2020-7-27 17:50 |

Coinspeaker

MakerDAO Is Now DeFi Most Valued Protocol as Ethereum Price Jumps 40%

MakerDAO is presently the DeFi platform with the highest amount of locked value, after a recent Ethereum price surge. According to a Cryptobriefing report, MakerDAO has hit one billion dollars in locked value due to a 40% Ethereum increase.

The rise is coming after June, when MakerDAO fell from being the most valuable protocol, for the first time. Ethereum’s surge has now pushed MakerDAO back to its top spot among other DeFi platforms.

In June, Compound locked value grew from $93 million to over $500 million. This significant growth caused Compound to take MakerDAO’s position as DeFi’s top runner.

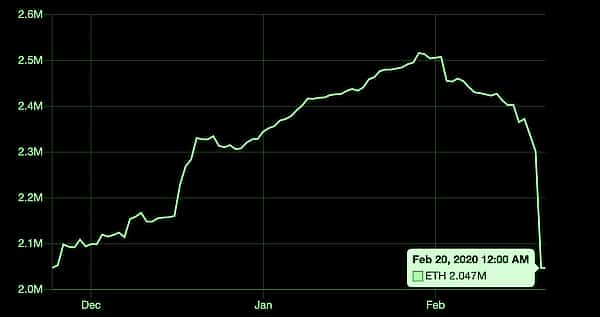

MakerDAO Benefits from Ethereum Price SurgeAn analysis by DeFi Pulse shows Maker’s recent historical statistics. Just last week, the total amount of Ethereum locked in Maker Vaults, increased about 300,000 ETH and is presently at 2.37 million ETH. However, the recent Maker surge is not as a result of the increased amount of ETH. Rather, the surge is because of the recent ETH appreciation. Basically, a large amount of activity on Maker is because users take many leveraged long positions on Ethereum. By this, users tend to borrow DAI, using ETH as collateral and using the borrowed DAI to buy more ETH.

As of the 22nd of July, Maker’s ETH debt ceiling rose to 220 million from its former 180 million. This means users can now borrow up to 220 million DAI. Also, the Cryptobriefing report shows that the number of DAI minted from Ethereum is presently at 213 million.

Apart from DAI, other collateral types by Maker are still far away from their debt ceiling. MakerDAO announced that KNC and ZRX were officially integrated as new collateral types. This was revealed in a tweet posted on the 28th of last month.

MakerDAO’s DAIDAI is a decentralized stablecoin created by MakerDAO, and backed by the US dollar. The stablecoin is available on several blockchains, including Ethereum. According to MakerDAO:

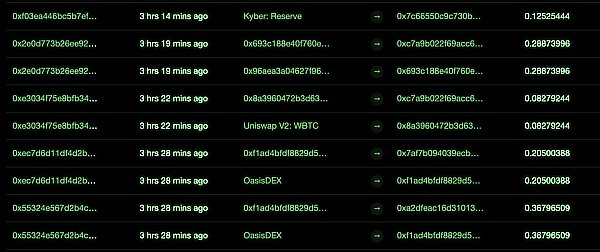

“DAI is easy to generate, access, and use. Users generate DAI by depositing collateral assets into Maker Vaults [which facilitate the generation of DAI against locked-up collateral]… [Other users] obtain DAI by buying it from brokers or exchanges, or simply by receiving it as a means of payment.”

Currently, on the Ethereum blockchain, the Maker Protocol is one of the largest Dapps. This is because a lot more developers are infusing it into their Dapps built on the Ethereum blockchain.

Speaking to CoinDesk, David Freuden, the co-author of MakerDAO expressed his excitement about the recent development. He said it is a “big day” for MakerDAO.

In addition, DAI’s present debt ceiling from BAT is 3 million, and 80 million from USDC. Also, for WBTC, the DAI debt ceiling is 20 million. Of the three, the one with better collateral requirements is USDC. This makes USDC the best option for users who intend to use Maker to open a leveraged long position on ETH.

Generally, the development might remain a blessing to MakerDAO for a long time, as the protocol could add advanced features and collateral types.

MakerDAO Is Now DeFi Most Valued Protocol as Ethereum Price Jumps 40%

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|