2024-8-22 13:07 |

Quick Take

In economic analysis, monthly data scrutiny is a cornerstone for understanding macroeconomic trends. Both analysts and the Federal Reserve rely heavily on these indicators to gauge financial health and inform policy decisions. The Federal Reserve and Jerome Powell have repeatedly stated they are data dependent. As interest rates have been held at 23-year highs for over a year, the expected weakening of the US labor market has materialized, with unemployment rising to 4.3% from the lows of 3.4%.

The importance of data validity cannot be overstated, particularly when examining metrics like nonfarm payrolls (NFP), which represent 80% of US workers contributing to GDP. However, recent revisions by the Bureau of Labor Statistics have cast doubt on the accuracy of initial reports.

A significant downward adjustment revealed 818,000 fewer jobs added in the year ending March 2024 than initially reported, suggesting a more rapid cooling of the job market than previously understood, according to Trading Economics.

I believe this substantial revision raises concerns about the reliability and timeliness of economic data. While job growth continues, albeit at a slower pace, the discrepancy between reported figures and revised data highlights the need for more accurate and timely economic indicators. The current system of monthly reporting, often based on data that is already a month old, may not provide an adequately responsive picture of economic realities.

Initial NFP numbers are based on surveys and estimates that may not capture the full picture due to incomplete responses or late submissions. As more comprehensive data becomes available, the BLS updates figures to reflect a more accurate employment situation. Therefore, I see a need for better real-time and more transparent economic data.

The Federal Reserve’s upcoming decisions on interest rate cuts will be crucial, with market indicators suggesting a 25 basis point reduction in September. However, without more accurate and timely data, policymakers risk repeating past mistakes of acting too late in response to changing economic conditions.

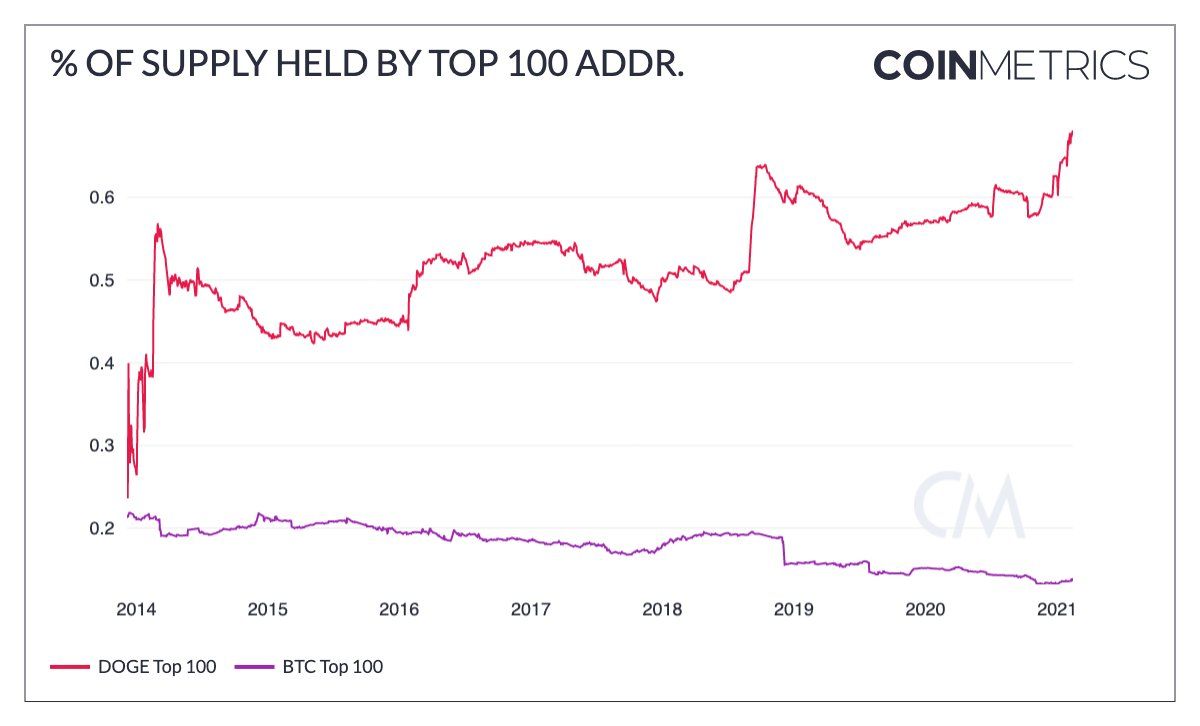

Bitcoin’s blockchain offers a potential solution to economic data challenges. It provides a fully transparent and auditable ledger that updates every 10 minutes, enabling real-time insights into economic activity and potentially revolutionizing how we track and respond to economic trends.

The post Job data revision exposes softer labor market appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Streamr DATAcoin (DATA) на Currencies.ru

|

|