2023-9-15 11:00 |

The metaverse, one of the pillars of the blockchain industry, has lost traction in the past few months as the crypto winter continues. Most of the flagship metaverse platforms have seen their users and their tokens plummet by double digits. Similarly, companies like Meta Platforms that were betting on the industry have slashed their ambitions.

The Sandbox and Decentraland users dropDecentraland and The Sandbox are the two biggest players in the metaverse industry. Sandbox’s SAND token has a market cap of over $599 million while Decentraland’s MANA is valued at $536 million. Axie Infinity’s AXS token has a market cap of $599 million. At their peak, these tokens were all valued at billions of dollars.

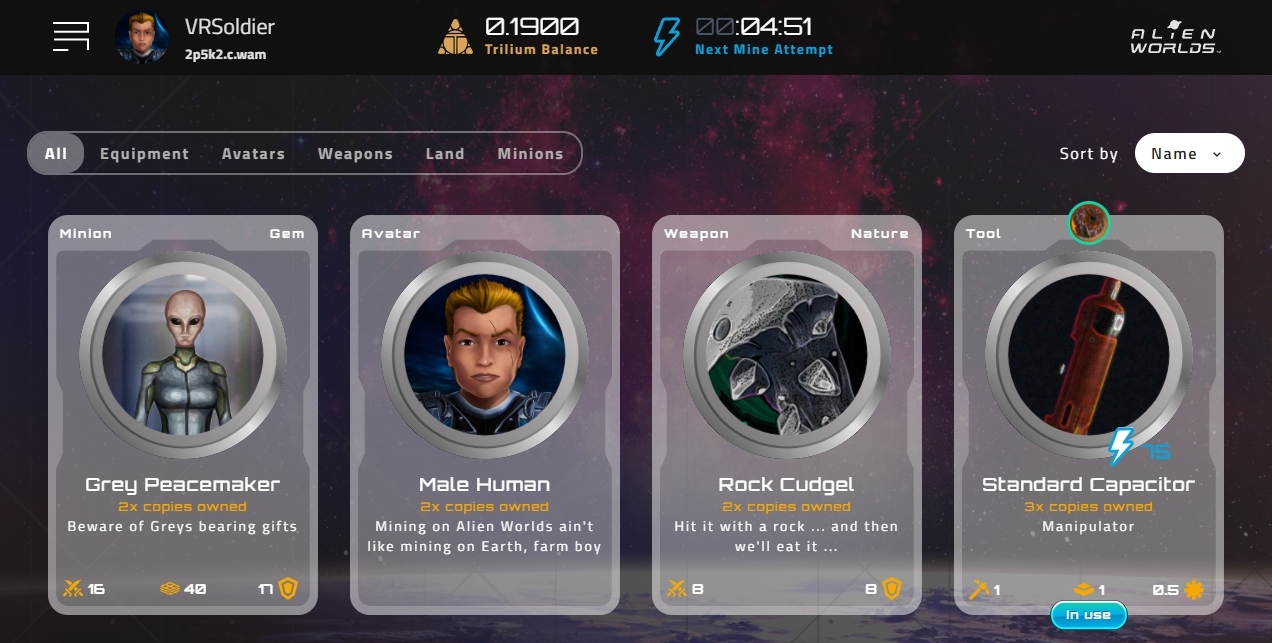

Data published by DappRadar shows that the number of people using these platforms has dropped sharply. For example, Decentraland had just 3.86k Unique Active Wallets (UAW) in the past 30 days, a 108% increase from the previous month. The number of transactions in the network roe by 63% to 72.80k while the balance in its smart contracts dropped to $15 million.

Activity in The Sandbox was much worse. The UAW dropped by 26% to 3.29k while the number of transactions in the smart contract dropped by 15% to 2.79k. The balance in its smart contracts also fell to $22.9 million.

Therefore, you would expect activity in platforms valued at over $500 million to be higher than that.

Meanwhile, NFT trends in Decentraland and The Sandbox has not been encouraging, As shown below, the floor price of these sales has in a downward trend after peaking earlier this year. Floor price is defined as the lowest price of an NFT at any given time. As such, a lower price is a sign that demand is a bit limited.

MANA and SAND prices have plungedA likely reason why activity in The Sandbox and Decentraland has dwindled is that their native tokens have crashed. MANA was trading at $0.28 on Thursday, 95% below its all-time high.

Similarly, SAND token was trading at an all-time low of $0.28, 80% below its record high. Therefore, most people who bought NFTs in these ecosystems or won rewards have seen their values plummet.

In most periods, blockchain applications do well when cryptocurrencies are rising and vice versa. For example, the floor price of Bored Ape Yacht Club (BAYC) NFTs has dropped as Ethereum weakened. Similarly, the DeFi TVL of all platforms dropped when crypto prices fell.

The post A lonely metaverse as Sandbox, Decentraland active users drop appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Metaverse ETP (ETP) на Currencies.ru

|

|