2024-5-3 07:08 |

In the early morning of today’s Asia time, Jack Dorsey, CEO of Block Inc., revealed the company’s latest plan. Dorsey stated that it intends to purchase Bitcoin (BTC) monthly, utilizing the dollar-cost averaging (DCA) method.

This move highlights Block’s commitment to integrating Bitcoin into its financial strategy. Moreover, it also emphasizes Dorsey’s position as a prominent “Bitcoin maximalist.”

Details of Block’s Bitcoin DCA Strategy UnveiledDollar-cost averaging is an investment approach where the same dollar amount is invested in a particular asset at regular intervals regardless of the asset’s price fluctuations. This method helps reduce the impact of volatility on the overall purchase.

Hence, companies with Bitcoin holdings, like Block, can strategically navigate Bitcoin’s volatile nature using DCA. Furthermore, this approach offers the potential to achieve a lower average cost per share over time.

Read more: What Is Dollar-Cost Averaging (DCA)?

Block provided further details on how they will implement the DCA strategy in its official statement. The company announced it will allocate 10% of its gross profits from Bitcoin-related products towards monthly purchases of Bitcoin.

“Under the DCA program, we plan to purchase Bitcoin on a monthly cadence, starting April 2024. We will execute these over a shorter time window due to lower notional trade values and improved Bitcoin liquidity compared to 2020 and 2021. To reduce slippage, we have chosen to purchase Bitcoin over a two-hour window that has historically had the greatest amount of liquidity,” the company explained.

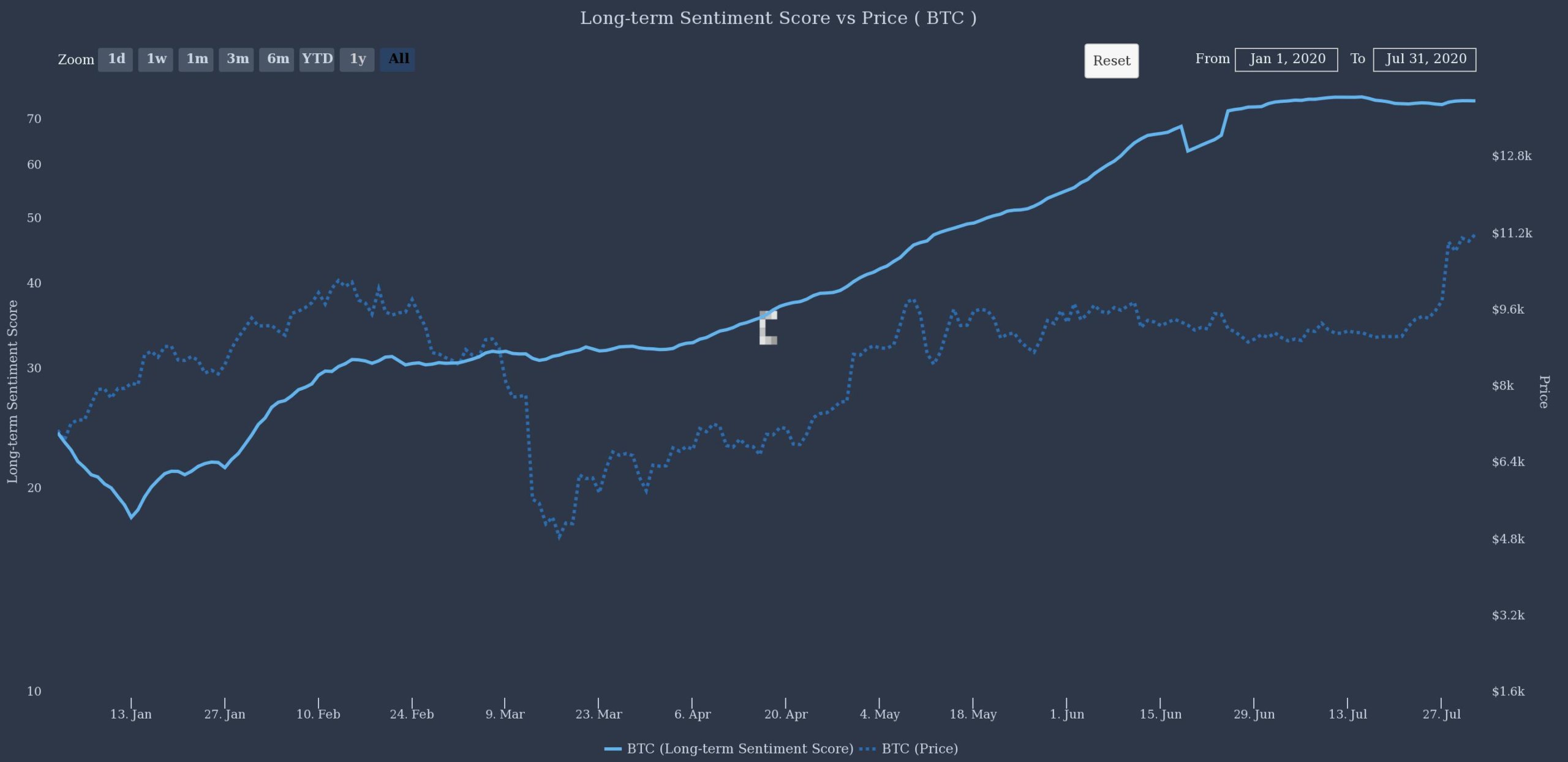

The shift to a Bitcoin-centric portfolio isn’t new for Block. The company made headlines in October 2020 when it purchased 4,709 BTC at an average price of $10,618 per Bitcoin.

Subsequent investments in February 2021 saw the addition of 3,318 BTC at a much higher price point of $51,236 each. As of March 31, 2024, Block acknowledged owning 8,038 BTC on the company’s balance sheet.

These early investments have proven lucrative. At the same reporting period, Block claimed its initial $233 million investment in Bitcoin had ballooned to approximately $573 million, marking a 146% increase. The remeasurement gain from its $233 million Bitcoin investment contributed to its net income in the first quarter of 2024.

Read more: Who Owns the Most Bitcoin in 2024?

Block’s Net Income. Source: Block’s Q1 2024 Earnings ReportBlock’s involvement in the Bitcoin ecosystem has significantly evolved beyond acquisitions. It recently launched a “Bitcoin Conversions” feature for Square users.

This feature allows merchants to convert a portion of their sales directly into Bitcoin, enhancing the utility of Block’s services in the crypto sector. Jack Dorsey explained the rationale behind this strategic direction in a recent letter to investors.

“We believe the world needs an open protocol for money, one that is not owned or controlled by any entity … An open protocol for money helps us serve more people around the world faster,” Dorsey stated.

The post Jack Dorsey Doubles Down on Bitcoin: Block Announces DCA Plan appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|