2020-8-26 20:00 |

The decentralized finance protocol Yam Finance that took the DeFi world by storm is coming back online soon.

Launched amidst much fanfare as a “minimally viable monetary experiment,” this project saw $700 million total value locked in its protocol within 24 hours of its launch only to come crashing back down after a bug was found in its rebase function.

This resulted in the value of YAM that rose to $159.54 to fall to $0.029. Although the price of YAM is still 100% down from its peak, it’s started to see some movement, currently trading at $0.048.

Interest in the project hasn’t waned either as the community took steps to save it. Just this past weekend, the team successfully migrated to YAM v2 after raising funds for the project’s audit and now preparing for the next version.

The Yam v2 governance portal is now live, with the help of Balancer Labs and gasless soft voting client Snapshot Labs.

YAM users are now required to vote and submit proposals that require YAM tokens in their wallet for the V3 launch.

After the migration of about 98.5% of YAM, the final supply of YAMv2 is 3,726,411.

YAMv3 Initial ParametersYAM launch team has also launched two initial proposals that are subject to community approval. The proposal for the new token economics involves 3.7 million of current supply with 1.1 million YAM for yUSD/YAM Uniswap pool (starts 330k and decreases 30%/week). Additionally, 1 million for community funds and 174k for delegator rewards.

Currently undergoing voting, with 81.5% favorable votes, the community is agreeing on YAMv3 initial parameters proposal, which involves a total V3 supply of 6 million YAM.

It also proposes updating reserve assets to yUSD (yyCRV), which has higher yield potential than yCRV along with hardcode proposal (50K pre-rebase) and quorum (200k pre-rebase) thresholds.

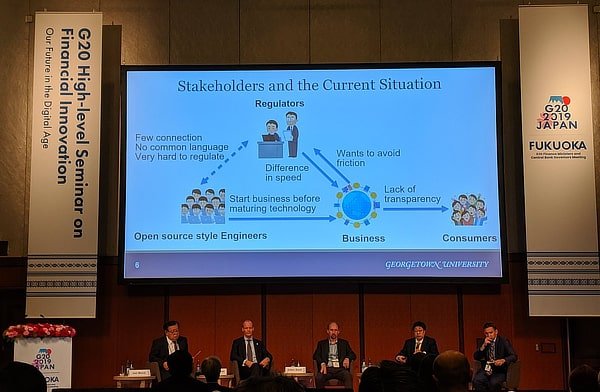

Several other proposals are also being voted for, including “complicate whale governance takeover” by limiting voting power per address to 1/1000 of the total yam supply, which has got 98.16% votes in favor. This proposal was made after YFI’s Andre Cronje exposed a governance flaw inherent to a governance project, Curve founder seizing 70% of the voting power.

The community, however, is against splitting YAM to governance and elastic tokens, the proposal of 1 V2 token: 0.8 V3 tokens as delegator rewards condition, increase rewards for Yamv2 holders, YAMv3 3-day migration period, adding ETH-YAMv3 Uniswap Pool to the initial distribution, adding AMPL/YAM farming pool in YAMv3, and limiting the LP incentives in v3.

Governance is hard. pic.twitter.com/IezxeWIu1L

— Ceteris Paribus (@ceterispar1bus) August 25, 2020

Meanwhile, they agreed to allow only the core team and those holding more than 5k YAMv2 to make new proposals.

origin »Cash & Back Coin (CNBC) на Currencies.ru

|

|