2024-5-13 16:40 |

A long-standing Ethereum investor known by their wallet address 0x2ce recently transferred a significant quantity of Ethereum (ETH) to Coinbase.

This movement involved 4,153 ETH, valued at approximately $12.17 million, based on the current exchange rate of $2,931 per ETH.

Are Long-Term Ethereum Investors Cashing Out?Initially, 0x2ce sent the funds to an intermediary wallet – 0x1d9, before the final transfer to the centralized exchange, Coinbase. Such movements to platforms like Coinbase generally indicate a plan to sell, contrasting with withdrawals to self-custody wallets, which suggest an intent to hold.

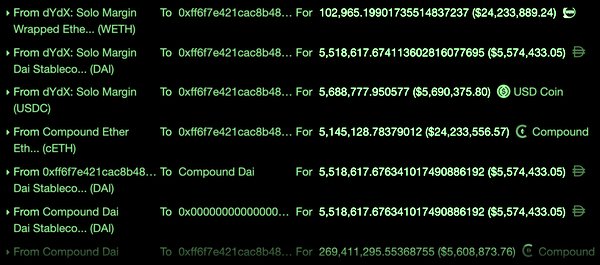

Regarding profitability, according to the on-chain analysis platform Spot On Chain, the crypto whale has realized substantial gains. He initially acquired 12,423 ETH from Poloniex at an average cost of only $11.03 per ETH, amounting to an estimated total of $137,000 between July 26 and August 8, 2016.

Since that initial acquisition, this investor has deposited 9,436 ETH to exchanges like Coinbase and Luno at an average price of $2,245, totaling about $21.2 million.

“The crypto whale still holds 2,566 ETH ( ~ $7.48 million) in a sub-wallet 0x2e3,” Spot On Chain said.

This transaction is part of a broader pattern observed among Ethereum long-term holders. Data from the on-chain analysis platform Glassnode reveals a decline in the total supply of ETH that had remained unmoved for five to seven years. Specifically, this metric has decreased by over 15%, dropping from 11.6 million ETH tokens during late February to the current 9.8 million ETH.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum Total Supply Unmoved Since Five to Seven Years. Source: GlassnodeDespite this trend of large-scale disposals, experts remain optimistic about Ethereum’s market outlook. Hitesh Malviya, the founder of the on-chain analysis platform – DYOR, points out several positive signals.

“ETH is close to finding a bottom,” Malviya said.

These positive signs include the fair price model on DYOR, which recently turned bullish. Moreover, the TVL (Total Value Locked) to market cap ratio has increased by 16.91% in the last 30 days, and the average on-chain demand has begun to rise.

The post Long-Term Ethereum Investor Sells $12.7 Million in ETH appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|