2026-2-9 15:00 |

Ethereum (ETH) drops toward $2,000 amid continued market volatility and selling pressure. Whale moves, ETF activity, and Bitcoin weakness fuel the recent decline. MVRV suggests ETH may be near a historical bottom, signalling potential rebound.

Ethereum’s recent rebound appears to be losing steam after the cryptocurrency reached a high of $2,136.

The coin is now quickly slipping towards the $2,000 mark, marking a continuation of a downtrend that has persisted over the past month.

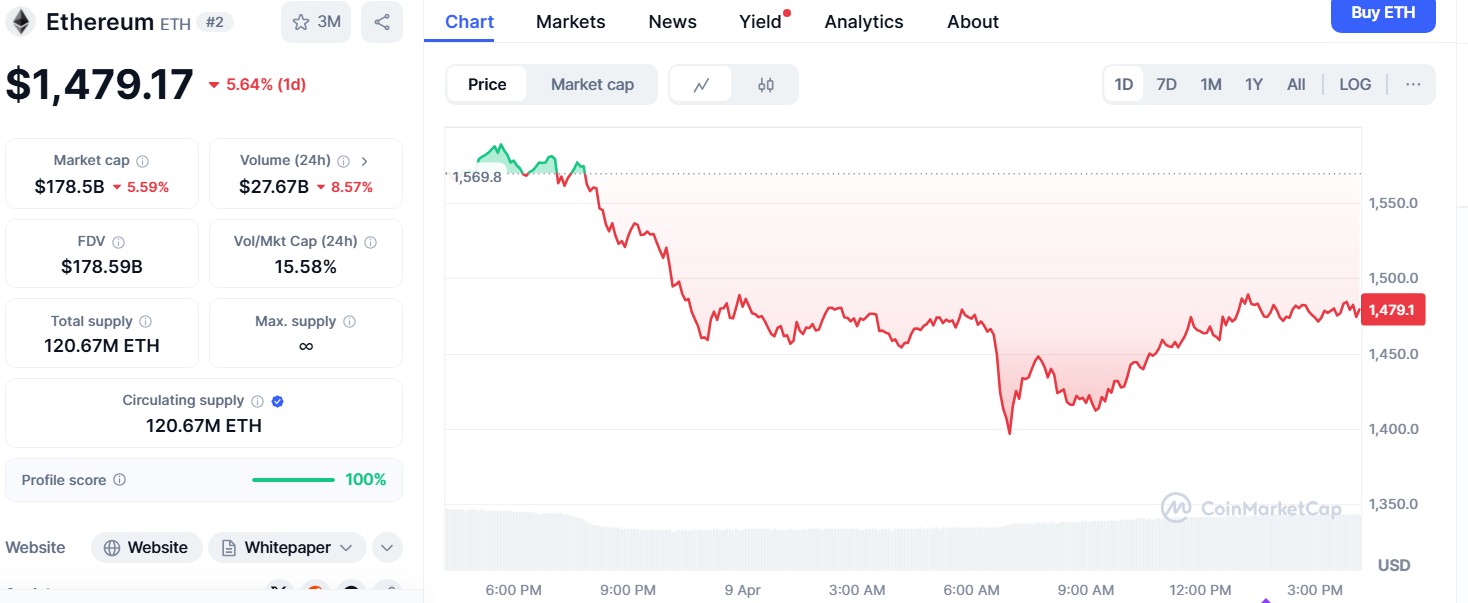

Ethereum (ETH) is currently trading around $2,015, representing a 34.9% decline over the last month.

The sharp monthly decline is part of a broader pattern of volatility in the crypto market this year.

Trading volumes, however, remain elevated, with over $21.5 billion worth of tokens exchanged in the last 24 hours.

Market factors driving the ETH price declineSeveral factors are contributing to Ethereum’s recent weakness.

One of the main drivers is elevated volatility in the derivatives and ETF markets.

Recent activity in Ethereum ETFs and Bitcoin-linked derivatives has amplified price swings.

Whale movements have also added pressure.

Large holders transferring ETH to exchanges can trigger panic selling, and reports indicate this has happened in recent weeks.

Bitcoin’s recent weakness has further weighed on Ethereum, given the strong correlation between the two cryptocurrencies.

Analysts also point to the breakdown of key support levels near $3,000 as a signal of continued downside risk.

Ethereum’s 7-day range of $1,824 to $2,369 highlights just how volatile the market has been.

But despite the downward pressure, Ethereum’s network activity remains robust.

Daily transactions and active addresses have not declined, signalling that usage of the blockchain remains strong.

This suggests that fundamentals may still support the network even if prices are under pressure.

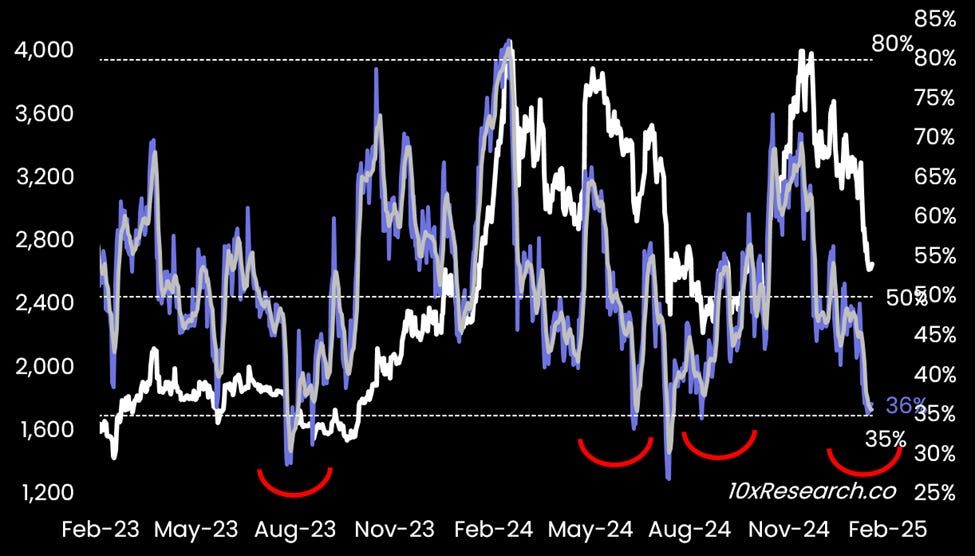

Could a market bottom be near?On-chain analysis offers a possible silver lining for Ethereum investors.

The Market Value to Realised Value (MVRV) metric on Santiment indicates that ETH has approached historically significant levels.

The coin recently traded below the 0.80 MVRV pricing band, a zone that historically corresponds with market bottoms.

This level often signals that many investors are at a loss, creating conditions for accumulation.

Previous dips below this band have been followed by sustained price recoveries over weeks and months.

Current readings suggest Ethereum is undervalued relative to recent history, though the deepest bottom has not yet been confirmed.

If ETH continues to hold near $2,000 and rebounds, it could mark the start of a longer-term recovery phase.

Traders and long-term holders will be watching closely for confirmation of support around this level.

Ultimately, the short-term trend is bearish, but on-chain indicators suggest that Ethereum’s decline may be nearing a turning point.

The coming days will be critical in determining whether ETH stabilises or continues its descent toward lower support levels.

The post Is the Ethereum rebound over? ETH price slips towards $2k after hitting $2,136 appeared first on CoinJournal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|