2022-5-5 19:28 |

Summary:

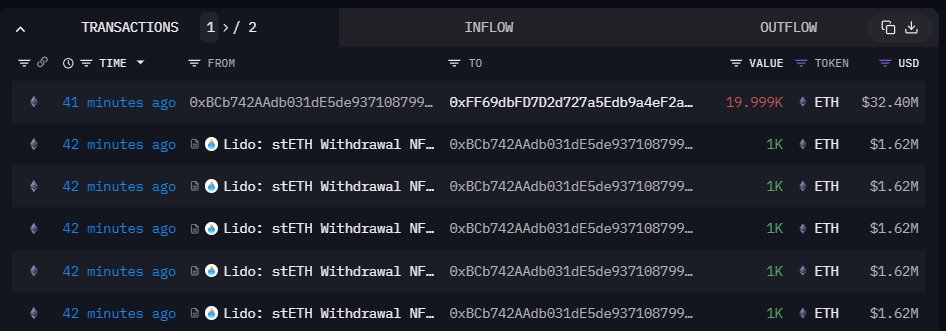

Lido Finance has surpassed Curve finance to become the largest DeFi protocol in terms of total value lockedApproximately $19.1 billion is locked on Lido Finance compared to Curve’s $19 billionLido Finance is available on the blockchain networks of Ethereum, Solana, Terra, Kusama, and Polygon.Earlier today, Lido Finance became the largest DeFi protocol in terms of total value locked, edging out Curve Finance from the top spot in the process. At the time of writing, the total value locked on Lido Finance stands at $19.1 billion compared to Curve’s $19 billion. Anchor comes in third with $17.08 billion, MakerDao fourth with $13.18 billion, and AAVE fifth with $11.69 billion in total value locked.

Top 10 DeFi protocols in Total Value Locked. Source, DeFiLlama.com Lido Finance’s Rise in DeFiLaunched in December 2020, Lido Finance has grown to facilitate staking on the five networks of Ethereum, Terra, Solana, Kusama and Polygon. Furthermore, $11 billion worth of assets is staked on Ethereum 2.0; $7.142 billion on Terra; $288.722 million on Solana; $2.525 million on Kusama; and $16.175 million on Polygon.

Lido’s vision is ‘to build a staking solution that is fully permissionless and risk-free for the blockchain itself.’ The current roadmap of the project includes adopting Distributed Validator technology and creating additional checks and balances on Lido’s governance. The latter includes directly empowering stETH holders to veto any decisions that will be made on the protocol.

stETH is a liquidity token that users get when they stake their Ethereum into the ETH 2.0 contract through Lido in a 1-to-1 ratio. stETH also allows its users to participate in the entire Ethereum DeFi ecosystem (Yearn, Curve, Maker, Aave) while still accruing ETH2.0 rewards earned from staking during Phase 0.

The team at Lido further explains stETH as follows:

stETH accrues staking rewards regardless of where it is acquired. This means that regardless of whether you acquire stETH directly from staking via stake.lido.fi, purchase stETH from 1inch or receive it from a friend, it will rebase daily to reflect Ethereum staking rewards.

This nullifies the downsides from staking into the Eth2 contract directly: illiquidity, immovability, inaccessibility. Instead of locking up your staked ETH, Lido allows you to put it to use so you don’t need to choose between Ethereum staking and DeFi participation.

origin »Bitcoin price in Telegram @btc_price_every_hour

Wish Finance (WSH) на Currencies.ru

|

|