2019-9-26 22:04 |

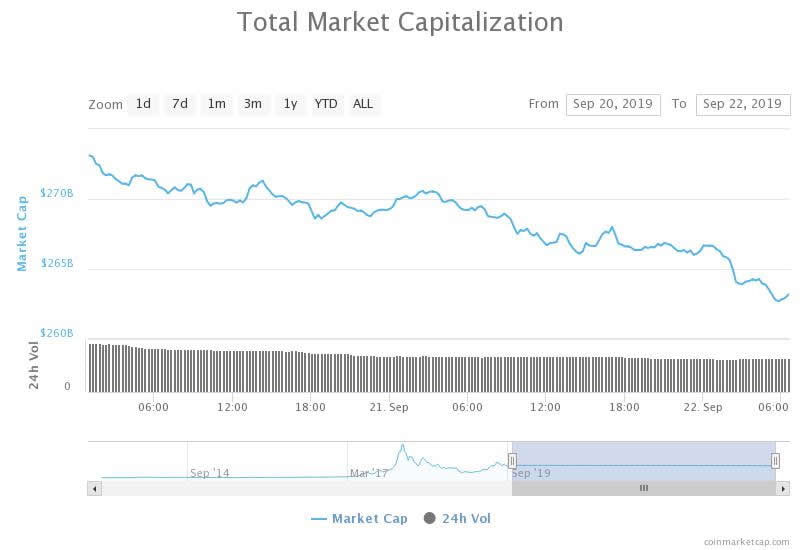

With radical price swings, market manipulation, and high profile hacks, bitcoin has never lacked excitement, but that started to change this summer. Prior to yesterday’s sharp drop, the OG crypto had been holding steady around $10,000 for over a month.

Those steady prices could have put markets to sleep. The decline in interest can be seen from the bitcoin tweet chart, which demonstrated a precipitous drop-off in bitcoin mentions on Twitter over the past few days in particular.

Courtesy Bitcoin Tweet Charts, tweets about bitcoin No Price Action Means Boredom Hits Bitcoin

With a price hovering around the $10,000-mark for the last few months, even the most hardened bitcoin followers may have lost interest. Price-wise, Bitcoin had simply been going nowhere since its parabolic rise in the first half of the year.

Bitcoin price volatility, as reported by Forbes, fell to its lowest levels since April. As David Martin, an analyst reporting on figures from Blockforce Capital and Digital Assets Data said:

“Volatility continues to wane for bitcoin and is now the lowest it’s been since April 1st, with a 30-day reading of 36% and a 60-day reading of 52%.”

Courtesy Forbes, bitcoin volatility

Bakkt Offers No Respite

It was widely believed that low volatility would help usher in more serious investors, who are more used to traditional investment vehicles. And that, in turn, would help usher in more dynamism in bitcoin demand, helping push its price up.

Bakkt, which finally launched this week, was supposed to be one such avenue for institutional demand. With physically delivered bitcoin futures products, its platform would give large investors the protection they were looking for and the crypto community the increase in demand that would send bitcoin moon-bound.

The rationale was to provide “reliable and regulated infrastructure” and push for the “adoption of new digital currency-powered technology and financial instruments,” according to Bakkt CEO, Kelly Loeffler.

But the futures market failed to bring in new money or price movement. With opening volumes at a paltry 71 BTC futures contracts traded in its first 24 hours, the ICE-owned exchange has hardly set the industry alight. The long-anticipated platform for physically-delivered bitcoin futures was met with yawns instead of applause.

Bitcoin Boredom Not An IslandAn interesting counter-correlation has emerged. The CBOE Volatility Index (VIX) measures volatility on Wall Street, and it is often referred to as the boredom index. A VIX index hovering around the 20s-40s is considered normal. Investors have concerns, but nothing alarming is popping up on their radar screens.

The financial crisis of 2008 saw the VIX rise to an eye-popping 70. Fear was in abundance on Wall Street as the collapse of the global financial system seemed imminent. Interestingly, it had hit extremely low levels – around 10 – just prior to the meltdown. Low volatility – boredom – can mean people take their eyes off what they should be watching.

Typically, however, a low VIX means investors start looking at higher-yielding investments than can be found on the stock market. If VIX is a gauge of a perceived lack of movement in equity prices, it can also predict a movement of capital to more exciting markets. There is not much trading to do if prices are too stable.

The fact that the CBOE’s VIX is so low is remarkable in itself, given trade war tensions and ongoing fears of a looming recession.

For crypto, a low VIX might intuitively suggest developing interest in the sector. It seems, however, that boredom is simply prevailing everywhere. Prior to yesterday’s sudden BTC price drop, the VIX level was quite low at only 14. It surged to about 17 yesterday.

Courtesy Yahoo! Finance, CBOE’s VIX (boredom) index

Whether the counterintuitive relationship between boredom on Wall Street and boredom on crypto street continues is anyone’s guess. Yesterday’s BTC price action and the VIX jump may indicate a more nuanced relationship, in which investors equate bitcoin risk with general market risk.

Either way, Wall Street’s boredom index is worth watching to see if it does, eventually, translate into more interest in cryptocurrencies. Even the most conservative money managers need a bit of excitement in their lives.

The post Is Wall Street Getting Bored? Bitcoin And The VIX Fix appeared first on Crypto Briefing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|