2024-6-20 18:36 |

Cryptocurrency exchange Kraken recently revealed that a security vulnerability led to the loss of $3 million worth of digital assets. This incident involved a self-proclaimed security researcher who identified a critical bug, subsequently exploited by related accounts to siphon funds.

The event has raised serious questions about ethical hacking and the increasing challenges of securing digital assets in the evolving cryptocurrency landscape.

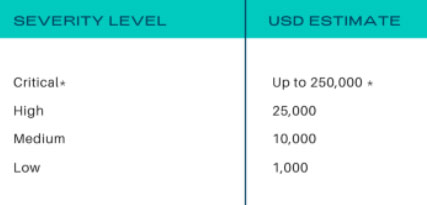

Discovery and exploitation of the bugOn June 9, an anonymous individual claiming to be a security researcher alerted Kraken to a significant security flaw.

While the researcher initially demonstrated the bug with a minimal crypto transfer worth $4, which would typically qualify for Kraken’s bounty program, the situation quickly escalated.

Two accounts associated with the researcher exploited the bug to withdraw over $3 million in digital assets from Kraken’s treasury.

Kraken’s chief security officer, Nick Percoco, highlighted on social media platform X the severity of the incident, noting that this was not a case of white-hat hacking but rather an act of extortion.

The researcher demanded a reward for the stolen funds, refusing to return the assets until Kraken speculated on the potential damage the bug could have caused if undisclosed.

Instead, they demanded a call with their business development team (i.e. their sales reps) and have not agreed to return any funds until we provide a speculated $ amount that this bug could have caused if they had not disclosed it. This is not white-hat hacking, it is extortion!

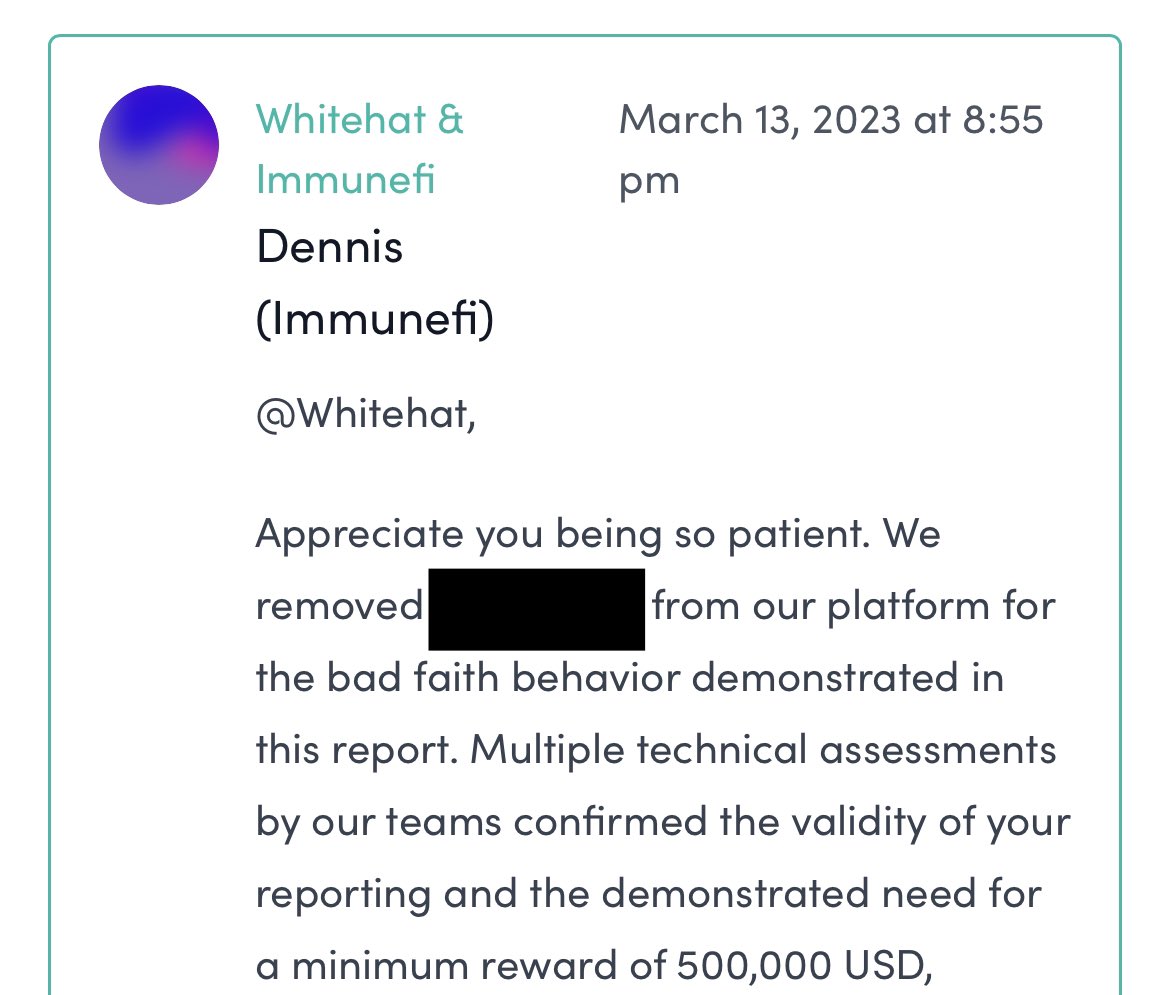

— Nick Percoco (@c7five) June 19, 2024 Ethical hacking or extortion?The incident has sparked a debate within the cryptocurrency community about the ethical boundaries of hacking. Ethical, or white-hat hackers, typically disclose vulnerabilities to companies responsibly, allowing them to address security flaws without causing harm.

However, Kraken argues that the actions taken by this researcher and the associated accounts do not align with these principles.

One of the three accounts involved had completed Kraken’s Know Your Customer (KYC) verification, identifying itself as a security researcher. Despite this verification, the identity of the individual remains undisclosed.

The researcher’s decision to exploit the bug for financial gain, rather than merely demonstrating its existence and claiming a legitimate bounty, has been widely criticized.

Impact on Kraken and the cryptocurrency industryKraken has emphasized that no user funds were at risk during the incident, as the stolen cryptocurrency came directly from the exchange’s treasury. Nevertheless, the event has underscored the ongoing vulnerabilities in the cryptocurrency industry and the need for robust security measures.

In response to the exploit, Kraken has disclosed details of the bug to the broader industry, aiming to prevent similar incidents. This transparency is part of Kraken’s commitment to improving security across the cryptocurrency ecosystem.

Rising trends in crypto hackingThe Kraken incident is part of a broader trend of increasing crypto-related hacks and exploits. According to Merkle Science’s 2024 Crypto HackHub Report, the first quarter of 2024 saw hackers steal $542.7 million in digital assets, a 42% increase compared to the same period in 2023.

Interestingly, private key leaks have emerged as the leading cause of these exploits, surpassing smart contract vulnerabilities.

In 2023, hacked funds lost to smart contract vulnerabilities plummeted by 92% to $179 million, down from $2.6 billion in 2022. However, over 55% of hacked digital assets were due to private key leaks.

These statistics reflect the evolving nature of threats in the cryptocurrency industry, with hackers increasingly targeting individual security weaknesses rather than systemic flaws in smart contracts.

The cryptocurrency industry has experienced 785 reported hacks and exploits over the past 13 years, resulting in nearly $19 billion in losses. These figures highlight the significant challenges that exchanges, wallet providers, and other stakeholders face in safeguarding digital assets.

What’s the way forward>Kraken’s experience serves as a stark reminder of the importance of comprehensive security measures and ethical practices in the cryptocurrency industry. While the exchange has taken steps to address the immediate issue, the incident underscores the need for ongoing vigilance and innovation in security protocols.

For the broader cryptocurrency community, the rise in hacking incidents and the shift in tactics from smart contract exploits to private key leaks call for enhanced security frameworks.

The post Kraken faces extortion after $3 million crypto bug exploit appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Kraken (KRAK) на Currencies.ru

|

|