2021-6-7 18:17 |

Virginia-based enterprise business intelligence firm MicroStrategy has announced another significant debt offering so as to help finance the company’s purchase of bitcoin, underscoring chief executive Michael Saylor’s confidence in the bellwether cryptocurrency.

MicroStrategy Plans To Scoop Up An Additional $400 Million Worth Of BitcoinMicroStrategy’s bitcoin appetite sees no end. According to a June 7 press release, the company will be conducting a sale of $400 million convertible senior notes in a private offering to “qualified institutional buyers”.

“MicroStrategy intends to use the net proceeds from the sale of the notes to acquire additional bitcoins,” the company said.

MicroStrategy Announces Proposed Private Offering of $400 Million of Senior Secured Notes to acquire additional #bitcoin. $MSTRhttps://t.co/ilhUt1M73j

— Michael Saylor (@michael_saylor) June 7, 2021Convertible senior notes are essentially financial securities that represent debt in an underlying asset. Bitcoin is the asset in this case, and the holders will have the option to convert the debt security into the stock of the company, cash, or a combination of both at a later date. Such sales are an effective way for a company to raise cash if it can easily afford the interest payments to investors.

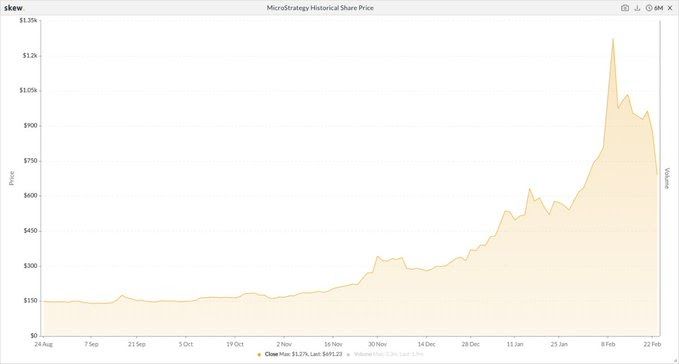

MicroStrategy has pulled off this maneuver in the past: it raised a whopping $1.05 billion in February and then promptly used the money to acquire additional bitcoin during the same month.

MicroStrategy Forms New Subsidiary “MacroStrategy LLC” To Manage Its BTCUnder the leadership of CEO Saylor, MicroStrategy became one of the first mainstream companies buying bitcoin. The company first bought 21,454 bitcoins in August last year using its excess cash. MicroStrategy has since become a repeat buyer despite bitcoin’s recent disastrous performance.

A June 7 filing with the United States Securities and Exchange Commission (SEC) reveals that MicroStrategy is expecting to incur “an impairment loss” of roughly $284.5 million related to its bitcoin purchases within three months ending June. This is as a result of the massive bitcoin correction witnessed during Q2 2021.

MicroStrategy currently owns approximately 92,079 bitcoins — worth $3.3 billion at today’s prices. The company has created a dedicated subsidiary, MacroStrategy LLC, to hold its existing BTC treasure trove.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|