2021-11-21 15:19 |

Bitcoin appears to be in a free-fall after falling to lows of $56,550 from an all-time high of nearly $70K.The cause of the price decline has been linked to derivatives over big-time sellers.Hilary Clinton’s comments and the approval of the Mt. Gox Rehabilitation Plan may have triggered the negative investor sentiments.

Bears had a field week in the cryptocurrency market as Bitcoin fell to levels that were unseen since mid-October. As Bitcoin fell, it dragged the entire markets underwater in a sea of red.

Blame It On Derivatives, Hillary Clinton and Mt. GoxOn Friday morning, Bitcoin fell to a new month low of $56,550 and the last time the asset experienced these prices was on October 13th as Uptober was in full swing. The weekly chart shows a somber decline of 10.27% going on to lose nearly 4% in 24 hours. The bearish sentiment sees a reduction of Bitcoin’s market capitalization to $1.08 trillion from highs of almost $1.3 trillion.

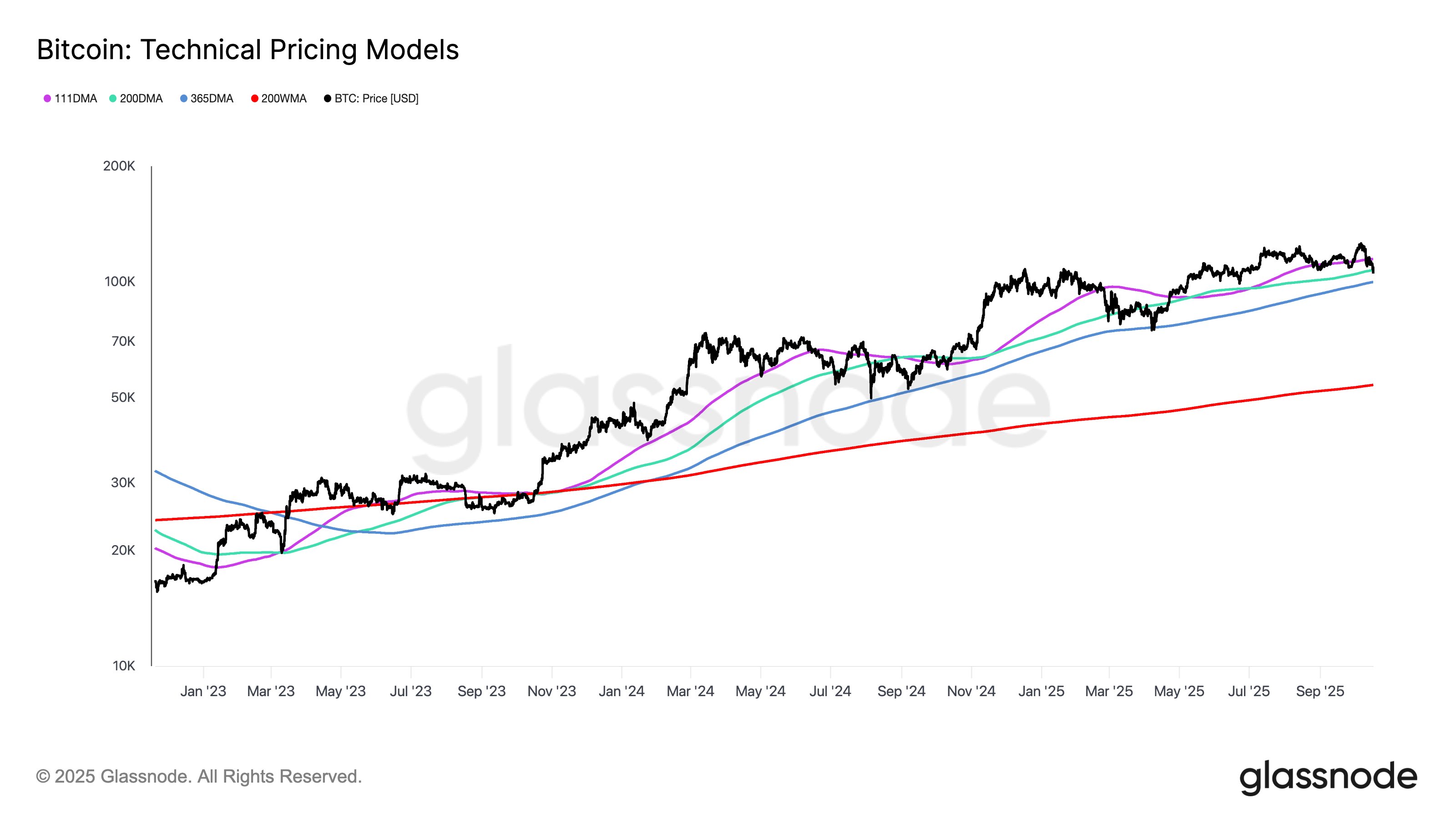

BTCUSD Chart by TradingViewSeveral analysts have tried to rationalize the recent slump in prices and it seems a consensus points towards derivatives. According to Ki-Young Ju of CryptoQuant, more people were shorting bitcoin through market orders in the perpetual futures market.

“Strong market-wide selling is going on. Undoubtedly, seller exhaustion lies ahead. Watch for high sellside volume bars in the short term. These tend to signal bottoming out after constant selling and precedes either a strong bounce or an entire trend reversal,” said Rekt Capital on Twitter.

Others believe that former US Secretary of State, Hillary Clinton’s statement that cryptocurrencies could lead to the destabilization of nations was to blame for the slip. The ex-First Lady told Bloomberg that by “undermining the role of dollars as reserve currencies”, cryptos have the potential to destabilize nations.

Another theory is the recent confirmation of the Mt Gox rehabilitation plan that will see the disbursement of over 100,000 BTC to creditors. Analysts anticipate a huge sell-off while some think that the sentiment is wrong because the disbursement isn’t scheduled to occur immediately.

On The Other SideEthereum, Cardano, and Binance Coin all suffered a similar fate to Bitcoin as they recorded losses to their values. Ethereum fell by over 10% in what can be described as a forgettable week while Solana lost 7%. Cardano, XRP, and Polkadot all shed 8.62%, 8.99%, and 10.02% respectively.

The mass decline in value brings the entire global crypto market capitalization to $2.56 trillion from $2.85 trillion at the start of the week. Analysts believe that the decline in prices is just a blip in the grand scheme of things as the market cap is expected to exceed $5 trillion in the future.

origin »ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|