2023-6-28 07:21 |

An altcoin with a long and storied history, Monero is currently running to the upside in a way it never has before. After closing higher for twelve consecutive days – a new record for the privacy-focused altcoin – Monero looks poised to once again make history with a thirteenth straight higher close. What’s happened after other Monero winning streaks in the past? Let’s take a closer look at the price history to find out.

Monero Win Streak Making HistoryMonero’s current winning streak of twelve consecutively higher closes breaks the previous record set in 2021 of ten straight higher closes. While the price advance is clearly impressive, its unprecedented nature means we’ll have to look at earlier and shorter win streaks to get an understanding of what might be ahead for Monero in the future. In other words, we’ll use the prior shorter historical win streaks to generate enough occurrences to make a more statistically meaningful conclusion.

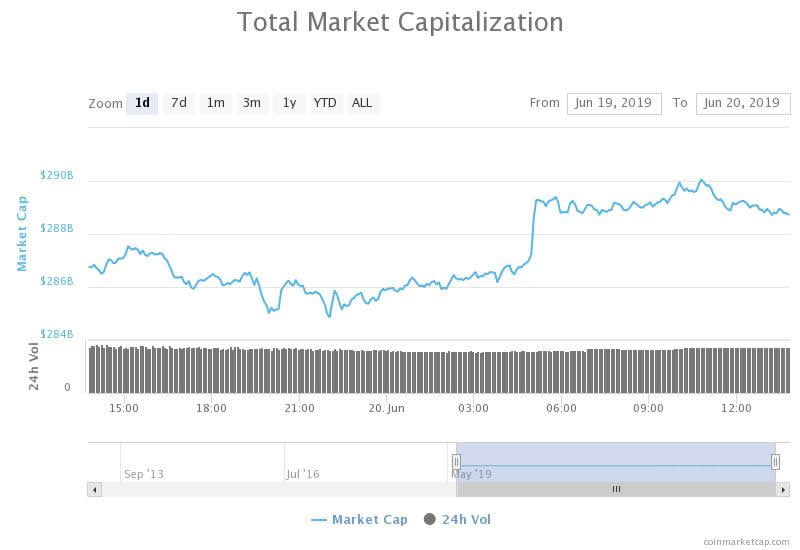

Monero 2023 Winning Streak | XMRUSD on TradingView.com

Because the number of occurrences varies based on holding time, we’ll start by listing the number of times that six straight higher closes has happened next to our several hypothetical hold times of 7 days through 365 days. Holding time is defined as the amount of time one held the asset before exiting. For example, if one hypothetically purchased Monero following the trigger event (i.e., 6 straight higher closes) and sold it 30 days later, this would be a holding time of 30 days.

Monero Occurrences of Six Consecutive Higher Closes by Holding Time (May 2014 – Present)

12 occurrences using a 7-day hold time 12 occurrences using a 15-day hold time 12 occurrences using a 30-day hold time 11 occurrences using a 60-day hold time 11 occurrences using a 90-day hold time 7 occurrences using a 180-day hold time 5 occurrences using a 356-day hold timeWhile the number of occurrences remains limited even with the shorter win streak, past Monero winning streaks of six consecutively higher closes provides enough data to examine so let’s dive into the analysis.

Past Monero Win Streaks Suggest More Strength AheadThe hypothetical average trade results for Monero (XMR) show a consistent positive edge across all holding times from 7 days through one year. Please note that even though the average historical trade results are positive for each hold time we examine, losses have also occurred for each hold time.

Going out to a roughly three-month hold time, the past win streaks have delivered far greater gains on average, with an average trade of +65.1% with a 90-day hold, +121.7% with a 180-day hold, to an impressive +373.8% with a 365-day hold.

While we’ve certainly never seen a streak of consecutively higher closes to match the current twelve and nearly thirteen, Monero’s long price history suggests that more strength could be ahead, especially going out to three months and beyond.

origin »Bitcoin price in Telegram @btc_price_every_hour

Monero (XMR) на Currencies.ru

|

|