2022-8-31 20:59 |

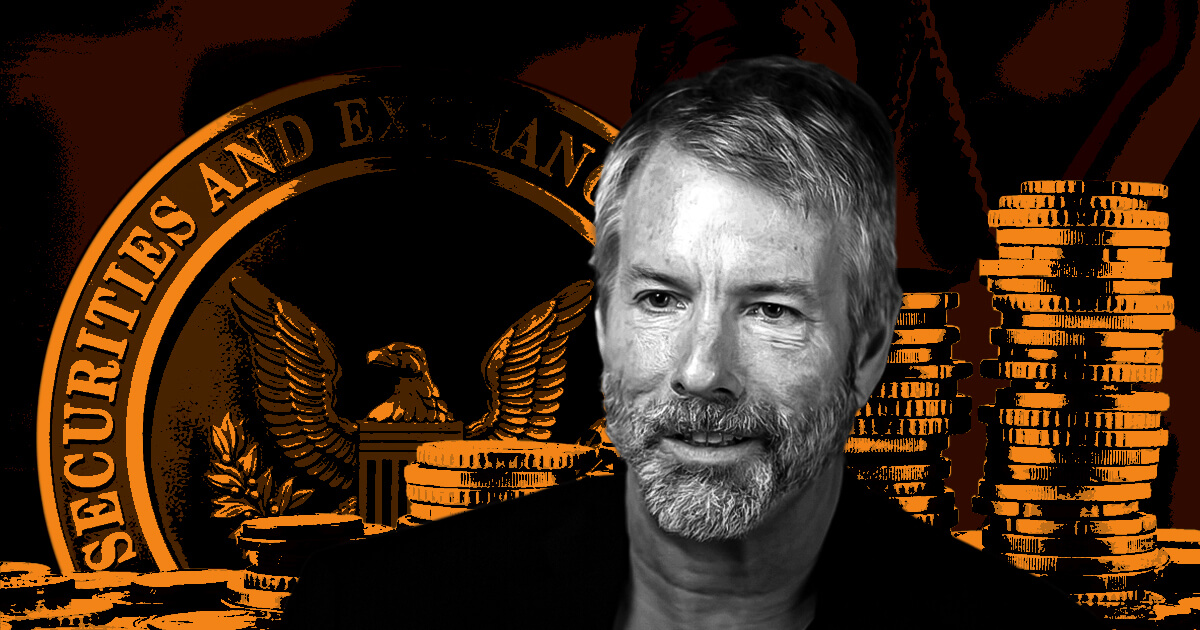

Billionaire Bitcoin whale Michael Saylor is being sued by the District of Columbia, where he currently resides, for tax fraud. D.C. Attorney General Karl Racine made the announcement Wednesday on... origin »

Bitcoin price in Telegram @btc_price_every_hour

General Attention Currency (XAC) на Currencies.ru

|

|