2021-10-8 02:00 |

Investor interest in Ethereum is no longer a novel phenomenon. The second-largest asset by market cap has seen more support with the rise of decentralized finance on its ecosystem. Applications of Ethereum have been the major drive behind the growth of the cryptocurrency and institutional and individual investors alike see the asset outgrowing number 1 coin Bitcoin in the coming years.

A recent CoinShares survey has echoed the sentiment that has been held by investors in the market for a while now. It showed that number of investors who believe Ethereum is set to outpace Bitcoin is over twice the number of investors who are bullish on the growth of bitcoin. Lately, investors have been moving out of their bitcoin positions in favor of ethereum, and the CoinShares survey shows that this might only be the beginning.

Related Reading | Umbrella Network Announces New Launch: Decentralized Oracles On Ethereum Mainnet

Investors Want EthereumThe CoinShares survey shed light on investors’ sentiment around the top crypto projects in the market. When asked, 42% of respondents said that they saw the most compelling growth outlook for Ethereum. While 18% said that they saw a compelling growth outlook for bitcoin. The survey showed that Ethereum was regarded as the project to grow the most in the coming years.

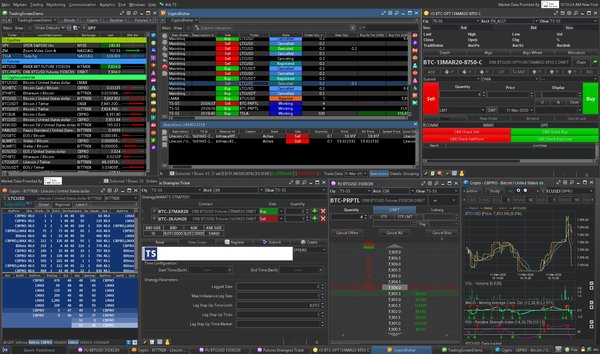

ETH price settles at $3,600 | Source: ETHUSD on TradingView.comThis does not although take away anything from bitcoin. Blockchain structuring has allowed Ethereum to be at the forefront of one of the most important investment spaces in crypto; the DeFi market. The bitcoin blockchain is gearing up to compete in this space against the likes of Ethereum and Solana with the launch of smart contracts on the network. Expanding the crypto-asset’s utility beyond just its monetary policy.

Investors Reveal Reasons For InvestingWhen asked what the biggest motivator for investing in cryptocurrencies was, the top answer was surprisingly not the value of the assets themselves or even diversification. 35% of respondents said that they were investing in the market because the assets were speculative. Only 25% said they used cryptocurrencies as a way to diversify their portfolios. With about 15% investing for the value of the assets.

Respondents also said that regulation, restrictions, and volatility were the biggest hindrance to investing in the crypto market. Regulation also made the top when respondents were asked about the key risks associated with digital assets. A combined 58% said government bans and regulations currently pose the biggest threat to the digital assets market.

Related Reading | Last Resistance Before Ethereum At $5K? Expert Predicts Q4 In The Green

Despite growing interest from institutional investors, individual investors still dominate the cryptocurrency market. 45% of investors said they were invested in the market individually. While Europe and the Middle East possess the largest amount of domiciled funds, with about 70% saying their funds were domiciled in the region.

Featured image from Forkast, chart from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|