2020-8-28 00:00 |

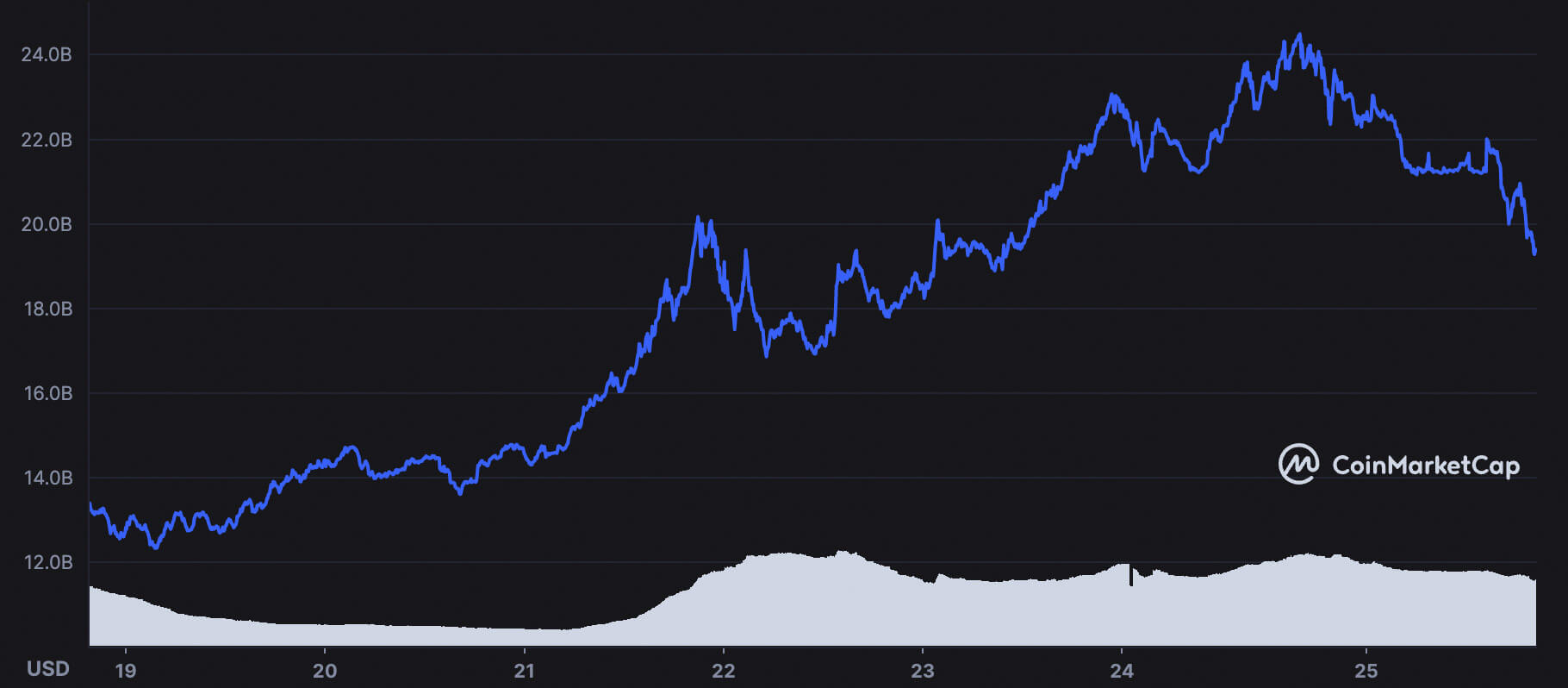

Polkadot has become a rising star within the crypto markets, with the layer one “Ethereum killer” seeing massive inflows of capital throughout the past few weeks that have allowed it to become one of the largest crypto assets.

Currently, DOT is the sixth-largest cryptocurrency, with its market capitalization only being a few million away from passing that of Chainlink.

This intense growth has come about as investors begin looking towards so-called “Ethereum killers” as viable investment prospects, as the recent DeFi mania has directed a spotlight on Ethereum’s lack of scalability.

Interestingly, traders on Bitfinex don’t seem to think that Polkadot’s intense uptrend will last for too much longer, as DOT short positions outweigh longs by nearly 3 to 1.

Polkadot Secures Spot as Sixth Largest Crypto, Closes in on ChainlinkAt the time of writing, Polkadot is trading up marginally at its current price of $6.00. This marks a massive climb from weekly lows of roughly $3.00, and only a slight decline from highs of $6.80 that were set just a few hours ago.

The strength of its uptrend has allowed it to climb the ranks, with its market capitalization passing that of other major crypto tokens like Cardano, Litecoin, Bitcoin Cash, and others.

One analyst spoke about this intense growth in a recent tweet, explaining that the “dinosaur” cryptocurrencies that have long dominated the top 10 ranks are being upset by newer innovations.

“Within just a week, DOT has climbed the ranks up like a mountain goat into the top 5. Insane momentum. Dinosaurs have been struck by two meteor showers now (LINK, DOT). Who brings the third?”

Image Courtesy of Hsaka. Chart via TradingView.One of the primary factors likely driving Polkadot’s growth is the “Ethereum killer” narrative that has resurfaced due to the ETH blockchain being plagued with high fees and long transaction processing times.

Traders Widely Flip Short on DOT Despite Overt StrengthTraders seem to believe that DOT’s parabolic uptrend is running out of fuel, as data shows that the number of short positions on the cryptocurrency far outweigh the number of long positions.

Data from Bitfinex – which recently launched support of Polkadot margin trading – shows that there are roughly 19k DOT long positions at the present moment, compared to there being 52k shorts.

The exchange’s CTO, Paolo Ardoino, pointed this out in a recent tweet, saying:

“DOT long/short statistics on Bitfinex: 19k longs DOT vs 52k DOT shorts.”

It is reasonable to assume that Polkadot’s near-term upside potential is now somewhat limited, but that’s not to say that it won’t be able to continue adding millions to its market capitalization in the weeks and months ahead.

Featured image from Unsplash. Charts and pricing data from TradingView. origin »Emerald Crypto (EMD) íà Currencies.ru

|

|