2021-12-14 19:07 |

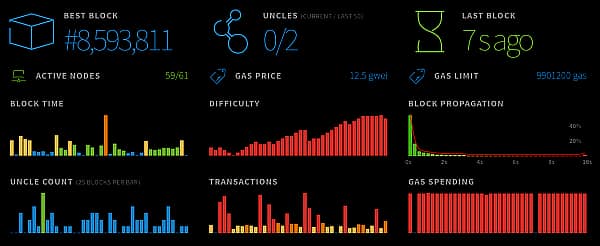

Ethereum co-founder and ConsenSys CEO Joseph Lubin believe the high gas fees in Ethereum are a measure of success. He said this during an interview at Dcentral, an event in Miami. Lubin pointed out that the high gas fees are a growth pain and are unavoidable.

Lubin further noted that when new technology becomes successful, it always has scaling issues. Explaining why this happens, he said software engineers max out the capabilities of the technology at hand regarding CPU cycles, screen real estate, and memory. Per Lubin, Ethereum’s scaling issues emanate from consumers maxing out the capabilities of the technology.

However, he said Ethereum 2.0 would help reduce transaction costs and energy use. Lubin disclosed that the upgraded version of the Ethereum network would arrive in the second quarter of 2022 or Q3 latest.

He added that,

We’re already seeing scalability happen at Layer 2, and at Layer 2 we’re seeing hundreds and soon tens of thousands of transactions per second that are actually very inexpensive—they’re Solana-inexpensive, Avalanche-inexpensive.

The blockchain of blockchainsWhile he touted the low costs of Solana and Avalanche, Lubin said their transaction costs are slowly increasing to $1 and $2 as more consumers embrace them. With Ethereum shifting to a Proof-of-Stake (PoS) consensus mechanism, he believes it will become the blockchain of blockchains.

Lubin added that Ethereum would become a leading digital asset settlement layer because it will become the coordination layer for multiple layer 2 technologies.

According to him, the Ethereum network currently boasts around 200,000 validators. By shifting to Ethereum 2.0, the number of validators will increase exponentially because the barrier to entry will be minimal, thus allowing anybody to become a validator.

This news comes after Su Zhu, the co-founder of Three Arrows Capital, tweeted that,

Yes I have abandoned Ethereum despite supporting it in the past. Yes Ethereum has abandoned its users despite supporting them in the past. The idea of sitting around jerking off watching the burn and concocting purity tests, while zero newcomers can afford the chain, is gross.

Zhu added that Ethereum suffers from the Founders Dilemma, seeing as all its founders got far too rich and forgot what they initially intended to do with the network.

Meanwhile, Ethereum (ETH/USD) is trading sideways, with little to no movement today. At the time of writing, the second-largest crypto by capitalization is changing hands at $4,000.62 (£3,020.61) after losing 0.19% over the past 24 hours.

The post Joseph Lubin says Ethereum’s high gas fees are a measure of success appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|