2020-12-11 00:08 |

JPMorgan Chase says the rise of digital assets could make gold suffer.

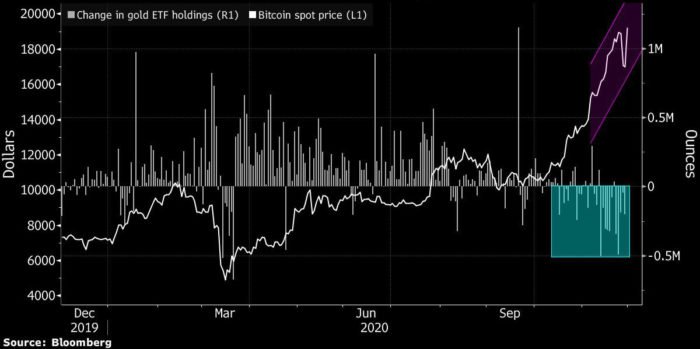

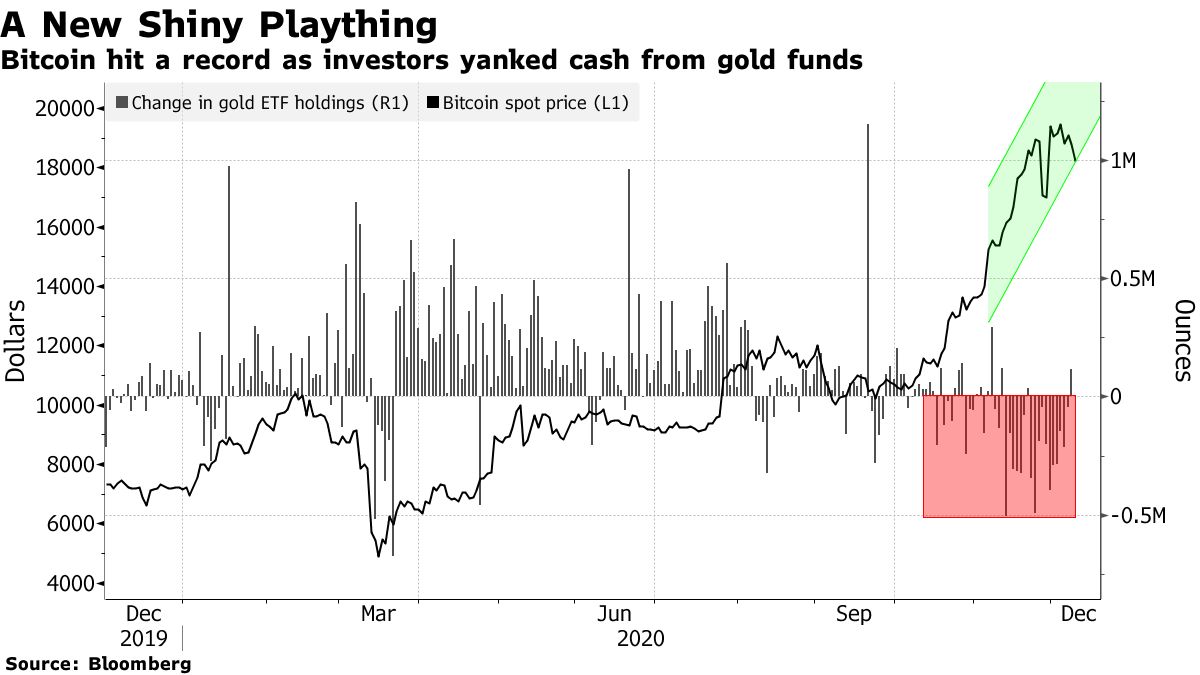

While money poured into Bitcoin in October, gold saw a record amount of outflows. According to the bank’s quantitative strategists, including Nikolaos Panigirtzoglou, this trend is only going to continue in the long run as more institutional investors take a position in the largest crypto asset.

Over the past few months, many have recognized Bitcoin as a good alternative to gold, and JPMorgan is just one of them. As we reported, even Ray Dalio is warming up to digital gold, with Citi, Wells Fargo, Deutsche Bank, and others seeing Bitcoin as a diversifier to the yellow metal.

Compared to bitcoin’s 156% return YTD without even hitting $20k yet, bullion only raked in 20.5% gains in 2020 after reaching a new peak.

To the generation born after Bitcoin, it’s as old as gold.

— Naval (@naval) December 10, 2020

“The adoption of bitcoin by institutional investors has only begun, while for gold, its adoption by institutional investors is very advanced,” wrote the JPMorgan strategists.

According to the bank’s calculations, for now, Bitcoin only accounts for 0.18% of family office assets compared to gold ETF’s 3.3%.

However, bitcoin is seeing a lot of demand, as seen with the Grayscale Bitcoin Trust, which saw an inflow of almost $2 billion since October, while gold ETFs had a $7 billion outflow during the same period.

“If this medium to longer-term thesis proves right, the price of gold would suffer from a structural flow headwind over the coming years,” wrote JPMorgan’s strategists.

Source: BloombergIn the short-term, the bank sees Bitcoin prices overshot, hence a selling with gold due for a recovery.

However, many believe both gold and bitcoin should be part of a portfolio. Even Dalio said Bitcoin has similarities to gold and other store holds of wealth.

“Gold buyers do not care what JPM thinks. Americans don't buy or own much gold. 92% of demand is outside of US. Bitcoin the fastest horse and can go up 20x-would be worth $6 trillion. If so gold doubles to $20trillion in mkt value. Plenty of value to go around,” said Dan Tapiero, co-founder of 10T Holdings.

Bitcoin (BTC) Live Price 1 BTC/USD =18,357.2242 change ~ 0.09Coin Market Cap

340.85 Billion24 Hour Volume

26.55 Billion24 Hour Change

0.09 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); The post JPMorgan: Bitcoin’s Rise Coming at Gold’s Expense; BTC Price Overshot, Bullion Due for Recovery first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Golos Gold (GBG) íà Currencies.ru

|

|