2024-9-17 21:00 |

After four years of buying up Bitcoin, American software firm co-founder by BTC maximalist Michael Saylor, MicroStrategy, now holds a total of 244,800 Bitcoins worth around $14 billion after its latest purchase a few days ago.

The firm’s cache is almost 1.2% of the pioneering cryptocurrency’s total circulating supply of 19.7 million tokens, according to crypto research platform Ecoinometrics. For comparison, this is by far more than the coins held by most spot Bitcoin exchange-traded funds (ETFs), including Grayscale’s GBTC and Fidelity’s FBTC.

MicroStrategy now holds 1.17% of all Bitcoins.

Steadily, MSTR keeps growing its Bitcoin stash.

It's now larger than most ETFs. pic.twitter.com/5YWFaWYBYP

MicroStrategy started purchasing BTC as a reserve asset in August 2020, when prices hovered around $12K, and its holdings have since upped. Data from BitcoinTreasuries shows that it remains far and away the largest holder of the alpha crypto among all publicly traded companies in the world.

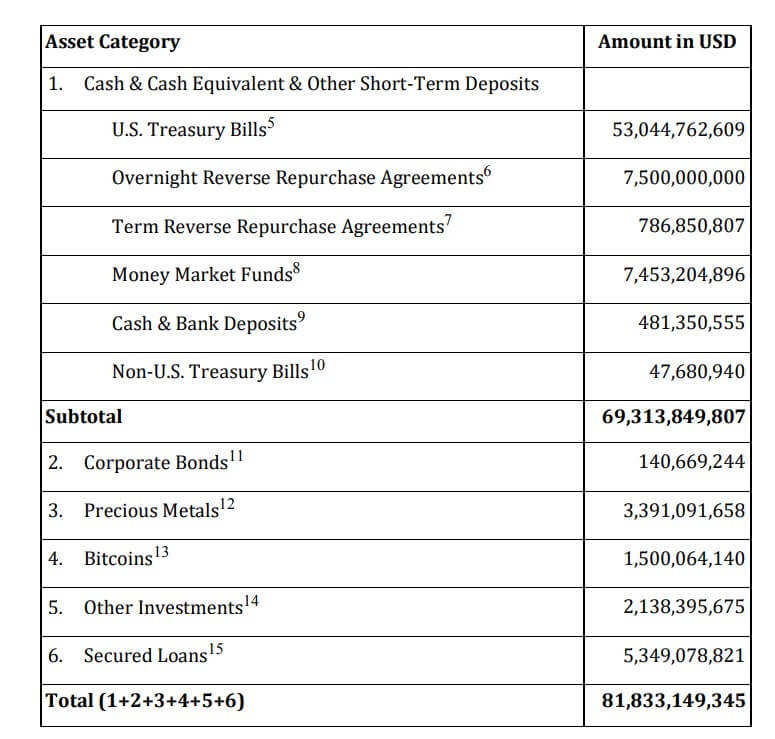

The Tysons Corner, Virginia-based company regularly issues corporate debt to raise capital to buy more BTC for its treasury. Saylor frequently tries to persuade other firms to adopt his company’s crypto accumulation strategy of putting the largest virtual coin on their balance sheets.

Metaplanet, a Japanese investment adviser, did indeed take a page out of Saylor’s playbook. The company announced in May that it was adopting Bitcoin as a reserve asset to hedge against the volatility of the yen. As of Sept. 10, it held 400 BTC ( worth $22.7 million at the time).

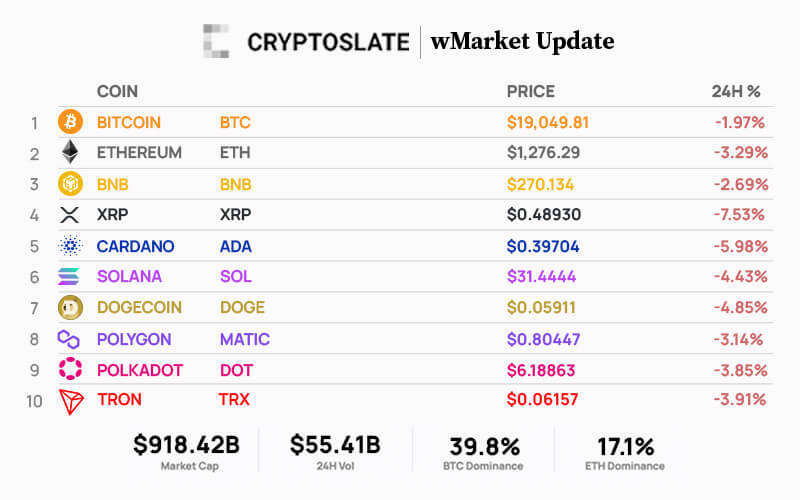

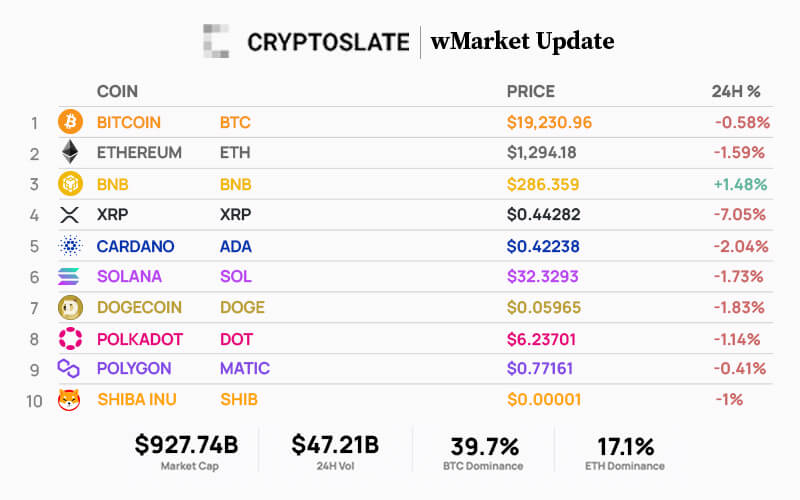

As of press time, the price of BTC had nose-dived to $57,685 ahead of a Federal Reserve rate-cutting decision on Wednesday. The crypto is down nearly 4% over the last 24 hours. In the long term, Saylor previously said he thinks Bitcoin will rocket up to a price of $13 million per coin over a span of 21 years.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|