2020-8-3 07:00 |

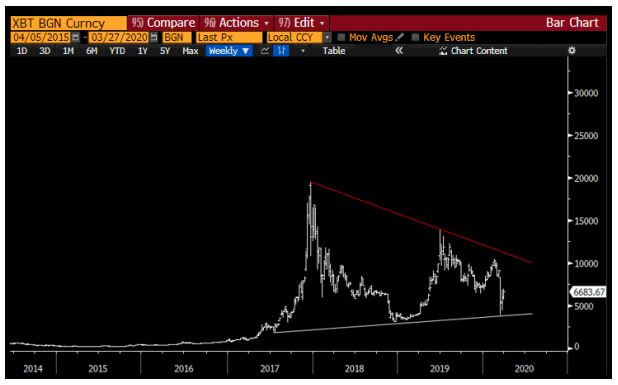

Bitcoin has seen extreme strength over the past seven days, gaining 21% against the U.S. dollar. As of this article’s writing, the leading cryptocurrency trades for $11,800 and seems poised to push higher. The recent price action is starting to convince traders that a longer-term bull trend is in the works. This can be corroborated by a number of on-chain and technical signs that were last seen at the start of Bitcoin’s bull trend. Pivotal Bitcoin Bull Signal Appears

Bitcoin is printing a variety of signals that were last seen at the start of historical macro rallies, analysts have said.

One trader shared the chart below on August 1st, noting that three pivotal moving averages are set to trend higher on Bitcoin’s one-week chart. These are the 26-month Hume moving average, the nine-month simple moving average, and the 21-month exponential moving average.

The trader says that at the start of the macro bull rallies in 2012/2013 and in 2016, these three technical levels began a steep uptrend that was difficult to reverse:

“BTC Monthly: One measure of a bull market: Price > 26 Hume MA > 9 Simple MA > 21 Exponential MA Twice prior this has signaled a prolonged bull run. Monthly MA’s are like aircraft carriers, i.e., slow to turn. A reversal at this point is unlikely.”

Chart of BTC's macro price action with a long-term moving average analysis by trader "Nunya Bizniz" (@pladizow on Twitter). Chart from TradingView.comShould history rhyme, Bitcoin is at the start of a longer-term bull trend that will likely last for at least a year. By historical standards, BTC should set a new all-time high an order of magnitude above the last.

Also suggesting Bitcoin is at the start of a long-term bull market is the “Super Trend,” which just flipped green for the first time since early-2019.

Bears Aren’t Convinced of the BreakoutAlthough the stars seem to be aligning in favor of Bitcoin’s growth, bears aren’t convinced of the ongoing breakout.

Peter Schiff, the chief executive of Euro Pacific Capital, suggested in a tweet published last week that BTC may spend little time above $10,000. He specifically pointed out that BTC’s previous attempts to break $10,000 over the past 12 months failed, resulting in steep retracements.

Here’s what he said:

“Two of the last three times #Bitcoin rose above $10,000 in Oct. of 2019 and in Feb. of 2020 it soon fell by 38% and 63% respectively. The last time Bitcoin rose above $10,000 was in May, and it only fell by 15%. It’s above $10,000 again today. How big will the next drop be?”

Two of the last three times #Bitcoin rose above $10,000 in Oct. of 2019 and in Feb. of 2020 it soon fell by 38% and 63% respectively. The last time Bitcoin rose above $10,000 was in May, and it only fell by 15%. It's above $10,000 again today. How big will the next drop be?

— Peter Schiff (@PeterSchiff) July 27, 2020

There also remain certain cryptocurrency traders who are hesitant to admit that Bitcoin has entered a bull trend. They claim that their hesitance to admit so is because Bitcoin has yet to reclaim the $14,000 2019 highs, which shuld unlock more upside.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Measure That Signaled "Prolonged" Bitcoin Runs Is About to Return origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|