2021-10-5 10:22 |

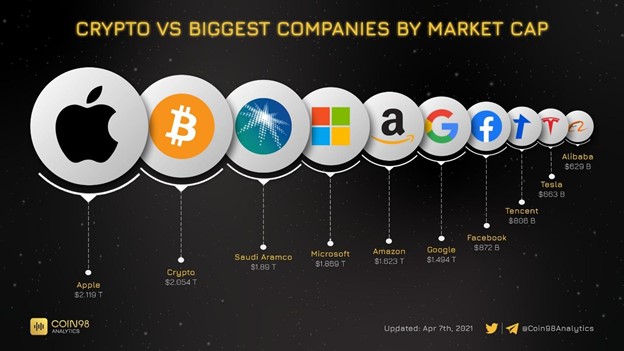

The emergence of cryptocurrency has disrupted the traditional financial industry and captivated the world while doing so. The decentralization movement does not only prevent fraud, but for those living under authoritarian governments, it can provide a medium of exchange resistant to censorship, giving a crucial means of financial freedom.

Although cryptocurrency has been lauded for its technological advancements, it hasn’t come without its moments of scrutiny. In May, Elon Musk decided to stop accepting Bitcoin as payment for Tesla, tweeting that he was concerned about the “rapidly increasing use of fossil fuels for bitcoin mining.”

This is because the top cryptocurrencies—including Bitcoin, Bitcoin Cash, and Ethereum—require large amounts of energy consumption to function. In 2020, a report showed that Bitcoin was on track to use more energy than that of 159 countries combined.

It’s no wonder that people like Musk are advocating for greener alternatives. Despite the fact that most new technology comes with trade-offs, the issue has sparked a conversation about how blockchains can further move towards environmentally friendly practices.

This is where Proof-of-Work (PoW) or Proof-of-Stake (PoS) gets interesting regarding the environmental impact of a blockchain. Both PoW and PoS algorithms can have a direct effect on energy usage. However, PoW is typically known to require a more significant amount of energy since miners need to sell their coins to pay their bills. PoW was created as the original consensus algorithm for blockchain and is used to confirm transactions and add new blocks to the chain for data storage.

Alternatively, PoS works off the percentage of coins held by a miner. Cryptocurrencies have adopted it to maximize energy efficiency because it usually has significantly lower consumption levels since miners aren’t required to solve complex mathematical problems, like in PoW blockchains. For this reason, PoS has been the default choice for the majority of newer blockchains.

With that being said, the argument that PoW-driven blockchains are unable to provide mining solutions that are energy efficient is not entirely accurate. With advances in scalability, new PoW technology has emerged that allows this form of mining to be as environmentally friendly and secure as PoS.

Though PoS blockchains might appear to be better for the environment on the surface, upon closer inspection, they pose multiple problems due to their lack of scalability. On the other hand, while PoW-based blockchains appear to use more power initially, they can also very much have the potential to be greener and more secure than PoS-based blockchains.

During the blockchain boom, while most players in the industry opted for the promises PoS mechanisms offered of high energy efficiency, one organization, Kadena, focused its efforts on scalability and dedicated its time to building a more robust underlying blockchain solution.

While blockchains using PoS argue that PoW isn’t sustainable, the most critical factor contributing to PoW’s energy efficiency is the transactions per second (TPS). Kadena claims it has the capability to push up to 100,000 TPS, which will be confirmed in testing later this year.

This will not only be a groundbreaking speed but also make it the only scalable PoW blockchain to exist. Compared to PoS, which can sometimes only achieve 10 TPS, this is a much faster and environmentally friendly protocol.

Many PoS systems that had high hopes for PoS solving surface-level problems are now faltering. This week, Solana crashed under high demand, Arbitrum was taken offline, and Ethereum was attacked. As the flaws in the PoS-based blockchains begin to be exposed and the need for a more sustainable solution becomes increasingly pressing, Kadena, the only sharded and scalable layer-1 PoW public network offer a robust solution to the masses.

Learn more about how this leading blockchain is disrupting the DeFi space on Kadena’s website.

origin »Bitcoin price in Telegram @btc_price_every_hour

Formosa Financial (FMF) на Currencies.ru

|

|