2020-7-23 14:58 |

Bitcoin’s hashrate data is inconsistent across major data providers, which has confused those who track mining information. Kraken Intelligence created a new hashrate metric that aims to bridge this gap by providing a more accurate estimate.

Misunderstood Bitcoin’s HashrateThere are two major reasons for hashrate to increase on a proof of work (PoW) network: the launch of more efficient mining hardware or mining farms turning on more machines.

Calculating hashrate is a well-known grey area as well. A quick look at hashrate data providers evidences the inconsistency of measuring this data. At the time of writing, hashrate on public sources ranges between 112 EH/s and 118 EH/s.

This fragmentation arises from the methodology of calculation.

To calculate hashrate, one must consider Bitcoin block times, and the current mining difficulty level. Since Bitcoin’s block times are dictated by randomness in the short run, there is no one true hashrate measure.

Kraken Intelligence developed a metric called “true hashrate” to provide Bitcoin’s hashrate within two bounds dictated by volatility.

This metric establishes a range with a statistical confidence level of 95% to estimate a lower and upper bound for hashrate. Instead of providing users with a single data point, setting a range offers a more accurate hashrate estimate. It further helps determine potential volatility in mining sentiment.

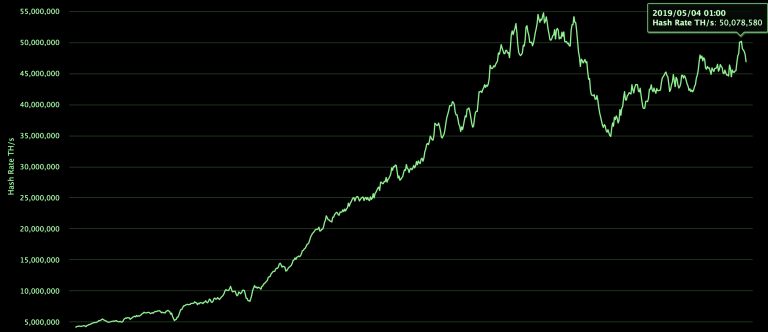

Bitcoin’s True Hashrate, via Kraken IntelligenceUpon looking back at Bitcoin’s early days using the true hashrate metric, Kraken noticed that the range has started to narrow in recent years. This indicates that mining sentiment has become stable in the last few years, except for a few notable events.

Since 2017, Bitcoin’s hashrate has been trending up while volatility in hashrate is trending down, via Kraken Intelligence.Block reward halvings are tricky for miners because these events put short-term stress on their earning capacity while adjusting Bitcoin’s native economics to increase the chance of long-term BTC price appreciation, thereby improving miner revenue.

However, a reduction in volatility over long periods suggests that mining is becoming a more mature business, dominated by well-funded institutional players who can ride through short-term unprofitability.

origin »Bitcoin price in Telegram @btc_price_every_hour

Kraken (KRAK) на Currencies.ru

|

|