2022-11-8 07:00 |

The Federal Reserve raised interest rates again, but Jerome Powell’s speech leaves many feeling uncertain as to the course the Fed will take in the future.

“Fed Watch” is a macro podcast, true to bitcoin’s rebel nature. In each episode, we question mainstream and Bitcoin narratives by examining current events in macro from across the globe, with an emphasis on central banks and currencies.

Watch This Episode On YouTube Or Rumble

Listen To The Episode Here:

AppleSpotifyGoogleLibsynIn this episode, CK and I cover Jerome Powell and the FOMC policy decision in depth, analyzing statements from the Federal Reserve, Powell and other financial experts. Then we move onto charts, starting with bitcoin and the dollar, then moving on to Treasury rates. Lastly, we discuss the diesel shortage brewing on the east coast of the U.S.

Federal Reserve FOMC Raises Rates AgainCK and I agree that the level of importance of the Federal Reserve and the FOMC policy decision to the market is a sign of a very unhealthy economy, where central bank decisions are the only game in town.

The Fed raised interest rates by 75 basis points (bps) to a new Fed Funds target range of 3.75% to 4%. This was not a surprise. The market had been predicting the Fed to not pivot away from their course in this meeting, despite the global liquidity concerns appearing in the financial system.

The central bank maintained their policy trajectory, but the statement did contain some softening of their hawkish tone. The sentence that jumps out is the following:

“In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

“Cumulative” is the word people are focusing on. What does “cumulative” mean in this context?

The Fed is placing their meeting-to-meeting decisions within a broader scope of their tightening program as a whole since March 2022, as well as considering their globally important role. The reasoning Powell portrays in the press conference that followed is mixed. They want to place their decisions within a whole program, but also want to be data dependent on a meeting-to-meeting basis.

Overall, I think that their intention is to cause uncertainty. Uncertainty is key at the end of a hiking cycle. The Federal Reserve’s intention is to cause an economic slowdown to bring demand down to be in line with supply, but they can’t do that if the market is frontrunning the end of the hiking cycle.

That’s exactly what we’ve seen over the last several months. I’m sure Powell has mixed feelings about the stock market remaining resilient to their hiking, with the S&P 500 above where it was at the time of the June meeting’s hike. That was three meetings with 75 bps hikes, yesterday made it four, and yet the stock market was higher. He wants a “soft landing” — to achieve their policy goals without major damage to the economy — but at the same time their goal is to damage the economy. It’s a contradictory tightrope they are trying to walk.

The intentions of the last few hikes in the tightening program cannot be achieved if the market is frontrunning their slowdown, the pause, and then the eventual reversal. This is where the purposeful uncertainty comes in. If the Fed can send mixed messages and keep the market uncertain, the effects of their last few hikes can be more significant.

ChartsThe charts on Fed Day were moving quickly. I delayed taking snapshots until 30 minutes after the Fed’s announcement, but the mixed messaging from Powell caused them to swing wildly. I won’t post them here because they are already out of date, but you can look at them on the slide deck for this episode.

The initial reaction was consistent across the board. Markets took the written statement, including the new language about cumulative effects, as a dovish pivot. Bitcoin spiked along with stocks and the dollar moved down.

However, as soon as Powell started to take questions at the press conference, and with his mixed messaging detailed above, markets reversed. Bitcoin and stocks headed down, the dollar up.

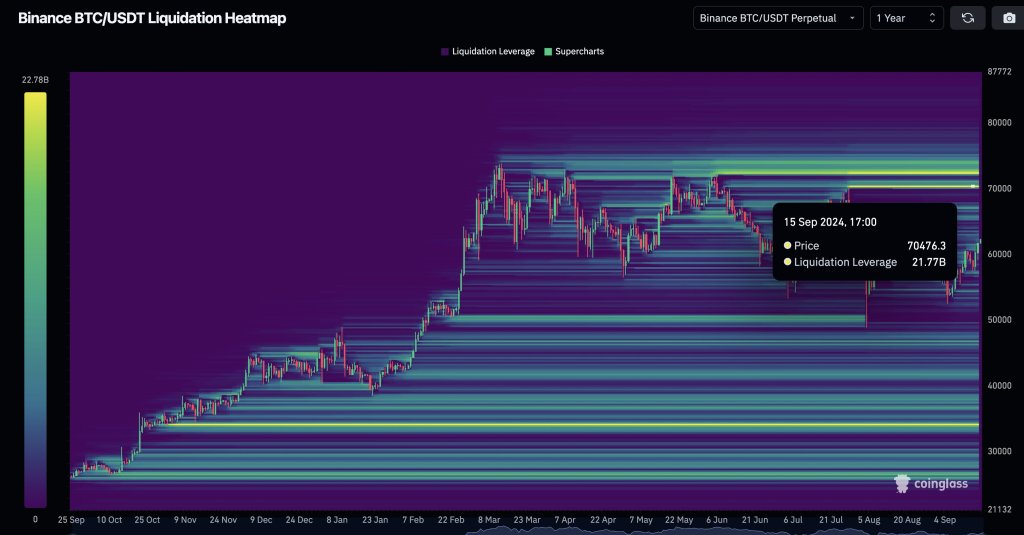

The one chart I will include on this companion post to the podcast is that of the 3-month and 10-year Treasury rates showing the most important inversion in the curve.

3-month and 10-year Treasury securities, in relation to the Fed Funds target rangeWhat you can notice on this chart is the 3-month yield going higher than the 10-year yield. Also, the 10-year yield is awfully close to being inside the Fed Funds target range.

What I’ve been saying for months is that the Fed will continue to raise rates until the market forces them to stop. That force applied by the market will show up as longer term rates simply not obeying the Fed anymore and going lower, like we can see with the 10-year yield here.

The Fed is admittedly “data dependent.” They tell us they are followers, but if you want to know where the Fed is going, all you have to do is look at the yields. If government security yields start heading down into the Fed Funds target range, by the next meeting their choices will be: raise rates again and lose confidence that they are in control of anything, or pause, or even do a “mid-cycle adjustment” and lower them. Powell has done what he calls a mid-cycle adjustment before. Back in 2019, the first rate cut in July was downplayed as just such a move. Of course, it was then followed by massive cuts in the following months.

Diesel ShortageThere are other things happening in the economy than the Federal Reserve. There is concern about diesel shortages in the U.S. Reports are flying about there being only a couple weeks of diesel left in storage, and with the winter coming on, diesel and heating oil demand is set to increase.

To cover this story, I read from a great article by Tsvetana Paraskova. She covers the shortage and reasons behind it in great detail.

In short, U.S. refinery capacity is down due to some plants being switched to making biofuel and our imports from Russia are non-existent due to crazy sanctions.

On the show, we get sidetracked because I am not personally that worried about the diesel shortage. It will cause some pain, but the solution is through that pain. Higher prices will cause one of two things to occur — or both: higher prices will stimulate more production or higher prices will cause political changes to allow higher production.

There is an almost universal fear of higher prices and they are demonized as “inflation” at every turn. Of course, high prices aren’t bad if you are a producer. They aren’t bad in general, either. Prices are supposed to be neutral and give you information about the economy. The only price changes that are a net negative are those due to changes in the money supply. Since our current economic condition is not due to money printing but instead supply crises and bad government policies, the price increases are necessary to fix the problems today.

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

origin »Bitcoin price in Telegram @btc_price_every_hour

Fedora Gold (FED) на Currencies.ru

|

|