2022-7-23 17:00 |

Taxes are one of the few certainties in life, and big tax changes are coming for crypto exchanges and wallets very soon. Will you be ready for them?

While cryptocurrency owners have been required to report their crypto gains and losses on their income taxes for a few years now, crypto exchanges and wallets haven’t needed to provide information to the IRS on their customers and their transactions. But that’s all changing, as new federal regulations will require crypto exchanges and wallets to provide tax documents in the form of a 1099-B to their customers. And it’s not going to be an easy process.

In order to be prepared for this change, you need to know what exactly is coming quickly down the road for crypto exchanges and wallets, what kind of reporting will be required of you, and why it might not be a good idea to build those capabilities in-house.

What’s on the Horizon for Tax ReportingDespite cryptocurrency’s intention to be decentralized, federal tax regulations have caught up to crypto owners, who must report their crypto holdings as property and pay any capital gains taxes associated with it. However, unlike brokerage or barter exchanges, crypto exchanges and wallets haven’t had to report customer information, transactions, and gains or losses to the IRS, and issue a form to customers for their own tax purpose.

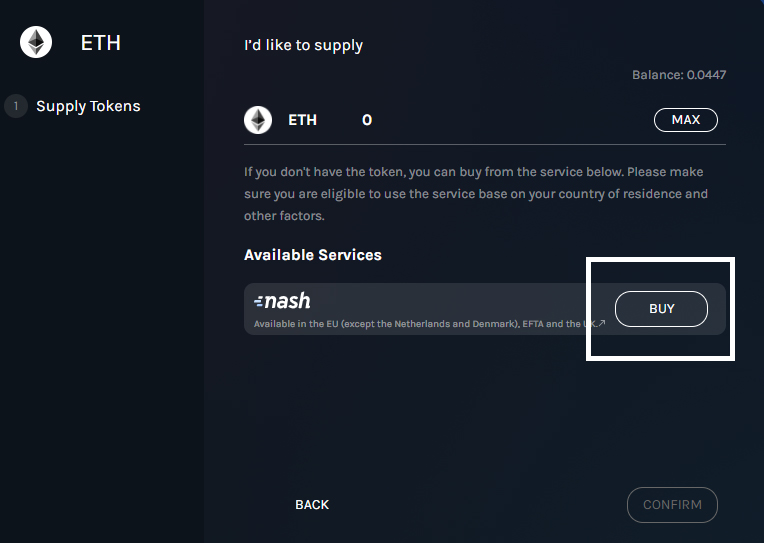

However, that has changed with the Infrastructure Investment and Jobs Act, also known as the Infrastructure Bill, on November 15, 2021. The Bill expands required tax reporting for crypto transactions and starting in 2023, crypto exchanges and wallets will be required by law to generate and issue 1099-B forms — or something like it — to their customers, the Federal government, and each state that requires reporting. And with nearly 600 crypto exchanges out there — with the largest one running a $15.9 billion volume — there’s a lot of work ahead of them.

A 1099-B — like other 1099 forms — is used to report non-W2 income earned over $600 and are records of freelance or gig work, interest received, dividend payouts, and more. Even certain purchases using crypto coins can trigger a taxable event applying to the $600 threshold. A 1099-B form is specifically issued by brokerage firms and barter exchanges and contains a record of all transactions made, the instrument used, gains or losses, and more. The message here is clear: The IRS is viewing your exchange like a brokerage firm or barter exchange. And as such, you have to track and provide a record of all crypto transactions per customer made on your platform. You may also have to report on existing tax obligations like backup withholdings as well.

Because this is required by law, you don’t have an option to do nothing — or you can and face the penalty. You need to build out your capability to handle this massive amount of data collection and tracking, so that come next year. But how will you do that?

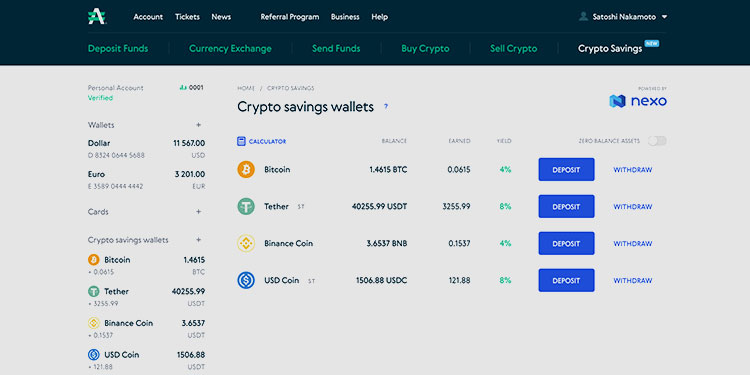

How to Prepare Your ExchangeCrypto exchanges and wallets need to prepare for this new tax regulation end-to-end, from collecting customer information to tracking and attributing transactions to generating a form that complies with the tax law. What kind of information does a typical 1099-B contain? You can find a customer’s name, address, and social security number — and SSNs require their own process to collect and verify before 1099-B issuance can begin. It also contains a list of every transaction made, including what was sold, the date sold, the quantity, the gain or loss, and other important information.

It’s a lot of data to track and a lot of reporting to get correct. Your first thought may be to build these capabilities in-house, but you’ll be facing a number of hurdles to doing so, like:

Compliance: There are a number of challenges to building in-house. The first is compliance and making sure that how you’re gathering and reporting information adheres to this new tax law. And you can be sure that the IRS will keep an eye on crypto exchanges and wallets to ensure they’re getting it right. Speed: Another challenge will be the speed at which you can design, develop, and deploy these new capabilities — especially when they need to be ready by the end of the year. Do you have the resources and budget to immediately turn your attention to solving this problem? Cost: Cost is another challenge if you build in-house. Consider the research, design, sourcing, development, testing, and maintenance costs of building, running, and maintaining the backend infrastructure of this capability. Does your exchange have the engineering resources to prioritize this as well? Maintenance: Finally, are you prepared to commit to the ongoing work to run this tax process year after year and maintain the underlying infrastructure? Who will be making the software updates to keep up with evolving tax laws? What team will own this? Use Custom APIsYou don’t have to build your solution yourself. The best approach to get you up and running quickly and easily is to use APIs to track and generate your 1099-Bs. Instead of building all those capabilities in-house, APIs will integrate with your system and easily pull all that data to generate the forms you need. Plus, custom-built APIs from a knowledgeable vendor will ensure that you’re not only keeping compliant with tax law but that you’re keeping up with any changes and ongoing maintenance of the API. Ultimately, going with API integration will save you time, money, and resources and prepare you for the new laws to take effect.

Tax Changes for Crypto ExchangesAn old adage says that there are only two things certain in life, and one of them is taxes. Crypto exchanges and wallets are facing an inevitable future of compliance when it comes to transaction reporting to the IRS — and possibly even more expanded reporting, including the taxability of staking. However, another old adage says that a stitch in time saves nine, so if crypto exchanges and wallets begin to build out their capabilities today, they won’t be scrambling when the IRS comes calling.

The post Is your crypto exchange prepared to issue 1099-Bs? Here’s how to do it easily appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|