2021-8-17 16:22 |

Investment giant Tiger Global Management which has $79 billion assets under its management, continues to pile into the cryptocurrency industry through crypto exchange Coinbase.

Tiger Global was already invested in Coinbase as it led the exchange’s Series E equity round in which the company raised $300 million.

According to the latest regulatory filing with the US Securities and Exchange Commission (SEC), Tiger Global disclosed just over 2.6 million Class A shares, a $665 million worth stake in the leading crypto exchange of the US.

As of writing, Coinbase stock is trading at $256.83, down from last week’s high of $294. COIN shares still have a long way to reach its all-time high of $429, hit briefly on its debut day in April on Nasdaq through a direct listing.

Last week, US PC Chipmaking giant, Intel, revealed that it owns a small stake in the crypto exchange. Intel is holding 3,014 COIN shares worth just under $800k, less than 0.005% of Coinbase’s current market cap.

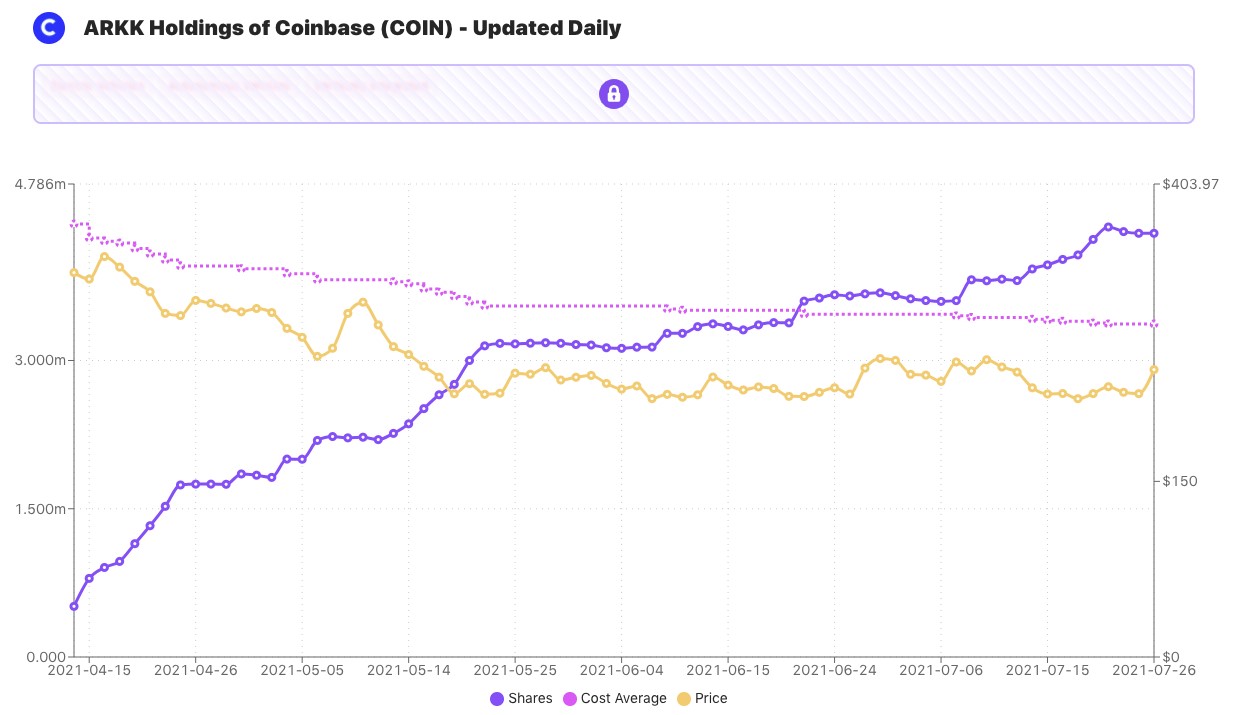

The top owner of COIN shares is Ark Investment which has a 3.96% stake in it, owning over $1 billion worth of shares, followed by Vanguard Group, Nikko Asset Management, Fidelity, Mitsubishi, and Goldman Sachs.

Coinbase is a pick-and-shovel play in the crypto asset class for traditional and institutional investors. Instead of directly investing in thousands of cryptos, investors are putting their money into the company that provides financial infrastructure and technology for the crypto economy.

Recently, the company reported a revenue of $2.23 billion for the second quarter, beating the analyst estimates, as its monthly transacting users grew 44% to 8.8 million users. Coinbase’s net profit exploded about 4,900% from the same period a year earlier to $1.6 billion.

While the company expects its trading volume to be lower in the Q3, analysts polled by Refinitiv expect a full-year EPS of $7.76 per share alongside revenue of $6.29 billion.

12 out of 18 analysts polled gave COIN stock a ‘buy’ rating with a consensus price target of $358.

Bank of America meanwhile gave the stock a rating of ‘neutral’ and a price target of $273, with BofA analyst Jason Kupferberg writing that while Coinbase is aiming to ‘become the Amazon of crypto assets,’ he is still waiting for more concrete signs of progress.

The post Investment Giant With Billion in AUM Discloses Owning 2.6 Million Shares of Coinbase (COIN) first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Global Currency Reserve (GCR) на Currencies.ru

|

|