2020-10-16 13:00 |

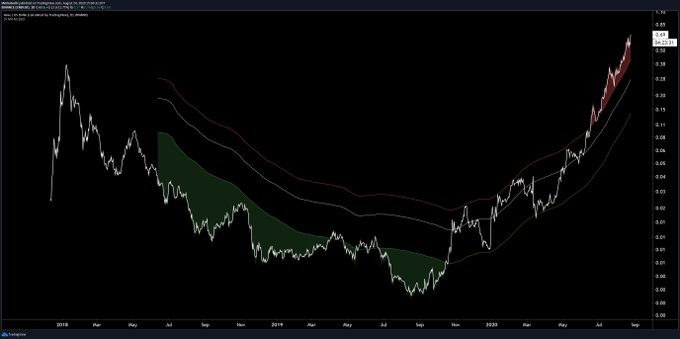

Aave’s LEND token, along with its new token AAVE, has dropped heavily in the past 24 hours despite stagnation in the Bitcoin and Etheruem price. The coin currently trades down 15% over the past day, underperforming BTC’s mild -0.5% performance.

The cryptocurrency’s drop comes in spite of Aave having fundamentals that are stronger than ever. Not to mention, all of DeFi remains in a trend of growth as investors continue to scrap traditional platforms for these new blockchain-based applications that can sometimes provide a better user experience.

Related Reading: Here’s Why Ethereum’s DeFi Market May Be Near A Bottom Aave Drops 15% Amid Strong Fundamental TrendsThe drop in the price of LEND/AAVE comes in spite of the Aave protocol itself touting strong fundamental trends.

Spencer Noon, head of DTC Capital, once said that the coin may be the “most undervalued DeFi token today”:

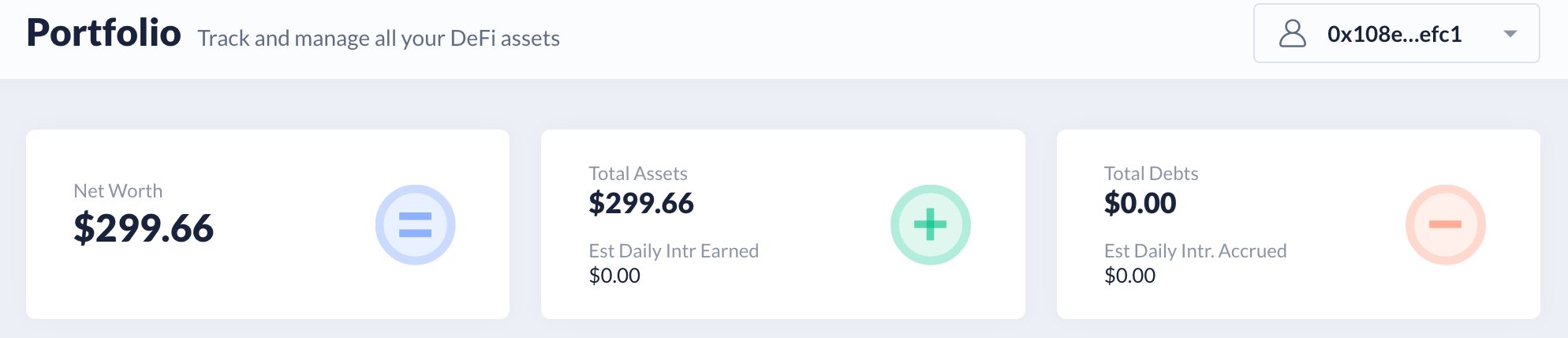

“One of the best signals of PMF in #DeFi is if a project can succeed w/o extra incentives (liquidity mining). @AaveAave doesn’t have LM yet it’s still one of the biggest beneficiaries of new yield farming activity. At $1.26B TVL and only $759M mcap—the fundamentals are so strong.”

Also, notable investor Kyle Samani said that if there was one Defi coin he had to hold for two years, it would be LEND.

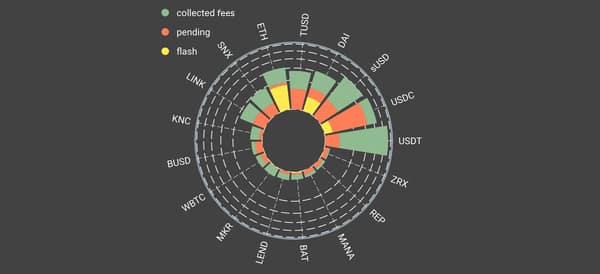

Aave itself has been in the midst of a transition between its old cryptocurrency, LEND, and a new token fittingly called AAVE. This new token will allow users to govern the protocol, which means that it has an inherent premium to its price. The coin can also be staked in a safety module, which will allow users to act “as insurance against Shortfall Events.” This staking module will allow users to earn AAVE on their deposits, along with a “percentage of protocols fees.”

Related Reading: Tyler Winklevoss: A “Tsunami” of Capital Is Coming For Bitcoin All of DeFi Still BullishIt’s not just that AAVE’s fundamentals are strong, all of DeFi is currently in a positive place due to a number of trends.

OKEx just announced that it has frozen all withdrawals after a private key holder began cooperation with a public safety bureau. Many see the firm’s ability to freeze withdrawals as validation of decentralized exchanges, which put the power in the hands of the users to move their funds and trade their coins.

Related Reading: 3 Bitcoin On-Chain Trends Show a Macro Bull Market Is Brewing Featured Image from Shutterstock Price tags: lendusd, lendbtc, lendeth, aaveusd, aavebtc, aaveeth Charts from TradingView.com Leading DeFi Coin Aave's LEND Dives 15% Despite Positive Fundamentals origin »Bitcoin price in Telegram @btc_price_every_hour

Aave (LEND) на Currencies.ru

|

|