2026-1-6 08:16 |

The findings highlight growing demand for regulated exchanges that support seamless fiat on- and off-ramps

SYDNEY, Jan. 6, 2026 /PRNewswire/ — KuCoin, a leading global cryptocurrency platform built on trust, today released its latest market insights report, Into the Cryptoverse: Australia 2025 Edition. The findings signal a definitive shift away from early-stage experimentation toward a mature phase of pragmatic growth, where accessibility, trust, and seamless integration with traditional finance are paramount.

Set against the backdrop of a rapidly expanding national landscape—where 22% of Australian adults now hold digital assets [1]—the report draws on a targeted survey of active investors, traders, and builders conducted during a major industry event in November 2025. The data reveals a sophisticated user base that is moving beyond speculative trading toward real-world utility. Crucially, these users are prioritizing platforms that reduce friction, enabling smooth movement between fiat currency and digital assets.

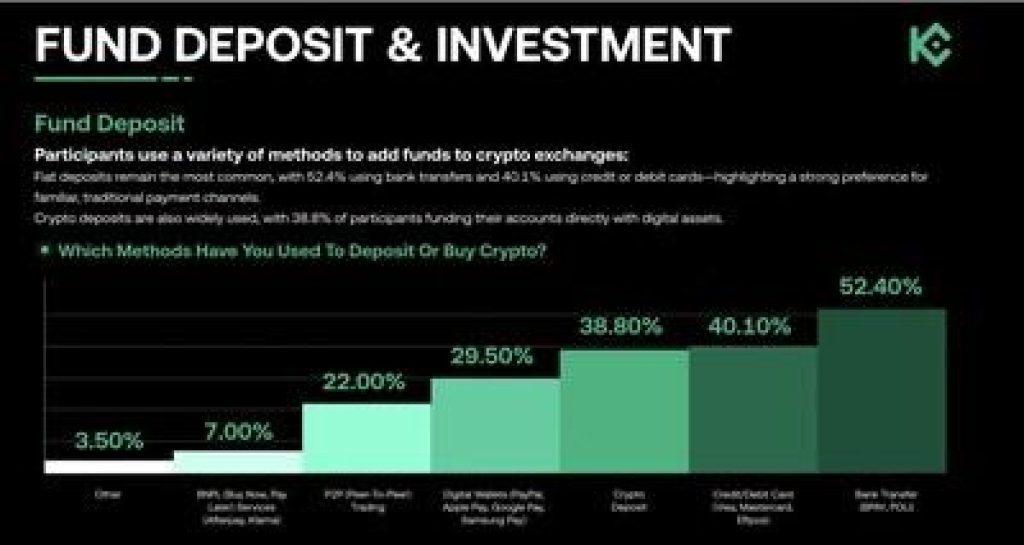

Funding accessibility emerges as a defining theme of the report. The survey data clearly shows that traditional fiat rails dominate crypto onboarding in Australia. Bank transfers are the most widely used funding method, cited by 52.4% of respondents, followed by credit and debit cards at 40.1%. In comparison, 38.8% of participants reported using direct crypto deposits, while alternative methods such as digital wallets (29.5%) and P2P trading (22.0%) play a secondary role.

This distribution highlights that ease of access to familiar, locally supported fiat payment channels remains the primary driver of exchange choice, underscoring the importance of robust bank transfer and card-based infrastructure in the Australian market.

Aligning directly with these market demands, KuCoin currently provides Australian users with direct AUD fiat deposit and withdrawal services, enabling funds to move instantly between local bank accounts and the exchange. This capability is central to KuCoin’s strategy of building infrastructure that supports both new entrants and experienced traders as the market infrastructure solidifies.

The report further highlights a community driven by working-age professionals who exhibit long-term investment horizons. While spot trading remains the foundation of engagement, the growing use of crypto for everyday payments suggests that digital assets are graduating from “speculative assets” to “routine financial tools.”

These insights validate KuCoin’s recent strategic expansion. Addressing the local emphasis on trust and regulatory compliance, KuCoin has secured its AUSTRAC Digital Currency Exchange (DCE) registration and established a physical headquarters in Sydney’s CBD. Under the leadership of Managing Director James Pinch, the company is dedicated to delivering a compliant, transparent, and localized trading experience tailored to the high standards of the Australian market.

Together, these findings underscore that the Australian market has entered a new era of maturity—one where trusted platforms, compliant operations, and accessible fiat services are the pillars of sustainable growth. KuCoin’s continued investment in local capabilities positions the platform to lead this transition.

For more details, readers are invited to explore the full Into the Cryptoverse: Australia 2025 Edition report.

[1] https://cfotech.com.au/story/australian-crypto-adoption-grows-as-22-invest-in-digital-assets

About KuCoin

Founded in 2017, KuCoin is a leading global crypto platform trusted by over 40 million users across 200+ countries and regions. The platform delivers innovative and compliant digital asset services, offering access to 1,000+ listed tokens, spot and futures trading, institutional wealth management, and a Web3 wallet.

Recognized by Forbes and Hurun, KuCoin holds SOC 2 Type II and ISO 27001:2022 certifications, underscoring its commitment to top-tier security. With AUSTRAC registration in Australia and a MiCA license in Austria, KuCoin continues expanding its regulated footprint under CEO BC Wong, building a reliable and trusted digital-asset ecosystem.

Learn more: www.kucoin.com

The post KuCoin Releases Australia Market Report: Over Half of Australian Crypto Funding Comes from Bank Transfers appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|