2023-7-15 22:00 |

In a significant turn of events, large cryptocurrency exchanges Coinbase, Kraken, Bitstamp, and Gemini announced their decision to relist XRP after a significant legal victory for Ripple against the Securities and Exchange Commission (SEC).

This momentous decision comes as a result of the exchanges reevaluating their previous delisting of XRP, showcasing a renewed confidence in the token’s regulatory standing. This was brought about by the recent landmark court ruling by Judge Analisa Torres.

Coinbase, Kraken, And Bitstamp Reinstate XRP TradingCoinbase, a leading cryptocurrency exchange, wasted no time in announcing the resumption of XRP trading following the court ruling. Brian Armstrong, the CEO of Coinbase, expressed the exchange’s decision in a tweet, stating:

“Coinbase will re-enable trading for XRP (XRP) on the XRP network. Do not send this asset over other networks or your funds may be lost. Transfers for this asset remain available on @Coinbase & @CoinbaseExch.“

The reinstatement of the digital asset on Coinbase’s platform marks a significant shift in their position after delisting the token in January 2021. Kraken, another prominent exchange, also confirmed its plans to reinstate trading for the cryptocurrency, as Marco Santori, Kraken’ Legal Officer tweeted stated:

“1/ This morning, the Federal Court for the Southern District of New York ruled that XRP is not a security. As such, just a few minutes ago, Kraken re-enabled trading in XRP for US users.”

Bitstamp, an early adopter of XRP, joined the bandwagon, emphasizing its role as a leading liquidity venue for the asset globally as it confirms the return of the token on its exchange for US users.

Ripple’s Legal Battle And Market ImpactThe court ruling stems from the SEC’s lawsuit against Ripple, which accused the company of conducting an unregistered securities offering through the sale and distribution of XRP.

Ripple chose to fight the lawsuit, investing substantial resources into the legal proceedings. The outcome of this case carries significant weight for the cryptocurrency industry, as it determines the regulatory oversight faced by digital asset firms.

Although Judge Torres’ recent summary judgment concluded that while Ripple’s initial sale of XRP to institutional investors could be classified as a securities offering, the subsequent trading of the tokens on crypto exchanges did not fall under the same classification.

This ruling provides a level of clarity regarding the regulatory status of the token and sets a precedent for similar cases involving other cryptocurrencies.

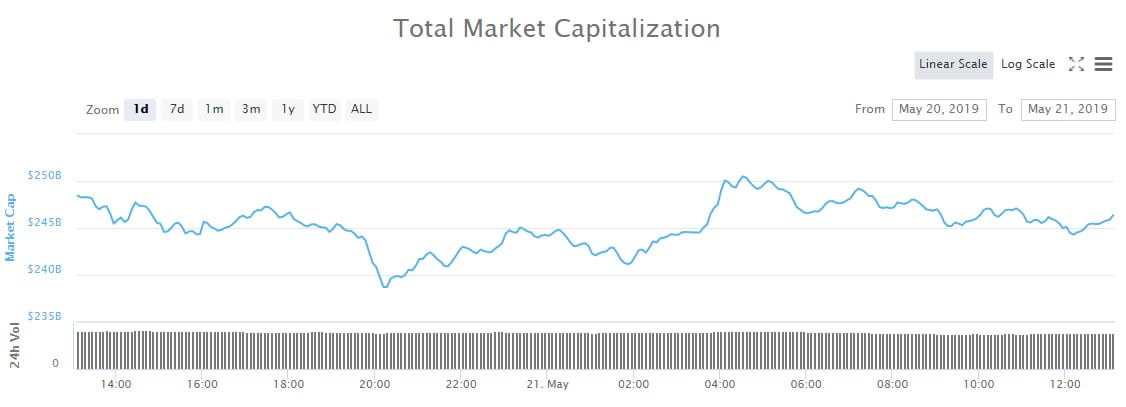

The market responded with enthusiasm to the court ruling as XRP experienced a surge in value, rising by over 75% compared to its price at the beginning of Thursday. Coinbase’s share prices also witnessed a significant jump of more than 24% following the ruling.

origin »Ripple (XRP) íà Currencies.ru

|

|