2023-7-3 20:00 |

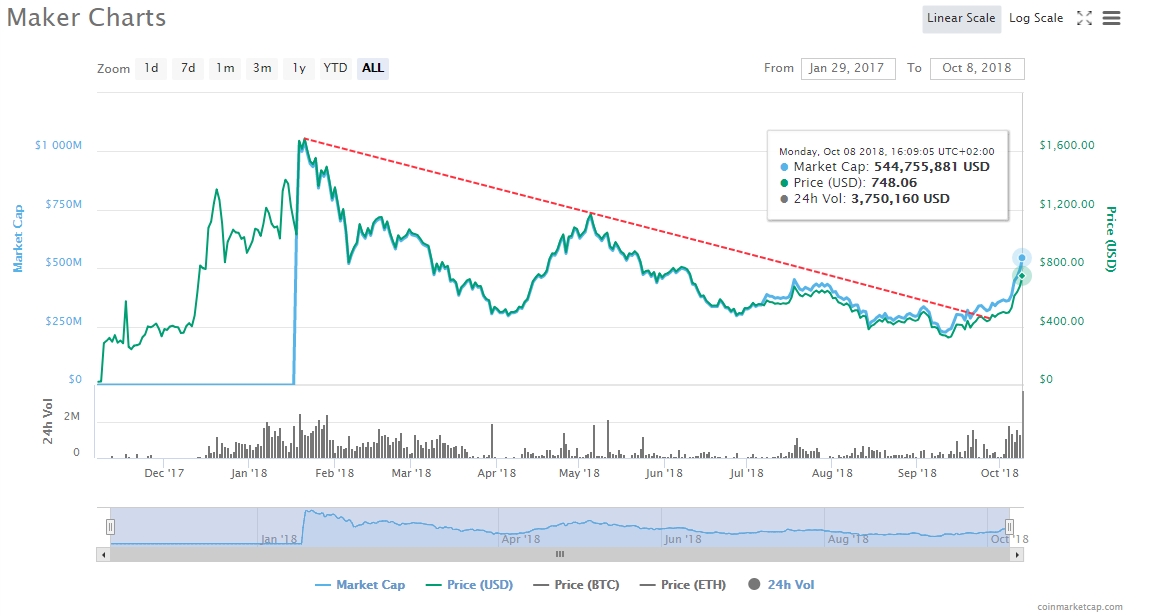

Over the course of seven days, Maker (MKR) has experienced remarkable growth, showcasing its potential as a lucrative investment opportunity.

According to data from CoinMarketCap, MKR has recorded a significant gain of 30% in this timeframe, sparking much interest and optimism among its numerous traders and holders.

For now, it remains unclear what is driving MKR’s price, but there is a clear, strong buying pressure and positive sentiment surrounding the DeFi token in the market.

Maker Price Action Surpasses MarketIn an impressive display of bullish momentum, Maker has witnessed a substantial gain attracting much of the market attention. Initially, MKR began last week trading around $706.85. The token then experienced a slight dip in price over the next few days, trading as low as $670.86 on June 28.

Related Reading: Litecoin $100 Milestone Indicates Promising Bullish Trends – Here’s Why

Thereafter, Maker started recording gains before a jump in price occurred on June 30, resulting in the token gaining by over 21% to hit a market price of $834.09.

Since the beginning of July, MKR has witnessed two more hikes in its market price, the most recent being today. In the early hours of this day, the MKR token boosted by 8% to hit a market price of $929.87 for the first time since March.

At the time of writing, MKR is sitting at a current price of $930.78 USD, with a market capitalization value of $897 million. In addition, the token trading volume is set at $76 million, having gone up by 14% in the last day, indicating an increased market activity.

Looking at the protocol performance, the MakerDAO has recorded a 1.04% decrease in its TVL over the last day based on data from DeFillama. Nevertheless, the protocol remains the second biggest DeFi project, with a TVL of $6.262 billion.

MKR Price Analysis And PredictionMKR has been exhibiting interesting price action recently, with two notable levels to watch. The first one is a resistance zone at the $973 price level, while MKR has faced selling pressure at this level in the past, preventing it from continuing its upward trend.

Traders and investors should closely monitor how MKR behaves around this resistance zone, as a breakout above it could potentially signal further upward momentum.

Related Reading: Bitcoin Sharks & Whales Show Strong Buying, Rally To Continue In July?

On the other hand, if MKR fails to break above the $973 resistance level, it may face a potential downward retracement to the $662 price level. This price zone has previously acted as a resistance, but if MKR experiences a pullback, it could potentially turn into a support zone.

Both of these levels are significant in assessing the price action of MKR and can provide valuable insights for traders and investors. Monitoring how MKR interacts with these levels could help determine the future direction and potential breakout or reversal opportunities for the cryptocurrency.

Featured Image: Freepik, Chart from Tradingview

origin »Bitcoin price in Telegram @btc_price_every_hour

Maker (MKR) на Currencies.ru

|

|