2020-4-8 21:15 |

Although BitMex has usually been the destination-of-choice for BTC futures trading, this has changed drastically in the last month.

March saw some historic swings for both in the cryptocurrency and mainstream financial markets. Naturally, it has had a drastic impact on trading volume with some exchanges benefiting more than others.

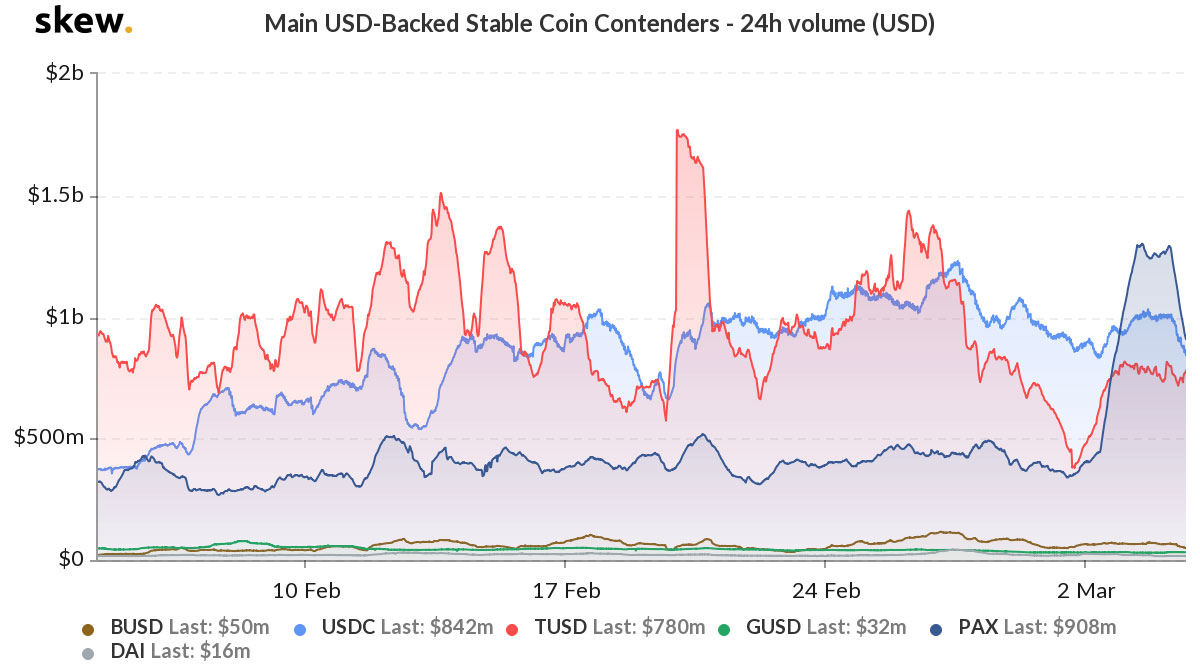

A Shakeup Among ExchangesSkew (@skewdotcom) is reporting that the 24H BTC futures volume among the top exchanges looks different today than it did just a month ago.

Binance now takes the lead with the highest level of BTC futures trading volume in the last 24-hours. Huobi is now in second place with some $2.13 billion in trading volume in the last 24H. OKEx and BitMEX are a close third and fourth, respectively.

Some reshuffling at the top of the table following the March sell-off pic.twitter.com/BYtgcQJ9tH

— skew (@skewdotcom) April 6, 2020

The sudden rise in trading volume on Huobi and OKEx may be an indication that traders are losing faith in BitMEX. The exchange was for the longest time the No. 1 destination for futures and margin trading, more generally. However, the exchange has been plagued with issues in the past few months. Aside from being blamed for the 50% drop on March 12, the amount of BTC BitMEX is holding has also fallen some 25%.

Bitcoin Futures See Uptick in Trading VolumeAs Bitcoin’s price continues to slowly climb upwards, futures markets have responded—and they are now seeing a rapid increase in trading volume. As BeInCrypto reported on April 4, the CME and Bakkt recently saw the largest daily increase in BTC futures trading volume in weeks.

Although an increase in futures trading is not inherently a bullish indicator, it is a positive sign of growing interest. As financial markets globally push higher, Bitcoin and the cryptocurrency market more generally have benefited. It remains to be seen if this bullish momentum can last given the lackluster macroeconomic situation globally, however.

Regardless, the fact that Bitcoin trading volume has not dried up amid this historic global crisis is promising. It seems that, despite the worrying macroeconomic situation, interest in Bitcoin and cryptocurrencies remains unshaken.

The post March Sell-Off Reshuffles Top Exchanges for BTC Futures Trading appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Open Trading Network (OTN) на Currencies.ru

|

|