2024-12-4 15:42 |

Volatility in Nasdaq-listed shares in bitcoin-holder MicroStrategy is now tracked at 2.5 times that of bitcoin. The milestone may spook most market participants but means increased income potential for savvy investors engaging in options trading.

MicroStrategy is the world's largest publicly listed bitcoin holder, boasting a coin stash of over 380,000 BTC. Investors looking to gain exposure to the cryptocurrency without having to directly hold it have poured money into the stock this year, catalyzing a 500% rise in the share price. BTC, meanwhile, has surged by 124% this year, according to data sources CoinDesk and TradingView.

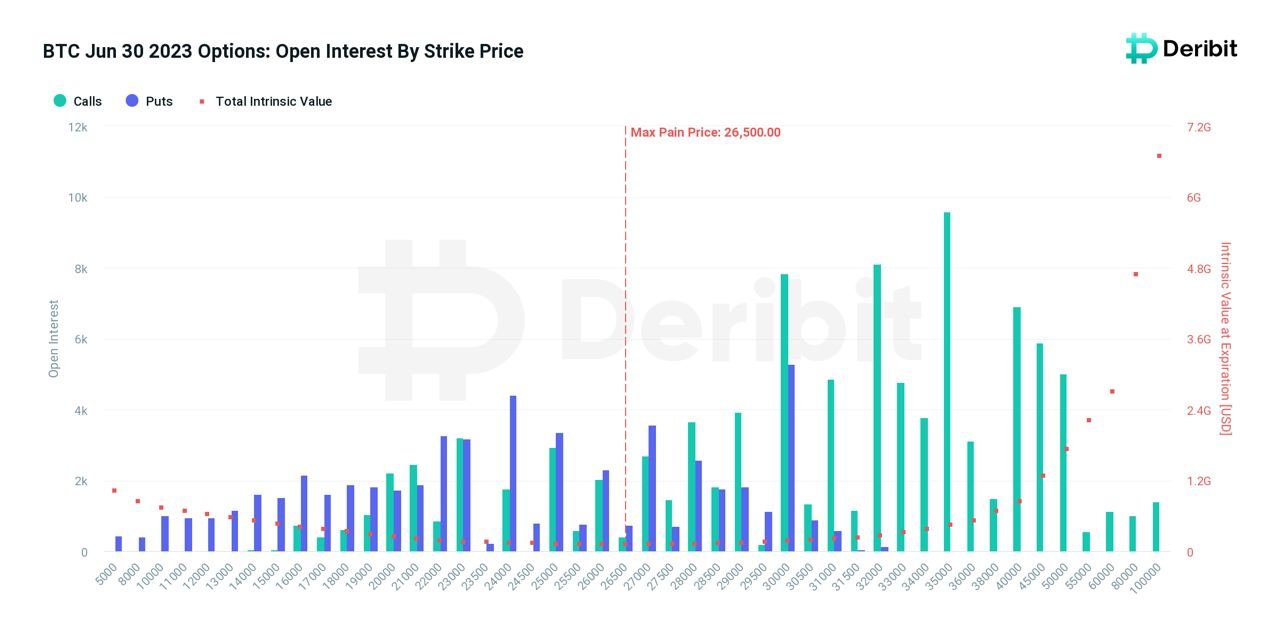

MSTR's outperformance goes beyond price. As of Monday, MSTR's 30-day options-based implied volatility, which represents expectations for price turbulence over four weeks, stood at an annualized 140.86%, according to OptionCharts.com. That's 2.5 times greater than bitcoin's 30-day implied volatility of 55.65%. BTC's IV is sourced from Deribit's DVOL index. Deribit is the world's leading crypto options exchange.

High IV means more incomeImplied volatility positively impacts prices (premiums) for options or derivatives that give the purchasers the right but not the obligation to buy or sell the underlying asset at a pre-determined price at a later date. A call gives the right to buy and put option, the right to sell.

When the IV rises, options premiums increase, allowing traders to collect more premiums by writing or selling call/put contracts.

Savvy traders holding the underlying asset capitalize on this dynamic by writing call options at strike prices significantly above the asset's current market rate. By selling these out-of-the-money calls or insurance against price rallies, they collect a premium, which represents an extra yield on top of their spot market holdings.

If the market surges, the gains from their spot holdings more than compensate for any losses incurred from being short the call. This so-called covered call strategy is popular in both the equity and BTC options markets.

MSTR's relatively higher volatility means a covered call strategy with MSTR options could generate returns 2.5 times greater than those from BTC options. Social is already buzzing with talk of traders "monetizing the MSTR volatility."

Readers, however, should note that the covered call strategy has risks. While it can provide additional income, it also caps potential upsides, meaning you could miss out on significant rallies and be better off just holding the coin stash.

origin »Bitcoin price in Telegram @btc_price_every_hour

Inverse Bitcoin Volatility Token (IBVOL) на Currencies.ru

|

|