billion24 Hour Volume

$10.62 Billion24 Hour VWAP

$5.43 K24 Hour Change

$204.6932 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|