2020-1-13 00:36 |

2020 is a crucial year for Bitcoin. The block reward halving, which occurs once every four years, is set to happen this May. Other than the halving, there are three important fundamental factors investors have to consider.

The three factors are:

the hashrate of the Bitcoin blockchain network, the total number of unique addresses on the network, and the improvement of institutional infrastructure surrounding it. Factor #1: Hashrate + HalvingIn May 2020, the third block reward halving in Bitcoin’s history will be activated. It will decrease the reward miners receive by mining blocks on the Bitcoin network by half.

Since miners often sell BTC they mine to sustain their operations, it will decrease the inflow of BTC into exchanges and over-the-counter (OTC) platforms, affecting the circulating supply of BTC.

Due to the fixed 21 million supply of Bitcoin, BTC is a scarce asset that is actually deflationary. As such, any event that affects its scarcity will always have a major effect on the price trend of the asset.

Whether that effect will come in the short-term or the long-term remains fiercely debated. Some anticipate a sell-the-news reaction from investors after the halving. Historical data points towards a post-halving sell-off and it took approximately 6 to 12 months after the halving for bitcoin to see an extended rally.

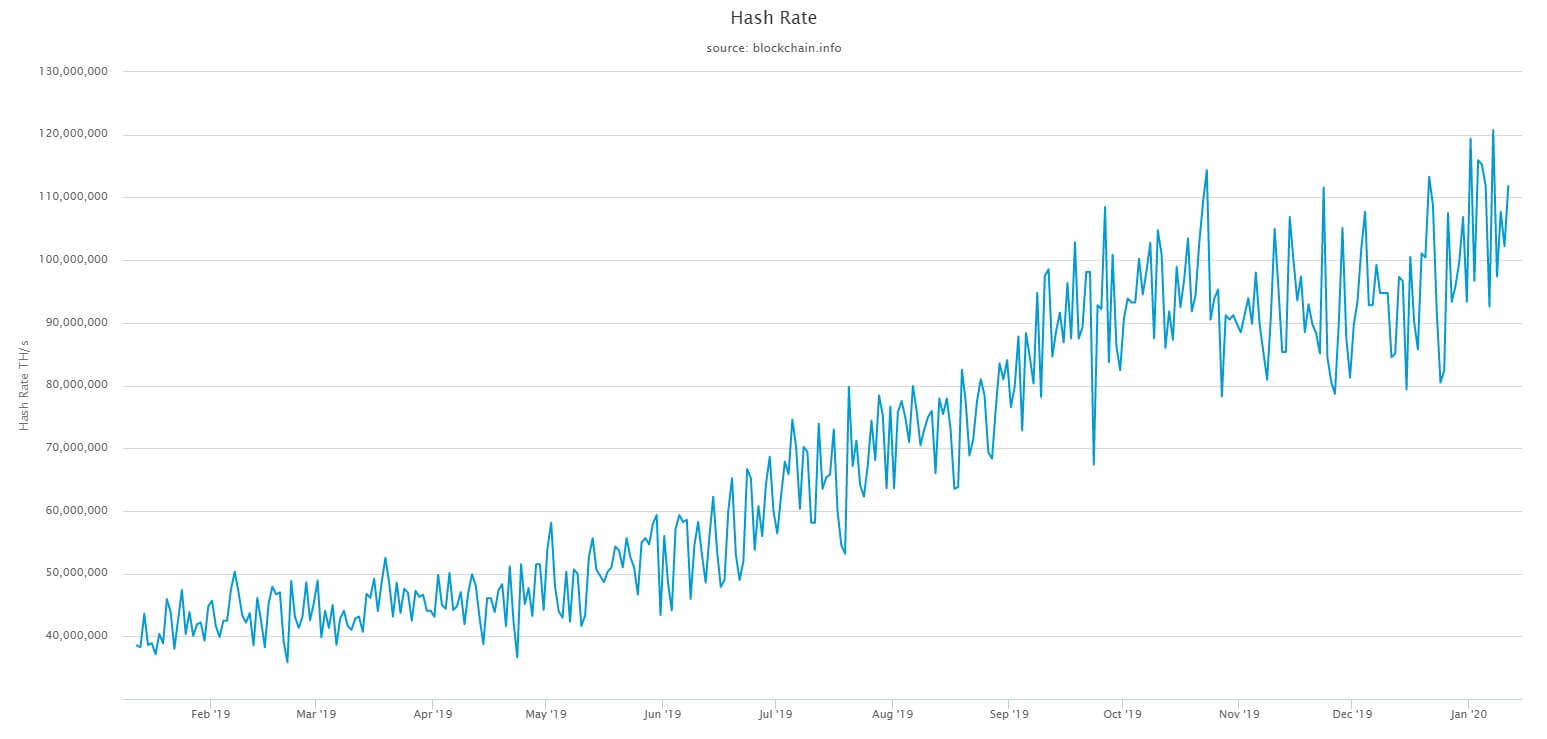

The rising hashrate of the Bitcoin network months before the halving is a positive sign, especially considering that the price of bitcoin dropped by nearly 40 percent in the past five months.

After seeing exponential growth, hashrate is at an all-time high on the Bitcoin network (Source: Blockchain.com) Factor #2: Number of unique addresses on the Bitcoin networkThe total number of unique addresses is a key piece of data to determine user activity on the Bitcoin network.

Since many users tend to generate new addresses on a regular basis, the number of unique addresses is the most accurate way to measure the organic rate of growth of BTC.

According to on-chain data provider Blockchain.com, unique addresses have remained relatively stable at 450,000 addresses in the past two years. In early 2018, the Bitcoin price was hovering near its all-time high and it indicates that despite the 60 percent drop in price, user activity has not declined as much as expected.

Factor #3: Improvement of institutional infrastructure2019 was really the first year the cryptocurrency sector saw the emergence of well-regulated and structured institutional products.

Existing exchanges like Coinbase and Circle launched custodial services and new firms like Bakkt released highly anticipated futures products for accredited investors.

In his end of the year review, Coinbase CEO Brian Armstrong said hundreds of institutional investors have joined Coinbase Custody. He said he expects every institution to eventually get into crypto in the future. Armstrong said:

“Eventually just about every financial institution will have some sort of cryptocurrency operation, and most funds will keep a portion of their assets in cryptocurrencies, because of the uncorrelated returns and upside potential.”

The post 3 key fundamentals that will determine Bitcoin’s 2020 trend investors need to observe appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|