2022-6-14 00:06 |

A month after the successful deployment of Bancor v3 on Ethereum, over 100 token pools have deployed on the protocol. According to a statement on June 10, Bancor said the activation of the more than 100 token pools, in addition to the four initial pools, provides an opportunity for liquidity providers to supply assets without limits and receive instant protection against impermanent loss.

Notably, these tokens and their respective pools have been confirmed to be secure, meeting the Bancor DAO’s stringent guidelines. Bancor is considering nine more tokens. However, their absorption depends on if smart contract-related risks are fixed. If not, they must convince the DAO that their whitelisting from V2.1 wouldn’t comprise the security of the v3 system.

Liquidity providers and projects can create active pools on Bancor v3 by supplying a minimum of 10K BNT of the token’s value. With this threshold met, the pool becomes active, rewarding liquidity providers with a share of trading fees.

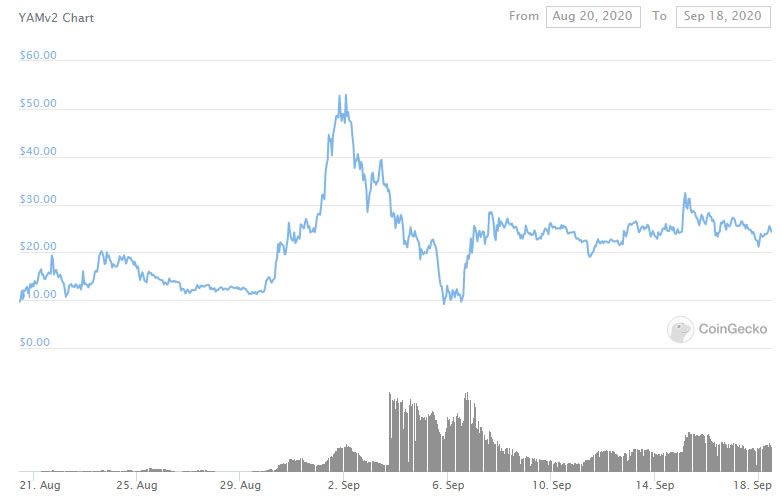

The laid down conditions by the Bancor DAO are necessary for the high octane DeFi sector. At the peak of last year’s crypto Bull Run, the Total Value Locked (TVL) in DeFi rose to over $250 billion, fueled by, in some instances, protocols promising high, unsustainable yields sensitive to price volatility. As the crypto market corrected, liquidity providers were massively impacted, cumulatively losing billions.

Bancor V3 provides a safer HODL and Earn solution to define the next chapter in DeFi. Central to this strategy is the desire for token safety and community. Accordingly, Bancor is helping projects build the much-needed on-chain liquidity while also earning decent yields safely.

Bancor V3 allows liquidity providers to supply single-asset liquidity to decentralized pools without cost incentives. In these pools, projects and whales can auto-compound their earnings with 100 percent guarantees that they are protected against impermanent loss. In this arrangement, Bancor v3 incentivizes the HOLD culture since liquidity providers know that their assets are safe, contribute positively to the ecosystem, and earn decent yields.

Bancor v3 offers a wide range of exciting features for token holders, especially projects. Their single-liquidity sourcing feature and protection against impermanent loss caused by the inevitability of price volatility inherent in automated market maker models used by most DEXes deploying on Ethereum and similar accounting models is a welcomed move. This feature rightly places DeFi liquidity back to DAOs and token holders.

As of early June, Bancor v3 has been widely embraced and is actively proving to be an ultimate liquidity solution that’s community-driven and offers reliable, sustainable yields. The protocol is currently in the advanced testing stage of their Dual Rewards and Auto-Compounding Rewards and will soon be activated. These features will draw in over 30 token DAOs to provide incentives on their Bancor v3 pools.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cryptoindex.com 100 (CIX100) на Currencies.ru

|

|