2022-7-21 17:00 |

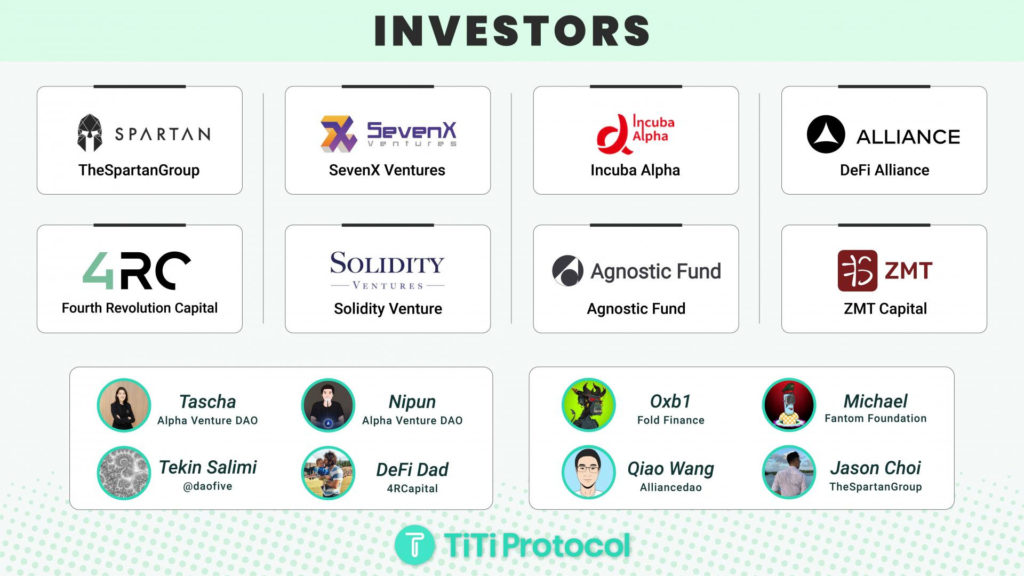

Bluejay, a multi-currency stablecoin protocol for issuing stablecoins pegged to real-world currencies, has concluded a $2.9 million funding round. Several venture capitals and DeFi projects took part in the funding round.

The venture capitals that participated in the funding include Moonlanding Ventures, C2 Ventures, Stake Capital Group, RNR Capital, Daedalus Angels, Oval Ventures, and Zee Prime Capital among others. On the other hand, the DeFi projects that took part include Ribbon Finance, Flux, Voltz, and Alpha Venture Dao.

Bluejay was founded in 2021 to provide investors with an avenue for more stablecoin solutions and the added capital will go a long way in ensuring it achieves its objectives.

In particular, the collected funds are intended for team development and stablecoin development with a focus on Asian-based stablecoins such as stablecoin pegged on the Singapore Dollar or the Philippine Peso.

The created stablecoins will then be distributed through partners that include DeFi protocols, fintech companies, centralized exchanges, and decentralized exchanges.

Focusing on AsiaAbout 60% of Southeast Asians are underbanked with 70% completely lacking banking services. That is why Bluejay feels there is a need to focus on Asia to offer financial inclusion in the region.

Although the region is under-banked, there has been a strong mobile penetration in recent years that has driven a variety of financial services and payment gateways for both businesses and individuals.

Bluejay believes that with the worldwide adoption of cryptocurrencies, stablecoins can play a meaningful role in the future of financial services in Asia. However, since most of the available stablecoins are pegged on the USD, there is a need for stablecoins that are pegged on local currencies especially the Asian-based local currencies to allow for real-world usage in transactions within the region.

Explaining Bluejay’s objectives, the founder of Bluejay Finance, Sherry Jiang, said:

“DeFi summer was the first wave of innovation, driven by yield farming. Despite the current state of the markets right now, we are incredibly bullish that the next cycle will be driven by sustainable, real use cases that solve a true need. Therefore, Bluejay remains focused on building products and partnerships that will enable these sustainable use cases of stablecoins and bring in the next billion users into DeFi.”

And in a rejoinder, Julien Bouteloup, the founder of Stake Capital Group which is one of the venture capitals that took part in the funding round said:

“Over the course of the past few years, stablecoins have proven to be a fundamental primitive within DeFi. However, most stablecoins have revolved around the US dollar. For crypto to branch into use cases like real world payments and money markets, it needs to have stablecoins that people in local economies can seamlessly transact with, such as the Euro and Singapore Dollar. Bluejay is positioned to address this need, which will only continue to grow as DeFi matures.”

Bluejay’s partnership with Silta FinanceThe successful funding round comes a few days after Bluejay announced its partnership with Silt Finance, a protocol focused on sustainable real-world assets.

Besides this partnership, Bluejay is also planning to announce several other partnerships in the coming weeks.

The post Multi-currency stablecoin protocol Bluejay Finance raises $2.9M in funding appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Multi Channel Influencer Creater Cloud Funding Platform (MCI) на Currencies.ru

|

|