2019-9-3 22:12 |

Earlier today, sharp-eyed observers noticed something strange happening on the BCH blockchain. More than half of Bitcoin Cash’s (BCH) hash power appears to be controlled by unknown miners, who are not part of any known pool. Although there’s no indication of anything sinister going on, that didn’t stop observers and doubters from questioning the security of Bitcoin’s largest fork.

According to statistics website Coin Dance, only 46.4 percent of Bitcoin Cash blocks were mined by recognized mining pools over the past 24 hours, while over 53.4 percent came from ‘other mining pools.’ For comparison, only 8.8% of Bitcoin (BTC) blocks came from unknown miners, in the same period. For Bitcoin SV, the figure was 36.1%.

Source: Coin Dance

Probabilities figure heavily into mining, so daily block figures may not reflect the actual distribution of hashrates. It’s worth zooming out for a more long-term view. Over the past week, the block distribution is a little less unusual- 48% of blocks came from unknown mining pools.

Source: Coin Dance

This is not the first time that more than 50% of BCH hashing power came from unknown or anonymous miners. Back in January 2018, the ‘other mining pools’ bucket made up more than 52% of the hashing power, without placing the network in jeopardy.

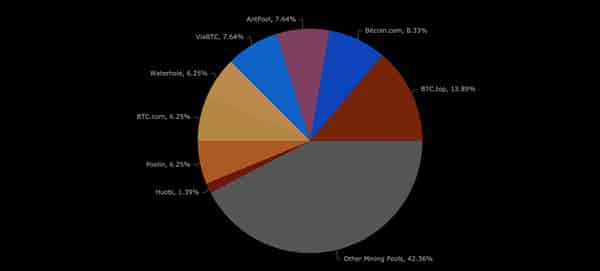

Aside from the loss of CoinGeek, the BCH mining scene hasn’t changed much since January 23 2018. Source: Coin Dance Who’s Mining Those Extra Blocks?

The mystery thickens when we look at the block explorer, where Bitcoin Cash blocks are propagating with unpredictable frequency. Although the BCH protocol is designed for new blocks to appear every ten minutes, the CoinDance Block explorer shows blocks appearing at minute or even second intervals:

Via Cash.coin.dance

Instead of six blocks per hour, Bitcoin Cash miners propagated eighteen blocks in the hour prior to 13:12 EST. That’s three times faster than they should be appearing.

Ordinarily, a sudden increase of block propagation would indicate the presence of additional hashpower, such as a new or dormant miner activating his rig.

But there’s no net influx of miners coming to Bitcoin Cash. To the contrary, based on hashrate estimates from Coindance, total hashrate remains at a fairly consistent 2,000 PH/s. While the hashrate from established pools is shrinking, the share belonging to unknown mining pools is growing.

Via Coindance

An alternative explanation might be in the difficulty of propagating BCH blocks. Bitcoin Cash allows substantially larger blocks than BTC, which may challenge the bandwidth and storage limitations of network nodes.

That seems to be a more likely culprit, given the uneven propagation. While many blocks are appearing at minute-long intervals, there are also several 30- or 40-minute intervals. On average, blocks are being mined only slightly faster than they should be: 148 over the past 24 hours, according to Blockchair, compared with the expected 144.

Via blockchair.com

Similar problems have also affected Bitcoin SV, whose block sizes are even larger. Several weeks ago, the BSV network unexpectedly forked into three separate chains.

Is Bitcoin Cash Under Attack?The discovery that 51% of hashing power is in unknown hands raises questions about the security of a proof-of-work blockchain. The past years have seen 51% attacks against Ethereum Classic, Bitcoin Gold and several other cryptocurrencies.

That’s probably not the case here. As Crypto Briefing has previously illustrated, a typical double-spend attack relies on a miner or group of collaborators to create another chain in secret, which is only published after spending a large sum of coins.

Since the unknown miners are operating in the open, these worst fears are likely unfounded.

But it does raise questions about the viability of the Bitcoin fork, which has yet to recover from last year’s vitriolic hash war. As a minority chain in the world of SHA-256 mining, the threat of a rented-hashpower attack is unlikely to go away.

Bitcoin Cash has faced other troubles as well. With half the community joining Bitcoin SV, BCH lost prominent backers and funding. As Crypto Briefing reported in July, the ecosystem has lost the largest amount of developers out of any large-cap coin in the ten months following the fork.

Crypto Briefing asked for comment from leading figures in the Bitcoin Cash community, but did not receive a reply by the time of publication.

The post “Mystery Miners:” Is Bitcoin Cash Under Threat? appeared first on Crypto Briefing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cashcoin (CASH) на Currencies.ru

|

|