2024-6-27 00:30 |

On Monday Bitcoin dumped suddenly to below $60,000 after defunct Bitcoin exchange Mt. Gox announced that it will begin distributing assets stolen from clients during a 2014 hack starting in the first week of July, following years of delays.

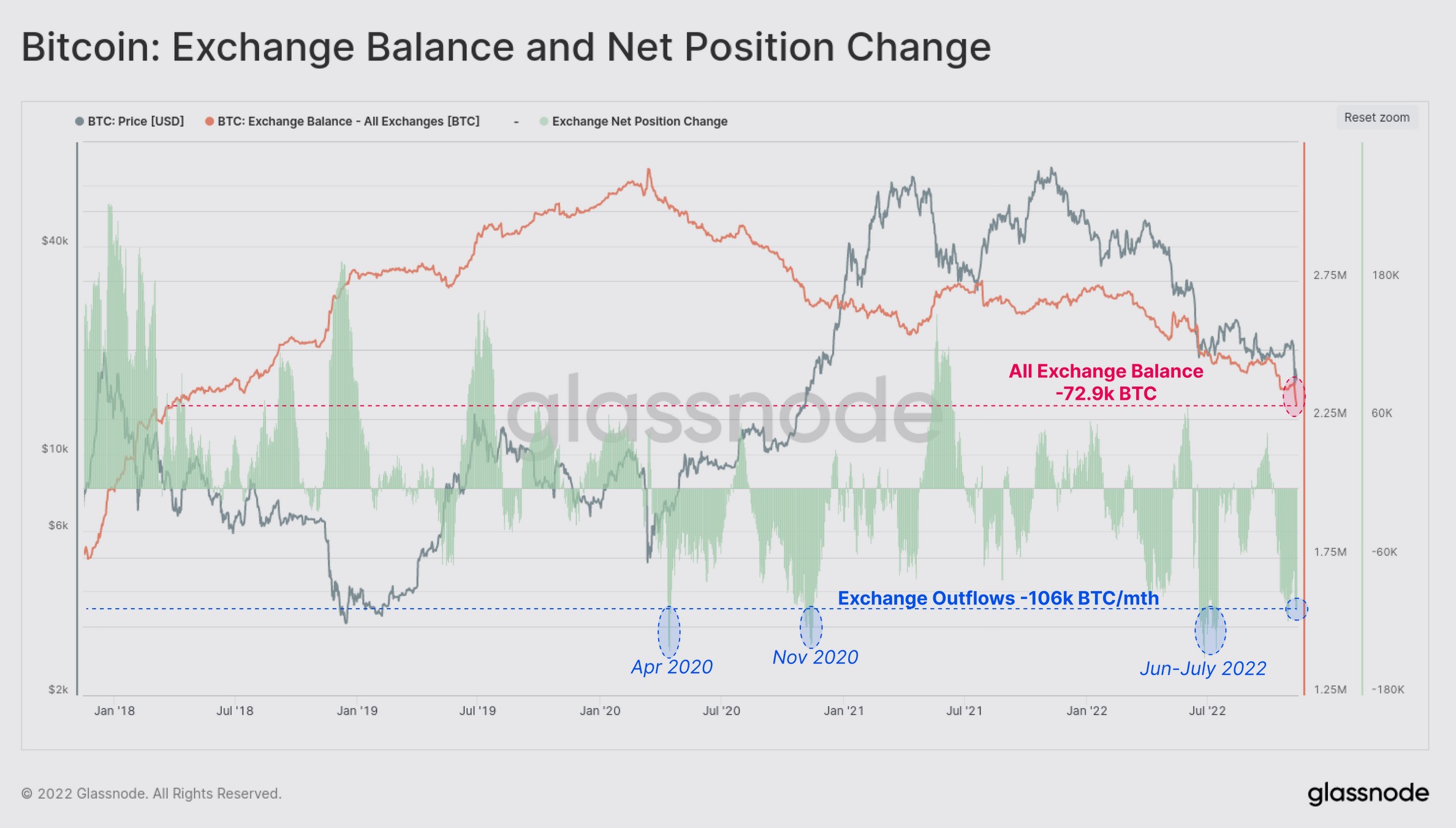

The repayments are expected to add selling pressure to the Bitcoin market, as early investors will receive assets valued much higher than their initial investments made over ten years ago, leading them to potentially sell a portion of their holdings to finally book a profit.

Mt. Gox was once the world’s leading crypto exchange, handling over 70% of all Bitcoin transactions in its early years. In 2014, hackers attacked the exchange, resulting in the loss of an estimated 740,000 Bitcoin (valued at $15 billion at current prices). Trustees developed a repayment plan that has been in the works for several years and received an October 2024 deadline from a Tokyo court last year. In May, the exchange moved over 140,000 BTC, worth around $9 billion, from cold wallets to an unknown address in 13 transactions, marking the first on-chain wallet movements in five years.

“The Rehabilitation Trustee has been preparing to make repayments in Bitcoin and Bitcoin Cash under the Rehabilitation Plan,” trustee Nobuaki Kobayashi said in a statement posted on the Mt. Gox website. “The repayments will be made from the beginning of July 2024,” Kobayashi added, noting that due diligence and certain safety steps will be required before the payments are processed.

Source: Mt Gox

However, some analysts believe that the selling pressure from Mt. Gox’s newly announced repayments could be less than market observers fear, alleviating concerns about an imminent selloff. “The impact on Bitcoin’s price from Mt. Gox distributing Bitcoin is likely overblown,” Sam Callahan, senior analyst at Swan Bitcoin, told CoinDesk. “Creditors who wanted to sell their Bitcoin have had more than 10 years to do so by selling their bankruptcy claims to more convicted, long-term investors. Additionally, most creditors will likely hold their Bitcoin because their cost basis is less than $700 per Bitcoin,” he added.

After a small rebound to $62,000, Bitcoin’s price fell back under $61,000 after the U.S. government transferred nearly 4,000 BTC (worth $240 million) to Coinbase, causing further market jitters. This move followed a similar action by the German government, which transferred 6,500 BTC to exchanges, of which 900 BTC were sold. Analysts observed that the market reaction included increased short positions and closed long positions, suggesting traders anticipate further supply entering the market.

The US government’s Bitcoin relates to seizures from the Silk Road marketplace, while the German goverment’s Bitcoin relates to seizures from the Movie2K torrent website. Both websites were in operation around ten years ago or more, as was Mt Gox. The timing of all three events is coincidental, but shows the impact that past events continue to have on the current market.

ETF Inflows End 7-Day Outflow StreakDespite the dire current market sentiment, on Tuesday, U.S.-based spot Bitcoin exchange-traded funds (ETFs) saw minor inflows totaling $31 million, ending a seven-day streak of outflows. Fidelity’s ETF FBTC led with $49 million in net inflows, followed by Bitwise Bitcoin ETF BITB with $15 million, and VanEck Bitcoin Trust ETF HODL with $4 million. Conversely, Grayscale ETF GBTC experienced a $30.2 million outflow, and ARK 21Shares Bitcoin ETF saw $6 million in net outflows. Since January 11, the 10 spot Bitcoin funds have amassed net inflows of $14.42 billion.

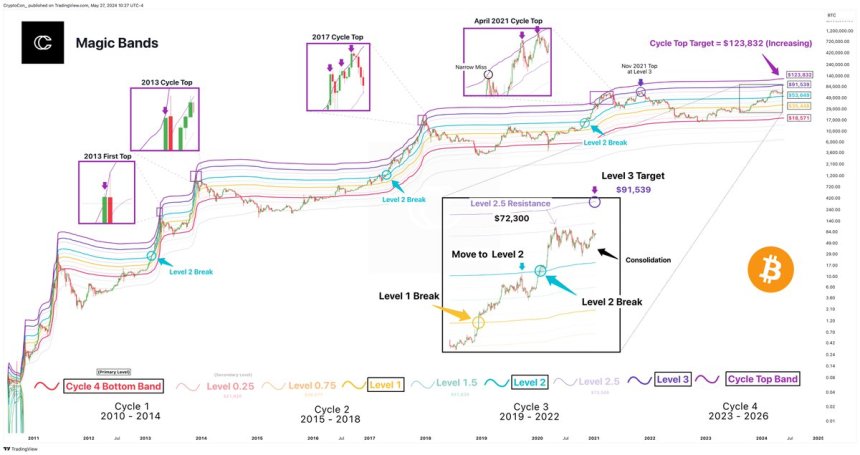

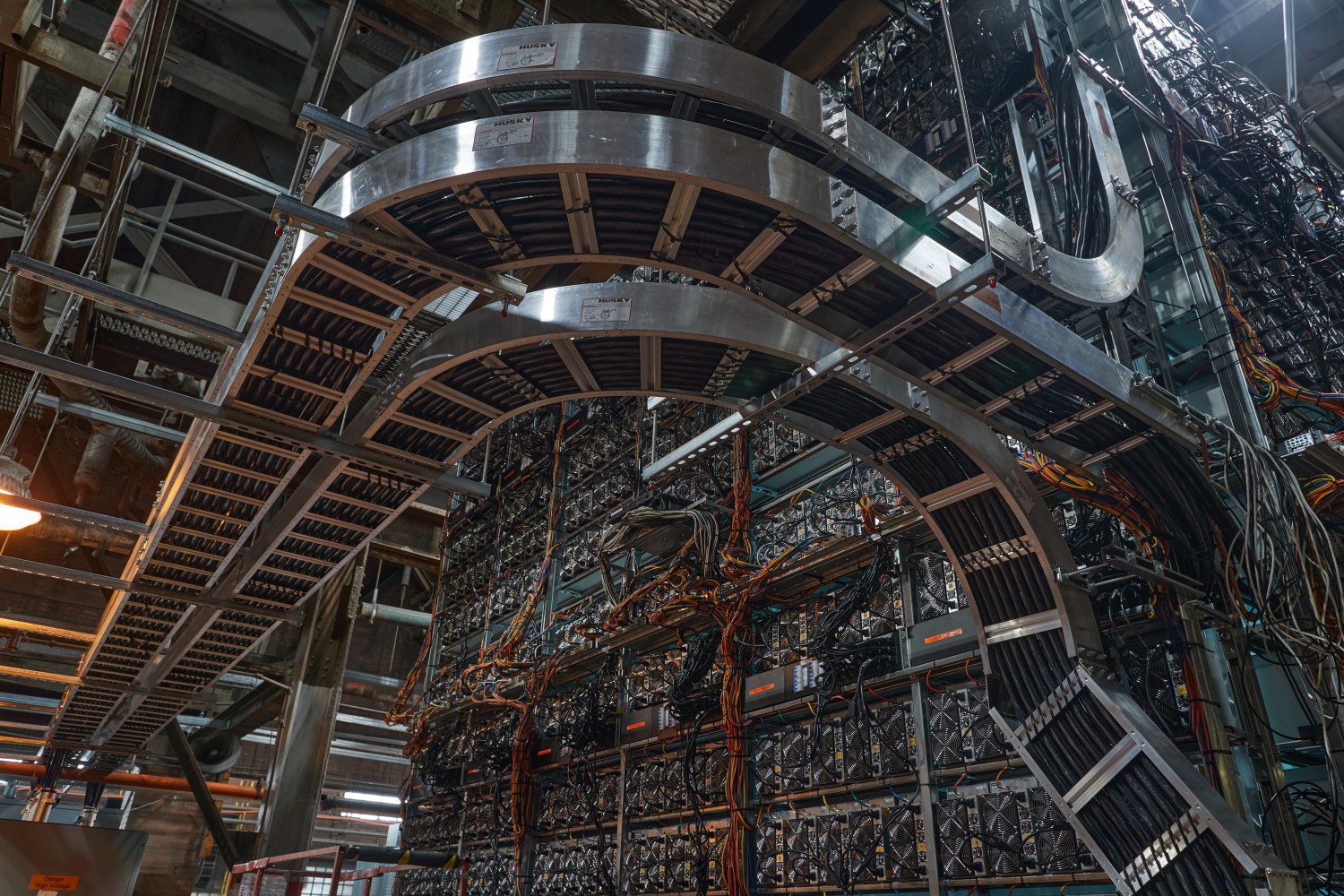

Another reason for this week’s price drop is a “cascading long squeeze” as miners continue to sell, according to a Bitcoin analyst. “Speculators kept adding to new long positions, just adding more fuel for more liquidations in a cascading long squeeze,” Bitcoin analyst Willy Woo wrote on X. A long squeeze occurs when a significant number of investors holding long positions (betting on a rise in Bitcoin’s price) start selling as the price drops to minimize their losses. This leads to further price declines, causing additional long-position holders to sell, creating a cascading effect. Woo highlighted the ongoing “post-halving miners’ capitulation” event, where miners shut down their hardware and sell their coins if Bitcoin falls below a profitable price point. “Superimposed on this liquidation squeeze, we have a post-halving miners’ capitulation,” wrote Woo. He explained that miners might be selling Bitcoin to fund necessary upgrades, while weaker miners are shutting down operations and being liquidated.

Meanwhile, Juan Carlos Reyes, the President of El Salvador’s National Commission of Digital Assets (CNAD), recently visited Argentina for high-level discussions with the National Securities Commission. This visit underscores the potential collaboration between the two Bitcoin-friendly nations, especially in light of Argentina’s significant inflation and currency control issues. Reyes, a long-time Bitcoin advocate, has been instrumental in El Salvador’s pioneering Bitcoin initiatives. His visit aligns with the global interest in how digital assets can address economic challenges, particularly in regions facing severe financial instability. Could Argentina be next to adopt a Bitcoin standard? We’ll have to wait and see.

origin »Bitcoin price in Telegram @btc_price_every_hour

MtGoxCoin (GOX) на Currencies.ru

|

|