2024-11-26 13:41 |

MicroStrategy's (MSTR) bitcoin (BTC) treasury model is unparalleled and the company is expected to attract billions of dollars of investment into the world's largest cryptocurrency, broker Bernstein said in a research report Monday.

Bernstein raised its MicroStrategy price target to $600 from $290 while maintaining its outperform rating on the stock. Rival broker Canaccord raised its price target to $510 from $300 and reiterated its buy rating.

The shares were trading over 6% higher at around $448 in early trading.

Bernstein said it expects MicroStrategy to own 4% of the world's bitcoin supply by 2033. It currently has 1.7%.

The company founded by Michael Saylor said last month that it planned to buy a further $42 billion of bitcoin over the next three years.

"We believe bitcoin is in a structural bull market with conducive regulation and U.S. government support, institutional adoption and favorable macro," analysts led by Gautam Chhugani wrote.

Broker Canaccord is also bullish about MicroStrategy's outlook, and it said it used a new methodology to value the stock.

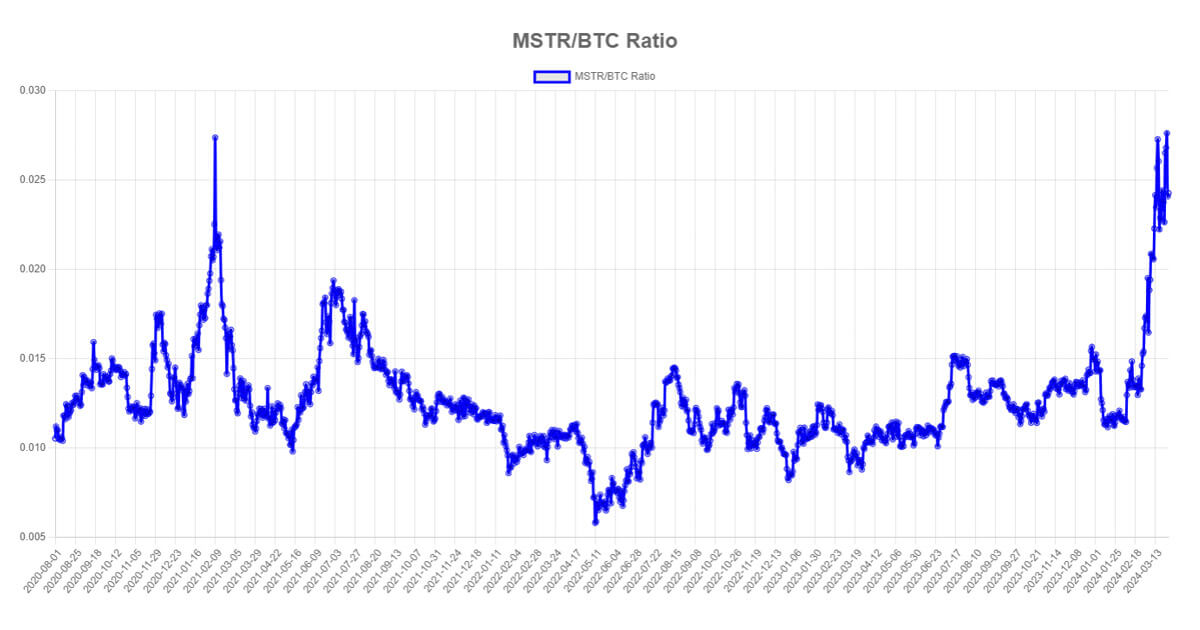

"Traditional P&L earnings metrics no longer really apply to MSTR, given the company's software business only accounts for a single-digit percentage of current enterprise value," analysts led by Joseph Vafi wrote, adding that "dollarized BTC accretion per shares captures everything going on at MSTR."

Read more: MicroStrategy Falls 16% Despite New Bitcoin Record as Some Question Valuation

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|