2020-8-21 04:13 |

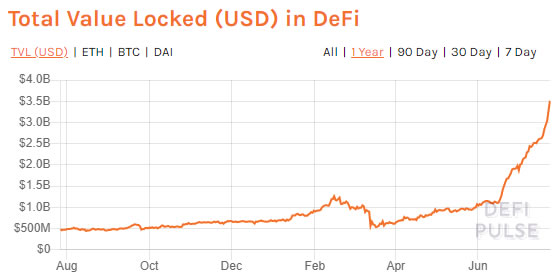

In a report published on Wednesday, DappRadar, a decentralized app (dApp) aggregator, stated that the DeFi growth could be significantly overstated. The foremost DeFi metric is the total value locked (TVL), which measures the amount borrowed to amount deposited on lending DeFi protocols and the liquidity provided on decentralized exchanges (DEX).

According to DeFi Pulse, the current TVL stands at $6.55 billion, a magnificent rise from $4.01 billion at the start of August – the ecosystem reached $2 billion in TVL on July 1. This extraordinary growth, however, is greatly overstated according to the report, which employed an inflation-adjusted formula to determine the actual TVL growth across DeFi products.

“The inflation-adjusted total value locked is calculated by locking the token price value at the same level as ninety days before 2020-08-17.”

The report focuses on MakerDAO, currently dominating the DeFi space with 21.87% of total value locked on the platform – $1.43 billion. The platform reclaimed the top position from Compound (COMP) after crossing the billion-dollar mark at the end of July before surging past $1.5 billion on August 14.

Over 75% of MakerDAO’s TVL Increase is OverstatedHowever, DappRadar experts argue that “75% of the total value locked increase on MakerDAO was fueled by increases in the top 3 token prices,” meaning only a quarter of the growth came from new money entering the space.

The top three assets on MakerDAO – Ethereum (ETH), Maker (MKR), and wrapped BTC (wBTC) – contribute to 97% of the locked assets on the platform. Over this research period, all three tokens experienced magnanimous returns in USD; hence, focusing on the “dollar TVL metric could give a distorted view” on the real growth, the report states.

Source: DappRadar

For instance, ETH (accounting for 73% of the TVL on MakerDAO) grew over 131% in less than 30 days boosting the TVL by $620 million during the period. However, employing the inflation-adjusted model, the total value locked increased by only $111 million. See the chart above.

In total, MakerDAO increased its TVL by $800 million in 30 days across the top three tokens while an inflation-adjusted TVL only shows an increase of $200 million in the same period.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|