2018-11-11 19:50 |

Since our last markets update five days ago, a lot has changed as a good chunk of the top cryptocurrency markets have dipped in value over the last three and a half days. Bitcoin cash markets touched a high of $638 on Wednesday, Nov. 7, but now prices are hovering around $544 per BCH on Sunday, Nov. 11.

Also read: Bitcoin Cash Miners Break Records Processing Multiple 32 MB Blocks

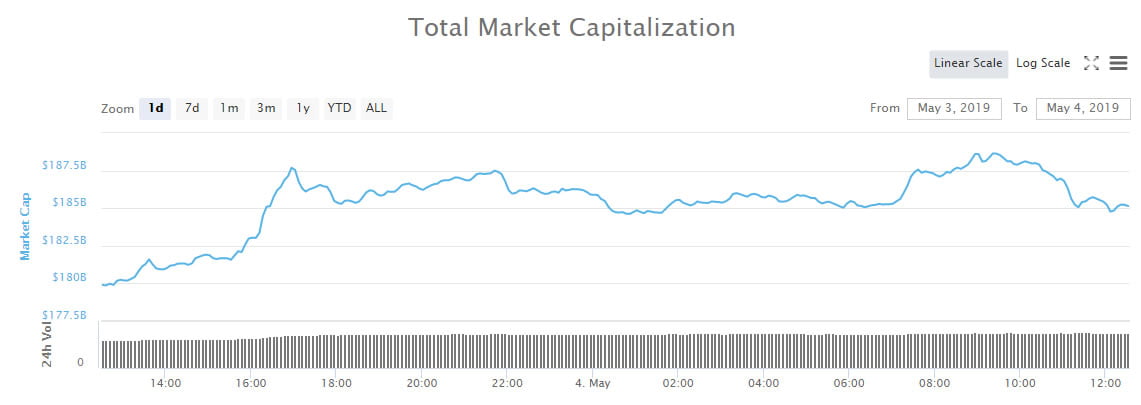

Digital Assets See Some Slight Losses Over the Last Three DaysCryptocurrency markets have had an interesting week after a long period of boring price action and stability. Last week bitcoin cash markets lead the pack out of all 2000+ digital assets, climbing over 51% in value and touching a high of $638 per coin. Digital asset markets, in general, have all seen some slight losses as the top ten cryptocurrencies are down 1-3% except for stellar, cardano and the stablecoin tether. The entire market valuation of the whole crypto-economy is worth $215.9 billion and there’s been $11.5 billion in global trades over the last 24 hours.

The top 10 cryptocurrencies on Nov. 10, 2018, at 10:00 a.m. EST.Bitcoin core (BTC) prices are hovering around $6,406 per coin and there’s around $3.7 billion in global BTC trade volume today. Following the BTC action, ethereum (ETH) prices are around $211 per ETH and the cryptocurrency is down 0.3% this weekend. Ripple (XRP) is down 0.9% today and each XRP is being swapped for $0.50 per token. Lastly, eos (EOS) has been officially bumped out of the fifth largest market capitalization and stellar (XLM) has taken its place. Stellar is currently trading for $0.26 per token and markets are up this Sunday 4.5%.

Bitcoin Cash (BCH) Market ActionThe fourth largest market capitalization held by bitcoin cash (BCH) is down 0.5% over the last 24 hours. Data stemming from the last seven days shows BCH is down 1.7% overall for the week. Currently, BCH is trading at an average of $544 per coin with a market valuation of about $9.4 billion. The last 24 hours of trade volume shows BCH markets swapped $641 million this weekend. The top exchanges swapping the most BCH today include Lbank, Okex, Hitbtc, Binance, and Huobi Pro. The trading pairs today dominating BCH markets include USDT (35.2%), BTC (35%), ETH (10.2%), USD (7.7%), and KRW (3.1%).

Bitcoin cash (BCH) daily. Nov. 11, 2018. BCH/USD Technical IndicatorsLooking at the 4-hour charts for BCH/USD on both Bitfinex and Bitstamp shows BCH bears may be feeling some exhaustion in the short term going forward. Currently, there looks like a trend shift is in the cards as the 100 Simple Moving Average (SMA) has crossed above the long-term 200 SMA. This indication is positive for the bulls as the path towards the least resistance is essentially the upside. The Relative Strength Index (RSI) shows things are meandering in the middle (-44.02) but definitely closer to oversold regions.

BCH/USD Bitstamp 4-hour at 10:15 a.m. EST. Nov. 11, 2018.The stochastic oscillator indicates a similar reading and the MACd also shows there’s currently room for improvement going forward. Order books show a similar forecast too as bulls need to muster enough strength past the $566 region to gain a lot more momentum, and there will be another pitstop at the $600 zone. On the backside, there is plenty of foundational support at the time of publication between the current vantage point and $495.

BCH/USD Bitfinex 4-hour at 10:00 a.m. EST. Nov. 11, 2018. The Verdict: Traders Assume the Pending Fork Will Affect Markets Before, During, and After the ForkMost traders seem positive that the price of BCH will trend higher as the fork approaches due to the memories of prior forks in the past. The 100-day average shows there is a lot of room for improvement over the next four days. Furthermore, BCH/USD short positions are at an all-time high this weekend which means a good majority of traders are betting against a rise.

BCH/USD Shorts on Nov. 11, 2018.However, others believe that these traders are setting themselves up for a “big squeeze” and expect prices to spike unexpectedly. With the fork approaching and especially the contentious nature surrounding it, it will likely drive markets in certain directions before, during, and after the network changes. Per usual in crypto-land, bitcoin traders are expecting the unexpected to take place next week and most are just crossing their fingers hoping they chose their positions correctly.

Where do you see the price of bitcoin cash and other coins headed from here? Let us know in the comments section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: All Eyes on Bitcoin Cash Prices Before the Pending Fork appeared first on Bitcoin News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cashcoin (CASH) на Currencies.ru

|

|