2022-5-24 18:38 |

Soon after Litecoin underwent the Mimblewimble Extension Blocks (MWEB) soft fork, South Korean exchanges have raised concerns for the network as the upgrade might conceal transaction information.

In two separate announcements, top domestic exchanges Bithumb and Upbit have added investment warnings for Litecoin.

Litecoin’s upgrade might circumvent AML guidelinesThe translated release by Bithumb noted, “The Mimblewimble (MWEB) expansion block upgrade includes enhancements to the scalability of the Litecoin network, but its core item includes an enhanced ‘Confidential Transaction’ option that does not expose transaction information.”

Meanwhile, Upbit stated, “We are striving to prevent money laundering and financing for offenses of public intimidation through digital assets that have technology that makes transmission records unidentifiable.” In addition, the exchange remarked that there have been no deposits made using the Mimblewimble function with Upbit. Further adding a cautionary note that, “For deposits made using the Mimblewimble function, please note that Upbit may not be able to return the wallet address as it is not possible to verify the sender’s wallet address.”

The soft fork enhances anonymityMWEB was originally introduced in November 2019 as part of the Litecoin Improvement Proposal. The fungibility-improving technology aims to enhance confidentiality between the senders and receivers in a transaction. As per the network, “MWEB will provide Litecoin users the option to not have to publicly display the amount you’re sending or how much Litecoin you hold in an MWEB address.”

Meanwhile, the Financial Action Task Force’s (FATF) travel rule also made a debut in the country in March this year. Over a threshold, the FATF requires virtual asset service providers (VASPs) to reveal information about parties involved in crypto transactions. Apart from the country’s know-your-customer (KYC) and anti-money laundering (AML) guidelines, a major part of the FATF proposal was sufficient security measures to identify the originator or the beneficiary of crypto transactions.

Therefore, after warnings by two major exchanges by volume, the other two exchanges of South Korea’s big four, Korbit and Coinone, might also come up with similar announcements around Litecoin. That said, delisting of Litecoin in South Korea can also be a possibility.

Terra collapse also factored inThe development also comes at a time when the South Korean administration is planning to introduce a stricter crypto framework for investor protection.

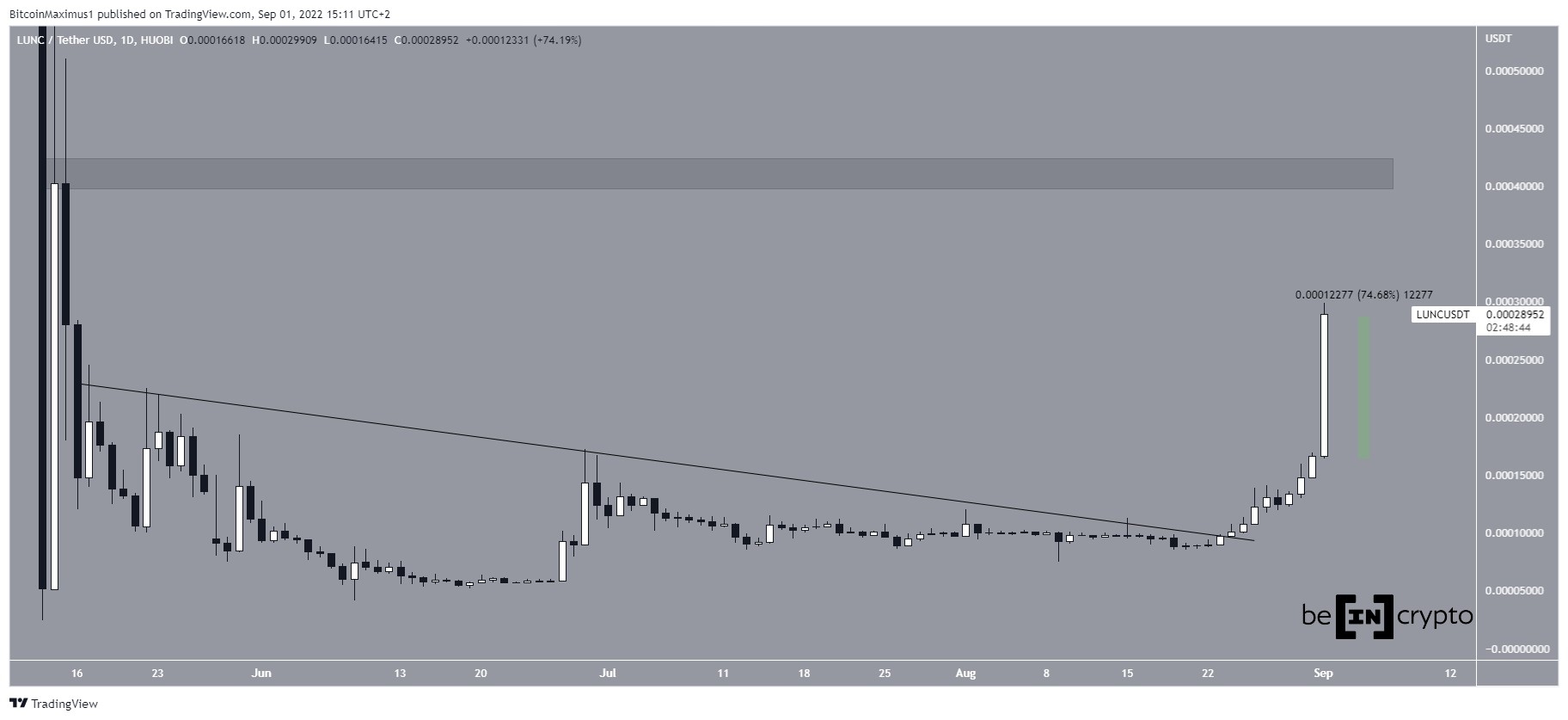

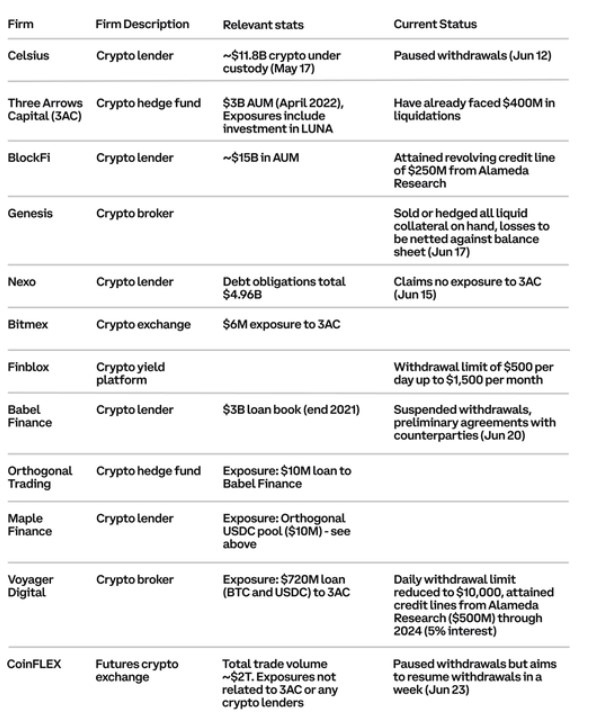

Meanwhile, the country’s Financial and Securities Crime Joint Investigation Team has officially launched an investigation to probe the collapse.

In addition, the Seoul Southern District Prosecutor’s Office is investigating whether it can bring charges of a Ponzi scheme against Terraform Lab’s CEO, Do Kwon.

What do you think about this subject? Write to us and tell us!

The post Litecoin’s MWEB Update Attracts Investment Warnings in South Korea appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Litecoin (LTC) на Currencies.ru

|

|