2026-1-22 21:23 |

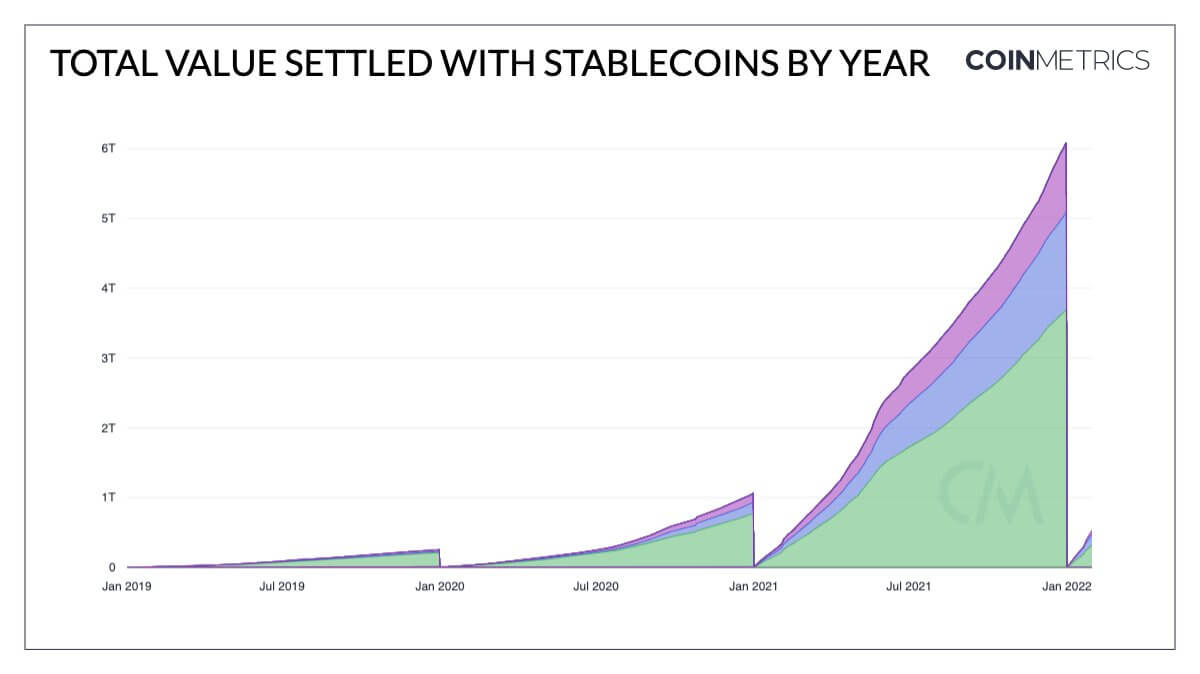

Institutions face challenges in offering stablecoins as a service, highlighting a gap in adoption. Proper on-ramps and off-ramps are essential for institutions to effectively use stablecoins. Specialization in blockchain can significantly enhance user experience for targeted use cases. origin »

Bitcoin price in Telegram @btc_price_every_hour

Usechain (USE) на Currencies.ru

|

|