2023-6-12 18:00 |

Long-term Bitcoin holders are standing strong amidst the storm, undeterred by the recent lawsuit filed against Binance and Coinbase Exchange by the US Securities and Exchange Commission (SEC).

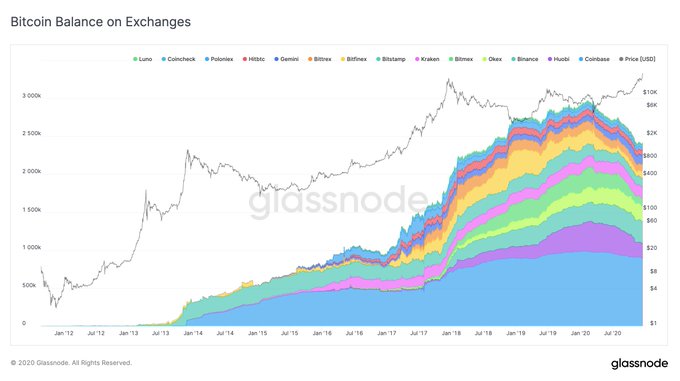

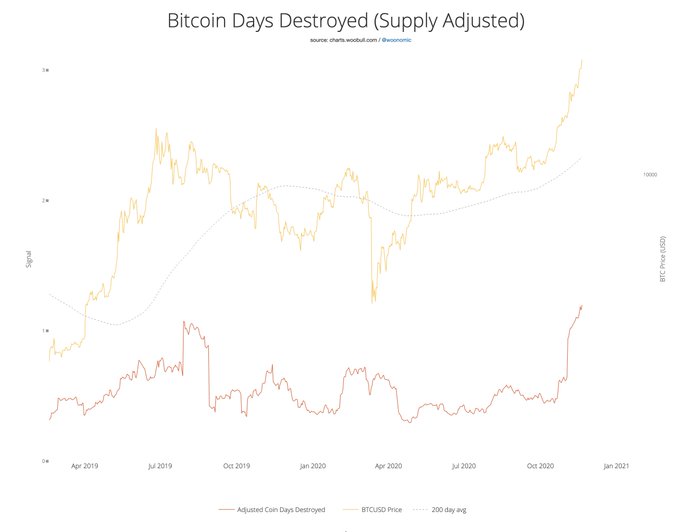

The resilience of these dedicated holders is evident as data from crypto markets analytics provider, Glassnode, reveals that the percentage of Bitcoin Long-Term Holder Supply sent to Exchanges remains incredibly low, standing at a mere 0.004%.

While regulatory actions have sent shockwaves through the crypto community, long-term holders of the crypto remain unwavering in their commitment to this pioneering digital asset.

The percentage of #Bitcoin Long-Term Holder Supply sent to Exchanges remains extremely quiet at 0.004%.

This highlights the profound inactivity of the cohort amidst elevated market distress, remaining indifferent to the #Binance and #Coinbase regulatory charges. pic.twitter.com/yWfdQHu4Ca

— glassnode (@glassnode) June 11, 2023

Their steadfast belief in the potential of Bitcoin to revolutionize the financial landscape acts as an unbreakable bond that shields them from the turbulence of the present moment.

FUD Fails To Shake Bitcoin HoldersContrary to prevailing expectations that the recent lawsuits targeting Coinbase and Binance would spur a mass exodus of cryptocurrency assets, a comprehensive analysis by Glassnode has shattered this assumption. The data provided by Glassnode shows that these legal proceedings have had no discernible impact on the unwavering resolve of long-term BTC holders.

According to Glassnode’s classification, long-term holders encompass those who have valiantly held their BTC for over 155 days, an impressive feat in the fast-paced world of cryptocurrencies. Remarkably, these individuals have shown no inclination to liquidate their assets through the embattled trading platforms.

Glassnode’s meticulous examination of the situation has already demonstrated the limited likelihood of assets held for such extended periods being readily sold off.

Bitcoin Challenges SEC’s Definition Of SecuritiesIn the vast web of the SEC’s efforts to classify digital assets as securities, one prominent exception stands tall: Bitcoin. The SEC’s framework, hinging on the famous Howey Test, faces significant hurdles when applied to the world’s leading cryptocurrency.

The Howey Test finds its roots in a landmark 1946 Supreme Court case involving the sale and leaseback of Florida orange groves by W.J. Howey Co. The court deemed these leaseback arrangements as investment contracts, necessitating their registration with the SEC.

This case further laid out the definition of a security, specifically as “an investment of money in a common enterprise with profits to come solely from the efforts of others.”

Even today, the SEC continues to rely on this measure. However, BTC’s unique attributes, staunchly defended by its proponents, prevent it from satisfying the requirements of the Howey Test.

Prominent figures within the SEC, including current chairman Gary Gensler and former chief Jay Clayton, have consistently expressed the belief that the alpha coin does not fall under the definition of a security.

Gensler reiterated this stance, stating unequivocally, “It’s not,” during recent public comments.

Featured image from NurPhoto/Getty Images

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|